Review of trades of the Owl Smart Levels strategy for the week from February 6 to 10, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from February 6 to 10, 2023.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

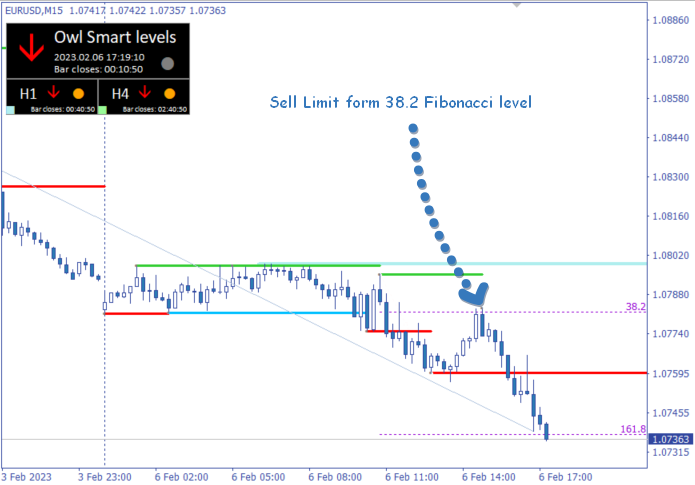

EURUSD review

Monday, February 6, started with EURUSD fluctuating in a small price range. The first signal, which appeared around 3:00 GMT, was ignored because the main rule of trading on Monday is to ignore signals received before 8:00 GMT on Monday.

The next Sell Limit signal was received around 12:00. The pending order was triggered within an hour and a half, and the market quickly began to move in the direction we needed. The first trade of the week and we have already taken a profit.

Fig. 1. EURUSD SELL 0.12, OpenPrice=1.0782, StopLoss=1.0795, TakeProfit=1.0737, Profit= +52$

As you may have noticed, one of the advantages of the trading system Owl Smart Levels is the fact that from the moment of receiving the signal you have enough time to place a pending order, a whole hour, to have time to place the order in your account.

Then, on February 7, the main signal timeframe turned against the older ones, and trades could not be opened. In the afternoon the signal was received again but by a sharp upward correction we made a loss on this trade. After that, a dead zone was formed on EURUSD, in which it is not recommended to trade according to the trading system rules. The dead zone continued on Wednesday and half of Thursday, as a result of which there was a reversal of the Valable ZigZag Indicator (which is responsible for the trading direction) on all 3 timeframes, so we got a signal to place a Buy Limit order. The order was quickly closed with a loss because probably it was a correction to the main direction downwards in which the pair turned last week.

The Euro was trading in the dead zone all Friday. The result of the week is +12$, though there were 2 negative and 1 positive trades. Due to profitability index 3.24 (TakeProfit/StopLoss ratio) we earned money this week.

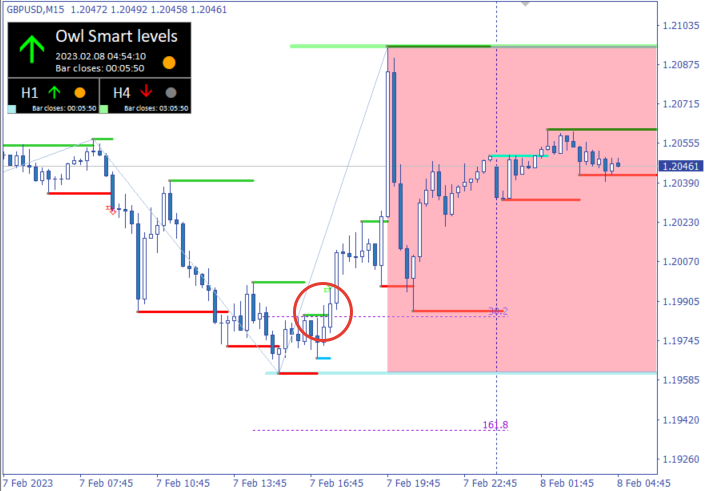

GBPUSD review

The British pound started the week with different indications of the Valable ZigZag Indicator (part of the Owl Smart Levels Indicator), so I spent the first half of the day waiting. Only in the evening there was a signal to place an order but I had to cancel it soon because the trading system rule states:

Pending order should be canceled if it was not executed within 24 candles of the working timeframe or if the indicator Valable ZigZag changed its direction.

Another signal for placing a Sell Limit order was received only at 15:00 on February 7. The order worked but on the next candle the trade had to be closed with a small loss, because the Valable ZigZag Indicator turned up again.

Fig. 2. GBPUSD SELL 0.11, OpenPrice=1.1984, StopLoss=1.1998, TakeProfit=1.1938, ClosePrice=1.1989, Profit= -5$

All future signals on this pair were canceled either by the 24 candles rule or because of the differently directed indications of the Valable ZigZag Indicator.

