You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

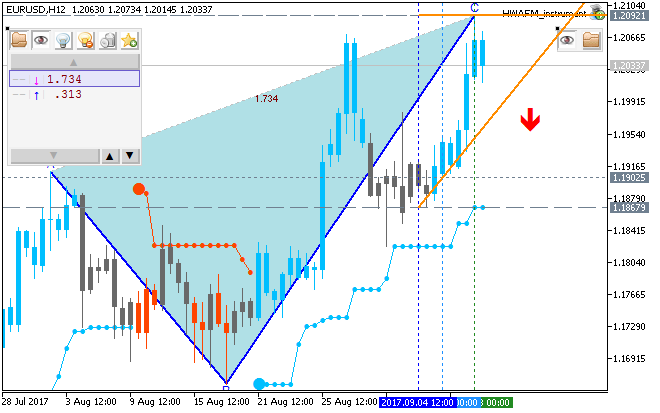

Today is September 6, 2017. The maximum price of EURUSD was 1.2070 on August 29, 2017. After that, there were no serious events that could seriously move the price anywhere. After that, we had NonFarm = 156K (it's less than 200K) on September 1, which did not affect the situation in any way. (When NonFarm is more than 200K, this provokes serious movement.)

Tomorrow September 7 at 14:45 (Kiev), the following event will occur, which may move the EURUSD price even higher. This is the interest rate for the EUR (Minimum Bid Rate). And the next event will take place on September 20. This is the interest rate for USD (Federal Funds Rate). This event can also seriously change the situation.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.09 07:25

Weekly EUR/USD Outlook: 2017, September 10 - September 17 (based on the article)

"Looking ahead to the coming week, we do not have any major news from the Eurozone but we have the PPI and the CPI data from the US which should tell us about the inflation in the US and give us a hint of when the next rate hike from the Fed would be. With the pair closing the week above 1.20, we believe that the uptrend is still intact but the moves could be much slower than usual as the ECB is clearly uncomfortable with the euro being at these levels and the traders seem to be biding their time for a turnaround in the dollar strength. So, in the coming week, we could see the EURUSD make its way towards the 1.21 and then 1.22 region provided the US data is not too strong. Else, we could see the pair correct towards 1.18."Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.09 15:54

Weekly Fundamental Forecast for EUR/USD (based on the article)

EUR/USD - "Fed Fund Futures highlight growing expectations Chair Janet Yellen and Co. will stay on hold throughout the remainder of the year as the central bank struggles to achieve the 2% target for price growth, with Governor Lael Brainard warning the central bank ‘should be cautious about tightening policy further until we are confident inflation is on track to achieve our target.’ In turn, the data prints coming out ahead of the September 20 interest rate decision may produce headwinds for the dollar as the core U.S. Consumer Price Index (CPI) is projected to slowdown in August, while Retail Sales are anticipated to increase 0.1% following a 0.6% expansion in July. Subdued price growth accompanied by signs of easing consumptions may encourage the FOMC to preserve a wait-and-see approach especially as Vice-Chair Stanley Fischer departs the central bank in October, and Fed officials may ultimately project a more shallow path for the benchmark interest rate as Hurricane Harvey and Irma risk derailing the economic recovery."

Will there be a downward turn on the EURUSD chart?

As can be seen from the graph, we have a clear divergence in the MACD, which allows us to assume a possible downward turn, or at least an approaching flat. Meanwhile, the presence of divergence is not a 100% guarantee of the forecast. On the chart, we showed weekly candles in yellow. As you can see, the last four weeks candles look up confidently. Therefore, we can not conclude that we can predict a 100% turn down.

Market still fear on how Hurricans would affect the Dollar, I'm expecting Eur/Usd would extend its gain afer the correction movement. Resistance can be found around 1.2090/1.2100 zone.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.13 14:35

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: U.S. Producer Price Index

2017-09-13 13:30 GMT | [USD - PPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report :

==========

EUR/USD M5: range price movement by U.S. Producer Price Index news events

==========

GBP/USD M5: range price movement by U.S. Producer Price Index news events

==========

AUD/USD M5: range price movement by U.S. Producer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.16 14:17

"The time has not yet come.." - interview with ECB Chief Economist and Executive Board member Peter Praet (based on the article)

The price on the daily chart is located above Ichimoku cloud for the primary bullish market condition: price is testing 1.2092 resistance level to above for the bullish trend to be continuing, otherwise - ranging within the levels.

-----

Indicator on separate window on the chart above is MFCS Currency Correlation Chart indicator for MT5 from CodeBase (free to download)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.16 15:00

Weekly EUR/USD Outlook: 2017, September 17 - September 24 (based on the article)

EUR/USD suffered under pressure from the US dollar and as the German elections near. Is this just a correction after reaching new highs? Or has the rally peaked? Inflation data and PMIs stand out now. Here is an outlook for the highlights of this week.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.21 09:11

Intra-Day Fundamentals - EUR/USD: FOMC Fed Funds Rate

2017-09-20 19:00 GMT | [USD - FED Interest Rate Decision]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - FED Interest Rate Decision] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight.

==========

From official report :

==========

EUR/USD M5: range price movement by FOMC Fed Funds Rate news events

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.21 16:54

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speech and range price movement

2017-09-21 14:30 GMT | [EUR - ECB President Draghi Speaks]

If the speech suggests the tightening of the monetary policy = positive for the euro.

[EUR - ECB President Draghi Speaks] = Speech to deliver opening remarks at the European Systemic Risk Board annual conference, in Frankfurt.

==========

From official report :

==========

EUR/USD M5: range price movement by ECB President Draghi Speech news event

==========

Chart was made on M15 timeframe with standard indicators of Metatrader 5 as well as the following indicators from CodeBase:

==========

EUR/USD M5: range price movement by U.S. Consumer Price Index news event

==========

Chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators: