You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.11 08:35

Weekly EUR/USD Outlook: 2017, November 12 - November 19 (based on the article)

EUR/USD managed to tick up amid OK data from Europe and weakness in the US dollar. GDP data stands out in a busier week. Here is an outlook for the highlights of this week.

Forum on trading, automated trading systems and testing trading strategies

is it time to sell eurusd

MAHER GERGES, 2017.11.14 18:45

as we are only one month away from raising interest rate from the USA?

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.15 15:05

Intra-Day Fundamentals - EUR/USD, NZD/USD and GOLD: U.S. Advance Retail Sales

2017-11-15 13:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From cnbc article :

==========

EUR/USD M5: range price movement by U.S. Retail Sales news events

==========

NZD/USD M5: range price movement by U.S. Retail Sales news events

==========

XAU/USD M5: rrange price movement by U.S. Retail Sales news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

EURUSD is retesting the resistance level of 1.1800 that can be seen up to weekly timeframe. Waiting for some formations of pattern in the daily timeframe or lower to see any possibility of continuation or reversal.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.17 16:57

EUR/USD Next year Outlook - EUR/USD at 1.17/1.19 in Q1 of 2018 and at 1.22 in Q2, and Q3 of 2018 (adapted from the article)

Monthly price is on breakout within the primary bearish market condition: price was bounced from 1.0494 support level to above for the good secondary rally with the "reversal" Senkou Span line to be testing to above for the long-term bullish reversal.

If the price breaks 1.2092 resistance on close monthly bar so we may see the reversal of the price movement to the primary bullish market condition; otherwise - the price will be ranging within the levels near Senkou Span line waiting for the direction of the trend to be started.

Most likely scenario for 2018: breaking 1.20 resistance to above for the global long-term bullish reversal.

==========

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.19 10:15

EUR/USD - 1.1860 as a next target for the primary daily bullish reversal (based on the article)

Daily price is on secondary rally within the primary bearish trend: price is located near and below Ichimoku cloud for Senkou Span line to be tested to above for the resistance level at 1.1860 as a next target for the primary daily bullish reversal.

==========

The chart was made on D1 timeframe with standard indicators of Metatrader 5 except the following indicators (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.21 07:34

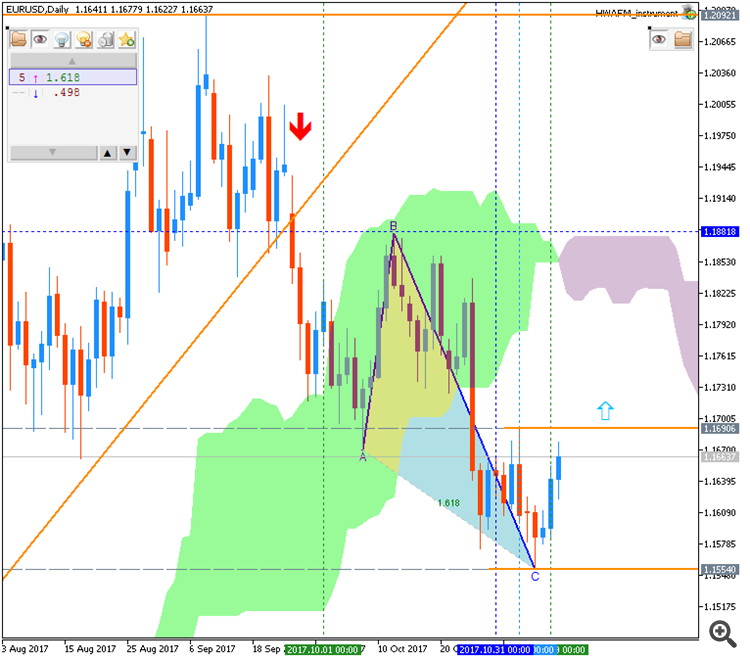

EUR/USD - bullish ranging within 1.1859/1.1584 levels (based on the article)

Daily price is on ranging near and below Ichimoku cloud and Senkow Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. The price is testing resistance level at 1.1859 to above for the daily bullish reversal toi be started, otherwise - bullish ranging within 1.1859/1.1584 levels.

==========

Chart was made on MT5 with PriceChannel Parabolic system (MT5) from this post (free to download) as well as the following indicators from CodeBase:

The EURUSD keeps pulling back to the downside, but the 1.1700 level may act as support, a breakdown below the 1.1700 level could take the pair to the 1.1600 zone. For now, the 1.1800 level has been acting as a good resistance.

Waiting to see the next result after the current candlesticks grouping in the range of 1.1750 and 1.1700.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.23 15:40

EUR/USD - daily bullish reversal; 1.1860 is the key (based on the article)

Daily price is on the secondary rally for Ichimoku cloud together with 1.1860 to be crossing to above for the daily bullish reversal to be started.

==========

The chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4: