SQUID GRID AI is a sophisticated grid-based system capitalizing on mean reversion opportunities across 6 uncorrelated assets, optimizing portfolio weight to maximize profits while managing risk with AI-driven market monitoring.

[ Live Signal ] - [ Dedicated group | Version MT5 - MT4 ]

📌 The concept

📌 Why choose this EA?

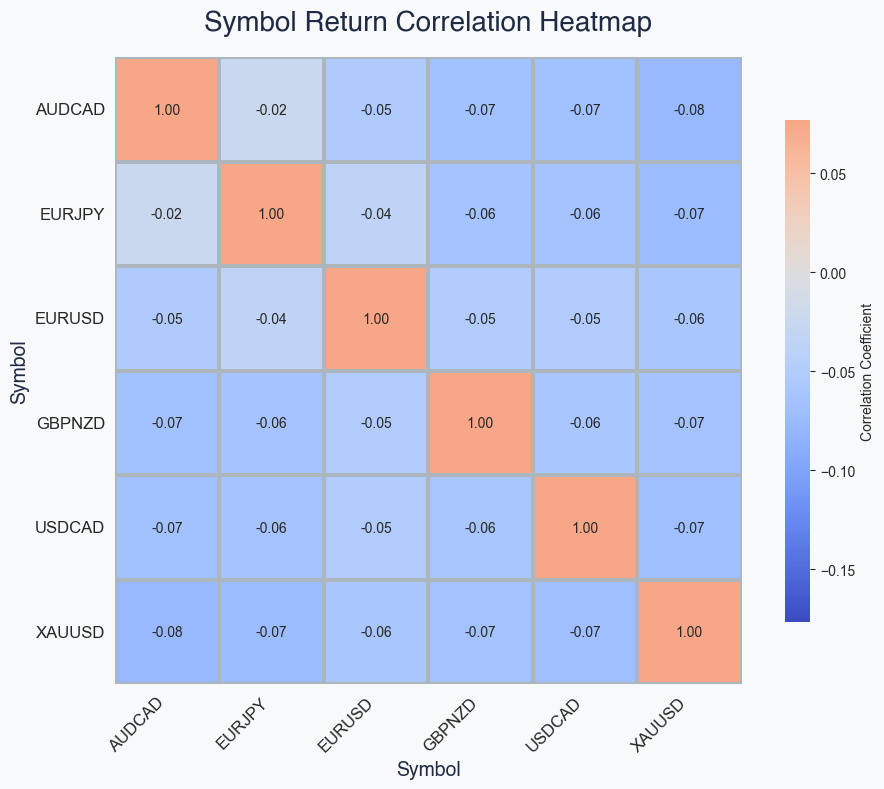

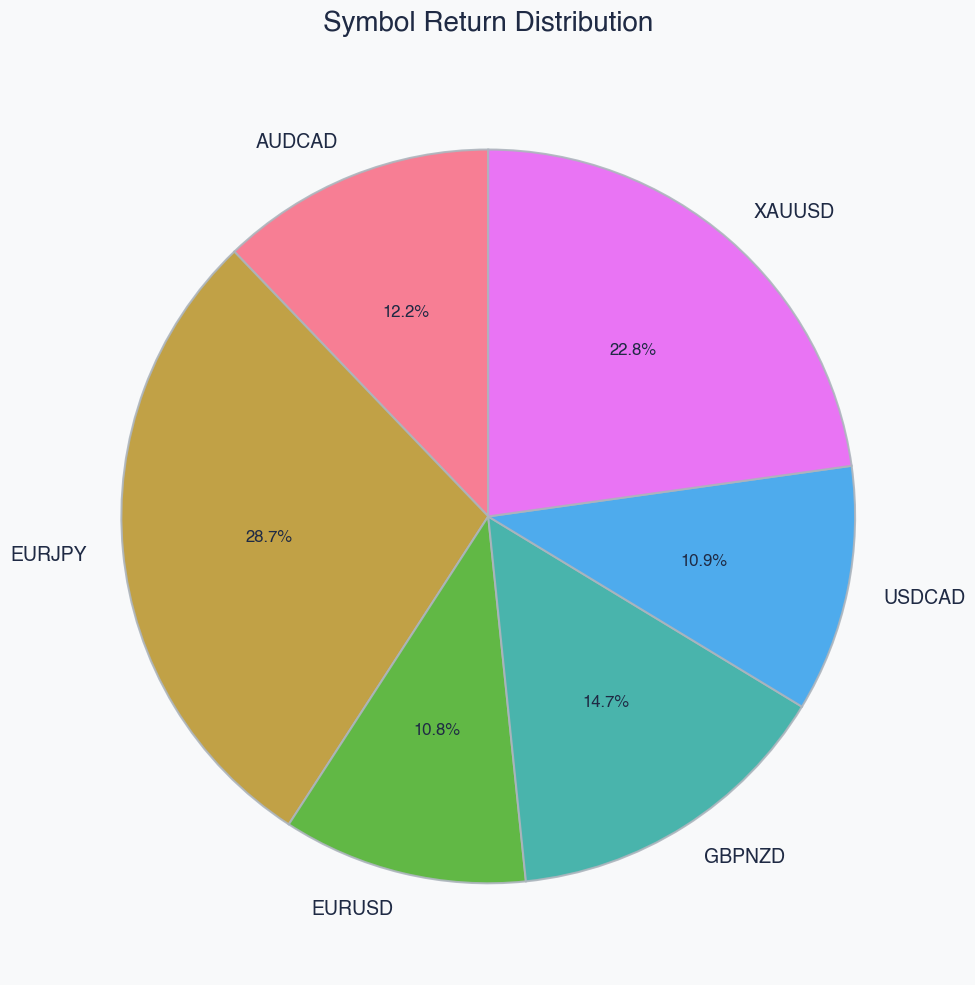

Multi-asset diversification

- Trades 6 uncorrelated instruments: XAUUSD, EURUSD, EURJPY, GBPNZD, AUDCAD, USDCAD

- Optimized weight allocation to maximize profitability

- Advanced structural risk-management at core

Sophisticated grid strategy

- Capitalizes on mean reversion opportunities

- Identifies overbought and oversold conditions for optimal entry

- Adds positions during price retracements to enhance profitability

- Important: No martingale strategy employed

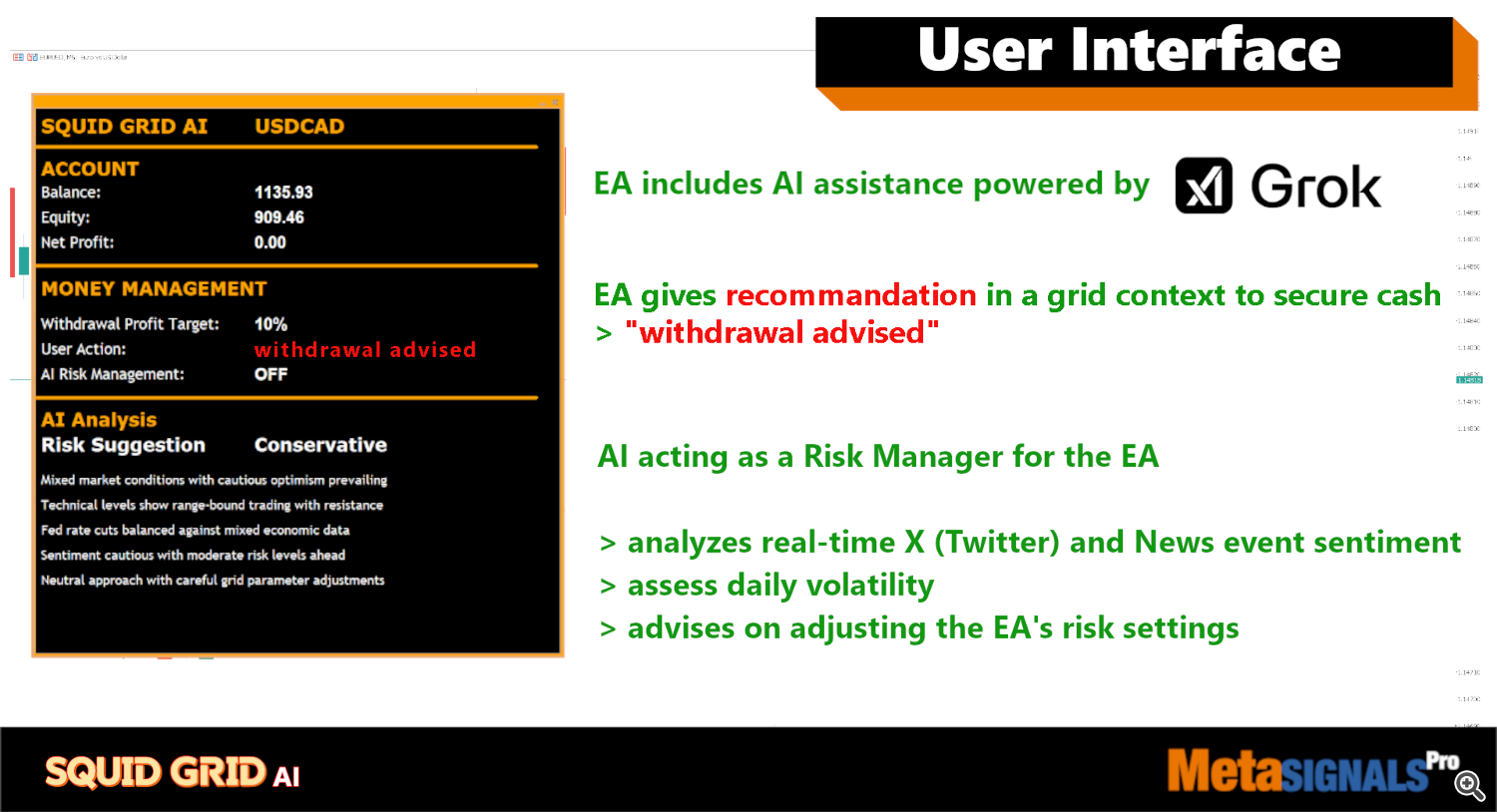

AI empowered Risk and Money Management for Grids

- Integrated with Grok4 AI for real-time market monitoring

- Analyzes daily macroeconomic conditions and market volatility

- Automatically closes positions or blocks trades during abnormal market events

- Customizable profit withdrawal thresholds based on risk tolerance

- Configurable Max Tolerable Drawdown and lot size settings

- Regular profit withdrawal recommendations (after 10-30% returns)

📌 Uncorrelated pairs and asset

📌 Optimised weight of the uncorrelated assets

<📌 Specs and Signals

- EA launching asset and Time frame: EURUSD | M5

- Traded assets: XAUUSD, EURUSD, EURJPY, GBPNZD, AUDCAD, USDCAD

- Timeframes: M5-H1 depending on asset volatility characteristics

- Backtest History: ICMarkets has limited CAD pairs history until 2025 so the backtests have been made on EasyForex

- Tested period: 2020 – 2025, OHLC

- Minimum / Recommended deposit: $500 / $2000

📌 Implementation

-

ensure that the trading asset symbols are added/shown in the Market Watch window of your MetaTrader terminal

-

this will enable your Expert Advisor (EA) to run on all chosen symbols simultaneously.

📌Our Commitments and backtest specs

Our system adheres to strict backtesting protocols with

🔹 100% qualitative data with no omissions

🔹 zero deletion or manipulation of historical stop losses or take profits.

🔹 zero overfitting

🔹 validated Walk Forward simulation

🔹 validated Monte Carlo simulation

🔹 continuous monitoring of the Live metrics with the backtest metrics