Result: small loss of 5$ due to the correctional market behavior this week.

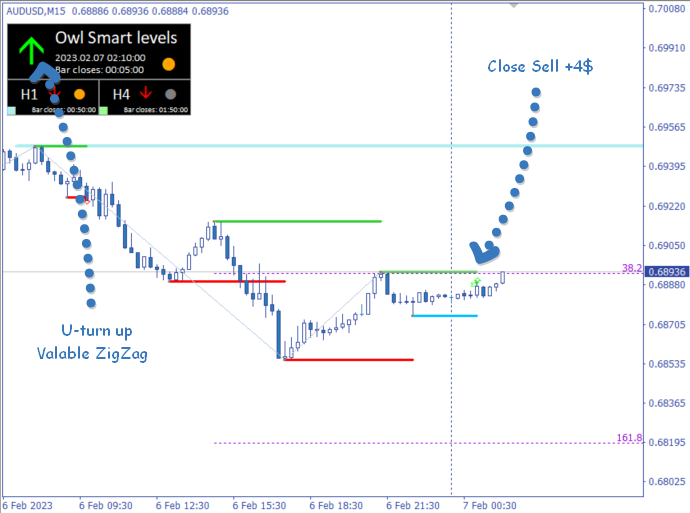

AUDUSD review

The first position of AUDUSD was closed earlier with a small profit, as Valable ZigZag Indicator changed its direction. The second trade was closed by the same rule, but with a slight minus.

Fig. 3. AUDUSD SELL 0.07, OpenPrice=0.6893, StopLoss=0.6915, TakeProfit=0.6819, ClosePrice=0.6887, Profit= +4$

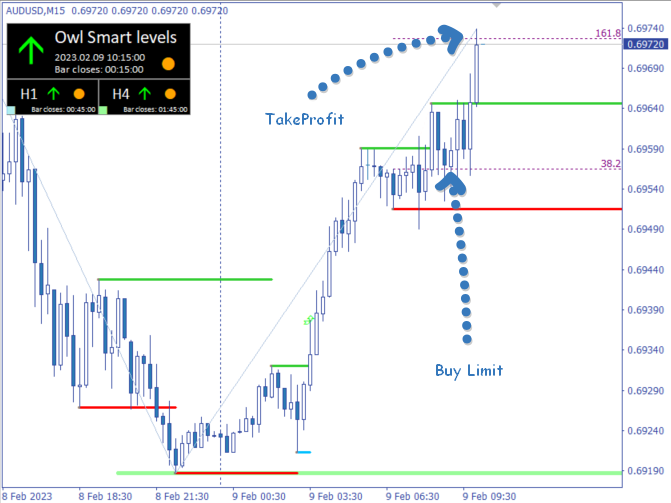

Overnight trades can be very profitable but sometimes you have to wait for the profit all night. So it happened with AUDUSD on February 8, a trade opened at 3:15 and closed with profit only 7 hours later. We had to close the next trade at 0 because again the rule of Valable ZigZag reversal was applied against us. This rule effectively protects our deposit from unnecessary losses and keeps the strategy profitability at a high level.

Fig. 4. AUDUSD BUY 0.15, OpenPrice=0.6954, StopLoss=0.6944, TakeProfit=0.6986, ClosePrice=0.6986 , Profit= +48$.

The market entry signal at 8:00 has perfectly shown how well the Owl Smart Levels strategy works. Profit after 1 hour of trading which is to be expected from strategies that work in the direction of the trend.

Fig. 5. AUDUSD BUY 0.30, OpenPrice=0.6956, StopLoss=0.6951, TakeProfit=0.6972, ClosePrice=0.6972 , Profit= +48$.

The remaining time AUDUSD pair entered the dead zone, and trading till the end of the week was prohibited by the strategy rules.

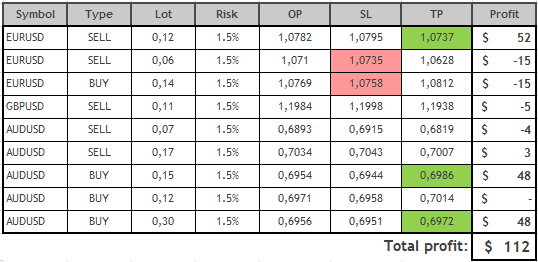

Results:

On time received signals from the Owl Smart Levels Indicator allows me not to miss trades and get a stable profit even in the weeks when the market is in a local correctional movement. And strict following the rules of the trading system allows you to reduce losses. These rules helped me earn money even in such a difficult trading week.

Download the Owl Smart Levels Indicator and check all the trades in the table yourself for accuracy.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.