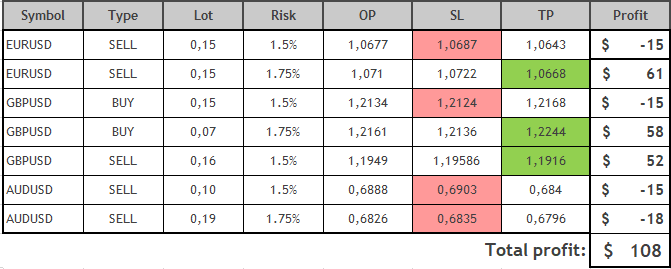

Review of trades of the Owl Smart Levels strategy for the week from February 13 to 17, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from February 13 to 17, 2023.

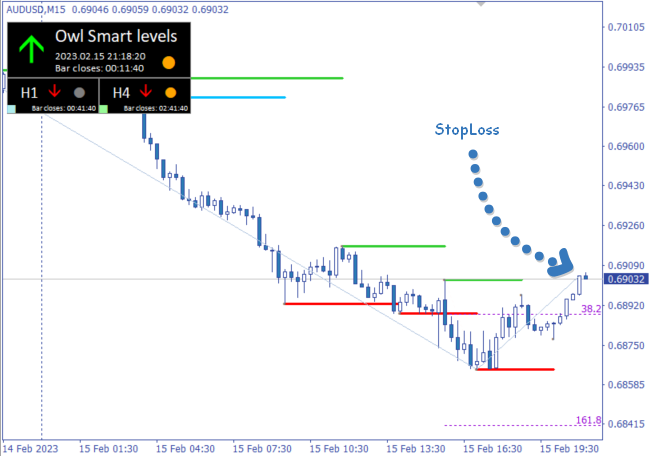

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

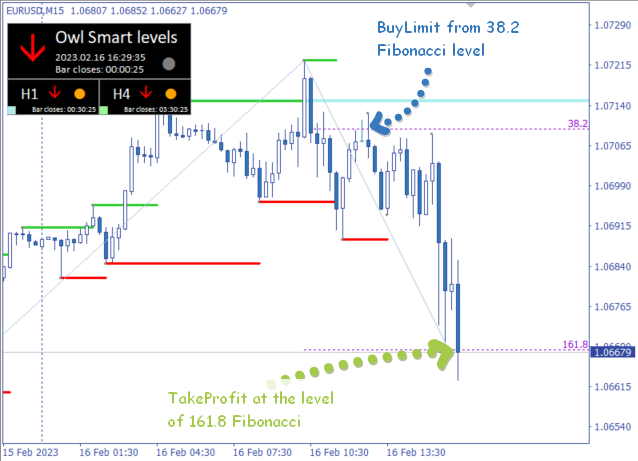

EURUSD review

The week for the EURUSD pair began in the dead zone, which lasted until the evening of February 15, and quickly closed with a negative balance. According to the strategy the next trade was opened with a higher risk. The risk was set as 1.5% for the first order and, if the trade closed with a loss, the next order is opened with the risk of 1.75% for the next trade.

Fig. 1. EURUSD SELL 0.15, OpenPrice=1.0677, StopLoss=1.0687, TakeProfit=1.0643, Profit= -15$

The next signal appeared the following day, immediately after the change of the direction in the signal indicator. The market quickly moved to the limit order and then at almost the same speed rushed to TakeProfit. The intermediate result for EURUSD is +46$.

Fig. 2. EURUSD SELL 0.21, OpenPrice=1.0710, StopLoss=1.0722, TakeProfit=1.0668, Profit=+61$

However, the next entry signal was ignored because of a rule to ignore the signal if it came earlier than 10 candles after the previous trade was closed.

There were no more trades at EURUSD this week. There were some signals to place a pending order but they were cancelled by a new signal and indicator reversal on the signal timeframe. In the afternoon on Friday the market moved to the dead zone.

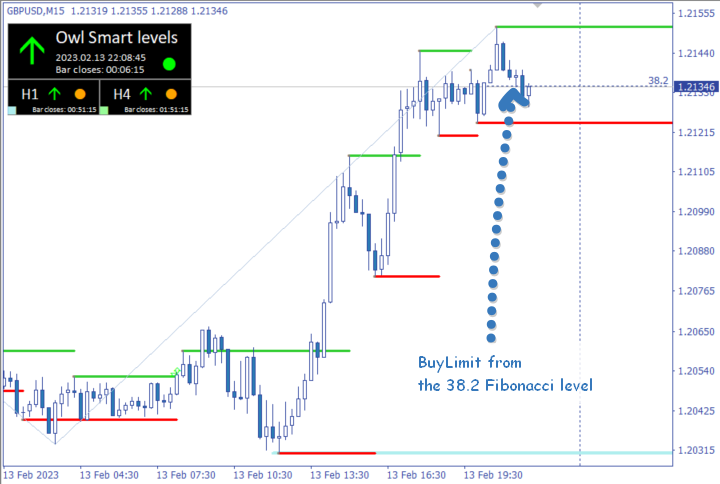

GBPUSD review

The week started in the dead zone for the British pound which means a prohibition to trade until the higher timeframes begin to show the same direction. By Monday evening all timeframes started to show the same upward direction and the first signal to enter appeared. The order was closed with a loss on the reverse signal of the Valable ZigZag Indicator.

Fig. 3. GBPUSD BUY 0.15, OpenPrice=1.2134, StopLoss=1.2124, TakeProfit=1.2168, Profit= -15$

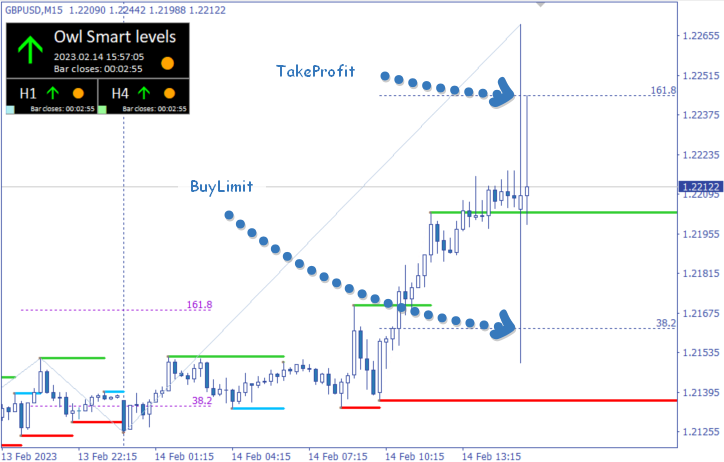

The next trade was opened on a sharp jump in price on the news. It could have closed on a stop on a sharp jump in price but the market did not catch the stop and literally within a couple of minutes the trade was closed with a profit.

Fig. 4. GBPUSD BUY 0.07, OpenPrice=1.2161, StopLoss=1.2136, TakeProfit=1.2244, Profit= +58$

After the announcement of the Consumer Price Index in the United States, the market fluctuated for a long time in different directions, the Valable ZigZag began to show downward, and it was no longer possible to enter the market. The entry signal appeared only on the evening of February 15 and the trade was closed with a loss.

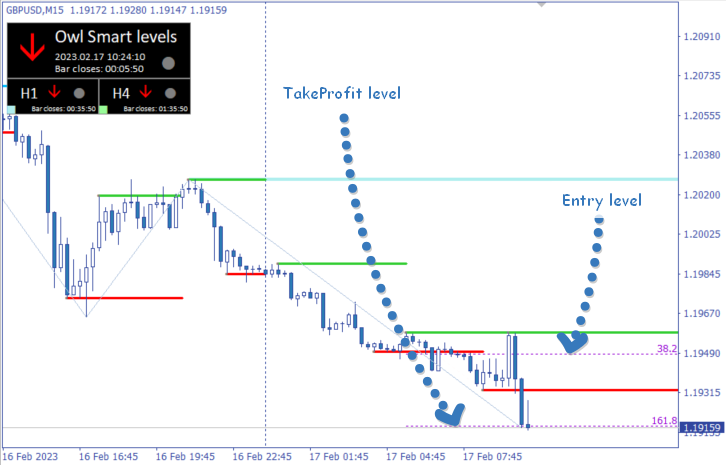

Having passed through the dead zone and multidirectional signals, the sell signal was received on Friday morning. The trade barely missed the StopLoss (2 pips) and was closed with profit within an hour.

Fig. 5. GBPUSD SELL 0.16, OpenPrice=1.1949, StopLoss=1.19586, TakeProfit=1.1916, Profit= +52$

Then one trade was not taken into account using the previously described 10 candles rule and the market entered the dead zone.

AUDUSD review

The Australian dollar this week started from the dead zone, came out of it very quickly and formed a signal. We did not take this signal into consideration according to the rules of the Owl strategy.

After that the market entered the dead zone and the price was fluctuating there till Wednesday. The first trade was possible to get only on Wednesday evening but as well as at other pairs, it was closed with a loss on Wednesday.

Fig. 6. AUDUSD SELL 0.10, OpenPrice=0.6888, StopLoss=0.6903, TakeProfit=0.6840, Profit= -15$

The second trade on AUDUSD was also closed with a loss. Not a good week for the Australian dollar. Result of the week: -33$.

Results:

Despite the fact that the amount of negative trades was more than the amount of positive ones this week the total result is +$108. This is achieved by the fact that the strategy has a much larger TakeProfit than the StopLoss. Therefore, even if you make 30% positive trades you will not make a loss but will remain in profit.

Let's see what the next week brings and how the Owl Smart Levels performs.

See other reviews of the Owl Smart Levels strategy:

- From February 6 to 10, 2023, Total: +11.2%

- From January 30 to February 3, 2023, Total: +24.7%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.