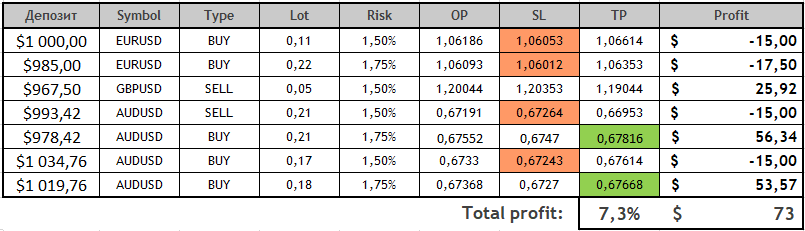

Review of trades of the Owl Smart Levels strategy for the week from February 27 to March 3, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from February 27 to March 3, 2023. The week was demonstrative for the work with the ignored signals. There were much more of them than trades. This brought to the forefront not so much the indicator's work as the rules for its use which are described in detail here and about which I never get tired to remind.

So, let's begin.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review

Almost all Monday and considerable periods of Thursday and Friday the market was in the dead zone which was shown by the dark-red area on the chart. Nevertheless, there were trades on each of the instruments under consideration.

We ignore the first signal because there are clear rules in the instruction when the signal should not be taken into consideration.

Fig. 1: The signal is ignored according to the rule: at the moment the signal appeared the price was already at the opening level.

The next two trades were both negative. Not a good week for the EURUSD currency pair. You can see one of them in the picture below.

Fig. 2. EURUSD BUY 0.22, OpenPrice=1.06093, StopLoss=1.06012, TakeProfit=1.06012, Profit= -17.50$

The last signal of this week on EURUSD we ignore according to the rule:

If at the moment the signal appears the price is below or has already been at the order opening level, the signal should be ignored.

Fig. 3: Example of a signal that should be ignored.

GBPUSD review

About half of the time the market on this currency pair was in the dead zone - at the beginning and at the end of the trading week. The Owl Smart Levels indicator gave the first signal around 00:00 GMT on March 01, it was ignored according to the rule described above. The first trade on this asset took place in the middle of the day.

Fig. 4. GBPUSD SELL 0.05, OpenPrice=1.20044, StopLoss=1.20353, TakeProfit=1.19044, Profit= +25.92$

The trade was closed before the market reached the StopLoss or TakeProfit level according to the rule:

If the Valable ZigZag Indicator has changed its direction (the arrow in the info panel has changed direction) the trade should be closed at the market price.

AUDUSD review

The first trade on the AUDUSD pair was very quickly closed with a minus on a sharp upward price movement.

Fig. 5. AUDUSD SELL 0.21, OpenPrice=0.67191, StopLoss=0.67264, TakeProfit=0.66953, Profit= -15$.

Then the market was in the dead zone most of the time on February 28, and the next trade was opened early in the morning of March 01. We earned profit on it only in the evening. We had to ignore several signals on that day according to the rule:

Ignore the signals if there is already an open position in the market.

Fig. 6. AUDSD BUY 0.21, OpenPrice=0.67552, StopLoss=0.67470, TakeProfit=0.67816, Profit= +56.34$.

The next trade opened on Friday and closed with profit only at the end of the day closing the week on positive note.

Fig. 7. AUDSD BUY 0.18, OpenPrice=0.67368, StopLoss=0.67270, TakeProfit=0.67668, Profit= +53.57$.

Results:

It hasn't been an easy week and only careful adherence to the rules of working with the indicator has allowed us to avoid losses. That's why it is important to strictly follow the rules while using the indicator.

Let's see what the next week brings and how the Owl Smart Levels performs.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.