You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.13 20:39

Intra-Day Fundamentals - EUR/USD, AUD/USD and GOLD: Federal Funds Rate

2017-12-13 19:00 GMT | [USD - Federal Funds Rate]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From official report :

==========

EUR/USD M5: range price movement by Federal Funds Rate news events

==========

AUD/USD M5: range price movement by Federal Funds Rate news events

==========

XAU/USD M5: rrange price movement by Federal Funds Rate news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.16 07:48

Weekly EUR/USD Outlook: 2017, December 17 - December 24 (based on the article)

EUR/USD made a move to the upside but eventually failed to stay there and retreated amid the ECB meeting. What’s next? Final inflation figures and a key German survey stand out. Here is an outlook for the highlights of this week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.20 07:26

Danske Bank: 'Firmly Headed' Into 1.20s In 2018 (based on the article)

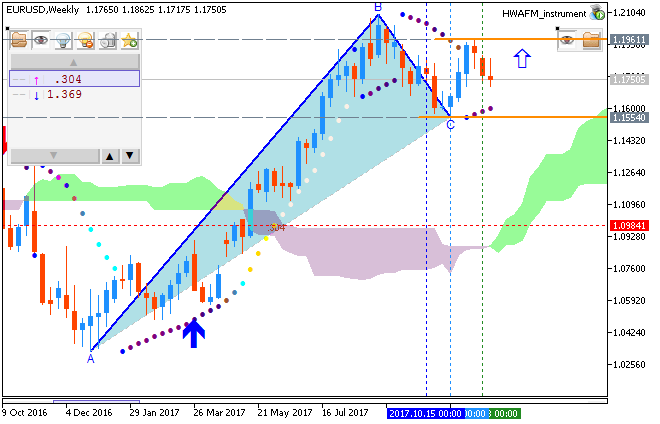

Weekly price is on bullish ranging market condition located above Ichimoku cloud and within 1.1554 support level for the secondary correction to be started and 1.1961 resistance level for the bullish trend to be continuing with 1.2092 weekly target.

============

The chart was made on W1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase:

In the Monthly chart the resistance level 1.20000 is being backed up strongly by trendlines showing downtrend.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.22 07:51

Intra-Day Fundamentals - Dollar Index and EUR/USD: U.S. Gross Domestic Product

2017-12-21 13:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

Dollar Index M5: range price movement by U.S. Gross Domestic Product news events

==========

EUR/USD M5: range price movement by U.S. Gross Domestic Product news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

In the Weekly chart, after the close of the week, EURUSD has completed the formation of triangle below the resistance level of 1.20000.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.24 07:14

Weekly EUR/USD Outlook: 2017, December 24 - December 31 (based on the article)

EUR/USD traded higher in the last week before the holidays. Will it continue higher in the last week of 2017? We have some inflation figures just before the New Year. Here is an outlook for the highlights of this week.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.27 05:37

Euro To Dollar Forecast For 2018, 2019, 2020 And 2021 (based on the article)

"In the beginning rate at 1.190 Dollars. High exchange rate 1.208, low 1.172. The average for the month 1.190. The EUR to USD forecast at the end of the month 1.190, change for January 0.0%."

"In the beginning rate at 1.190 Dollars. High exchange rate 1.234, low 1.190. The average for the month 1.208. The EUR to USD forecast at the end of the month 1.216, change for February 2.2%."

"In the beginning rate at 1.216 Dollars. High exchange rate 1.217, low 1.181. The average for the month 1.203. The EUR to USD forecast at the end of the month 1.199, change for March -1.4%."

"In the beginning rate at 1.199 Dollars. High exchange rate 1.207, low 1.171. The average for the month 1.192. The EUR to USD forecast at the end of the month 1.189, change for April -0.8%."

============

The chart was made on Metatrader 5 with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase:

Expecting EURUSD to stay above the level of 1.20000 for more than one day before continuing the long trend. In contrast for September last year, EURUSD just managed to stay for only one day above the level of 1.20000 before reversing its trend.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2018.01.05 17:03

Intra-Day Fundamentals - EUR/USD, USD/JPY and Dollar Index: Non-Farm Employment Change

2018-01-05 13:30 GMT | [USD - Nonfarm Payrolls]

if actual > forecast (or previous one) = good for currency (for USD in our case)

USD - Nonfarm Payrolls] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report :

==========

EUR/USD M5: range price movement by Nonfarm Payrolls news events

==========

USD/JPY M5: range price movement by Nonfarm Payrolls news events

============

Dollar Index M5: range price movement by Nonfarm Payrolls news events

==========

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5: