You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

AUD/USD Intra-Day Fundamentals: RBA Cash Rate and range price movement

2017-09-05 05:30 GMT | [AUD - Cash Rate]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Cash Rate] = Interest rate charged on overnight loans between financial intermediaries.

==========

From sbs article :

==========

AUD/USD M5: range price movement by RBA Cash Rate news event

AUD/USD Intra-Day Fundamentals: Australian Trade Balance and range price movement

2017-09-07 02:30 GMT | [AUD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Trade Balance news event

Crude Oil - weekly bullish reversal (based on the article)

Price on the weekly chart is breaking 53.62 resistance on close W1 bar to be reversed to the primary bullish market condition with 56.62/58.35 resistance levels as the nearest bullish targets in this case for example.

NZD/USD - daily bullish; 0.7293/0.7344 are the keys (based on the article)

Daily price was bounced from 200-SMA at 0.7130 resistance to above for the bullish market condition to be resumed. The price is testing the resistance levels at 0.7293/0.7344 for the bullish to be continuing.

USD/CAD Intra-Day Fundamentals: Canada's Employment Change and range price movement

2017-09-08 13:30 GMT | [CAD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[CAD - Employment Change] = Change in the number of employed people during the previous month.

==========

From official report :

==========

USD/CAD M5: range price movement by Canada's Employment Change news event

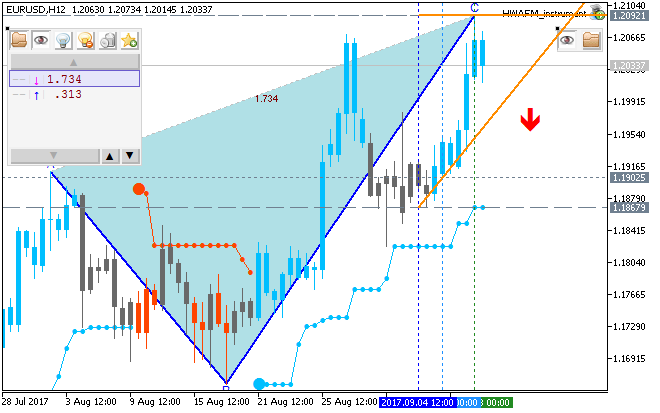

Weekly EUR/USD Outlook: 2017, September 10 - September 17 (based on the article)

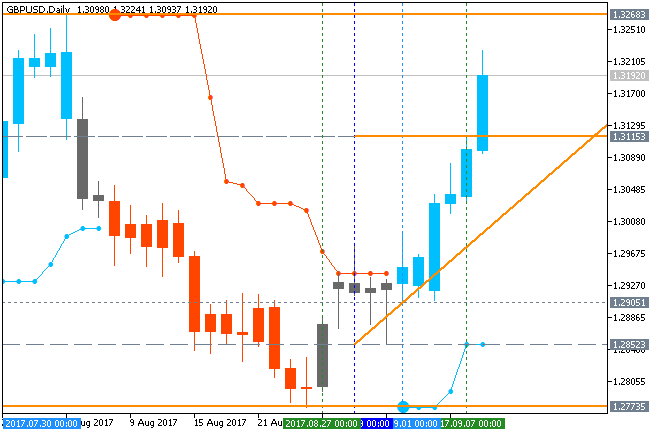

"Looking ahead to the coming week, we do not have any major news from the Eurozone but we have the PPI and the CPI data from the US which should tell us about the inflation in the US and give us a hint of when the next rate hike from the Fed would be. With the pair closing the week above 1.20, we believe that the uptrend is still intact but the moves could be much slower than usual as the ECB is clearly uncomfortable with the euro being at these levels and the traders seem to be biding their time for a turnaround in the dollar strength. So, in the coming week, we could see the EURUSD make its way towards the 1.21 and then 1.22 region provided the US data is not too strong. Else, we could see the pair correct towards 1.18."Weekly GBP/USD Outlook: 2017, September 10 - September 17 (based on the article)

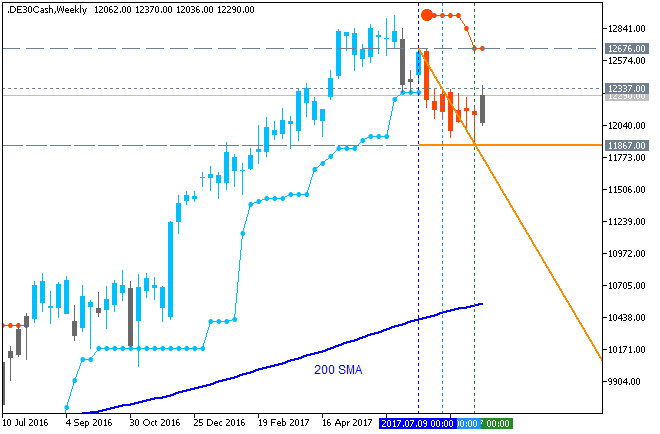

"Looking ahead to the coming week, after the focus on the dollar and the euro over the last couple of weeks, it is the turn of the pound to be in focus in the coming week as we have the CPI data and the rate announcement and statement from the BOE. We also have the CPI and PPI data from the US in the coming week and a combination of all these should guarantee a lot of volatility in the GBPUSD pair. The price is now in a key region and clean and clear break through 1.3260 should carry the pair towards 1.34 and 1.35 while a dovish BOE is likely to push the pair back towards 1.30."Weekly DAX Index Outlook: 2017, September 10 - September 17 (based on the article)

"The DAX broke higher during the week, after initially dipping down towards the €12,000 level. By breaking the top of the hammer from the previous week, this is a bullish sign and it looks as if were going to go looking for the €12,500 level above. That is an area that should be resistive, but in the overall look of the market, I believe we will be able to overcome that barrier. The DAX has been in an uptrend for some time, and should continue to be based upon the improving economic conditions in Europe, which of course is heavily influenced by Germany itself. I believe that buying dips continues to be the way forward, although we may get a bit of volatility in the short term, the longer-term uptrend is very much intact."Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The forecast will be set to neutral on the U.S. Dollar for the week ahead. While the downtrend is attractive, the Dollar is incredibly oversold and with a key Fed meeting on the docket for the week after next, profit taking from bears ahead of FOMC could potentially offset additional bearish drivers that might show up. If Thursday’s inflation comes-in at 1.6% or less, expect more selling in the Greenback."

Weekly Fundamental Forecast for EUR/USD (based on the article)

EUR/USD - "Fed Fund Futures highlight growing expectations Chair Janet Yellen and Co. will stay on hold throughout the remainder of the year as the central bank struggles to achieve the 2% target for price growth, with Governor Lael Brainard warning the central bank ‘should be cautious about tightening policy further until we are confident inflation is on track to achieve our target.’ In turn, the data prints coming out ahead of the September 20 interest rate decision may produce headwinds for the dollar as the core U.S. Consumer Price Index (CPI) is projected to slowdown in August, while Retail Sales are anticipated to increase 0.1% following a 0.6% expansion in July. Subdued price growth accompanied by signs of easing consumptions may encourage the FOMC to preserve a wait-and-see approach especially as Vice-Chair Stanley Fischer departs the central bank in October, and Fed officials may ultimately project a more shallow path for the benchmark interest rate as Hurricane Harvey and Irma risk derailing the economic recovery."