Review of trades of the Owl Smart Levels strategy for the week from July 3 to 7, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from July 3 to 7, 2023. There were opened 6 trades in two out of three currency pairs. The Owl Smart Levels indicator performed well last week and several times recommended opening good and profitable trades.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review

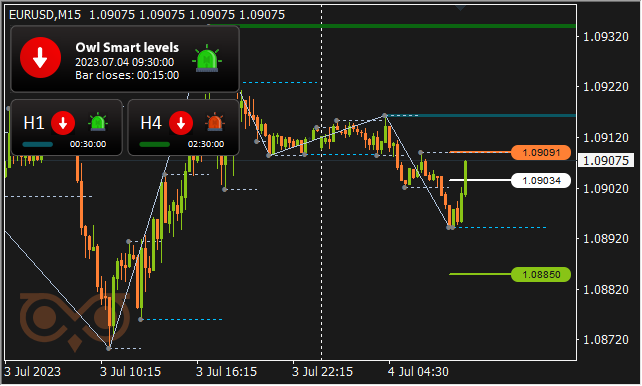

The first signal to open a trade on EURUSD (for selling) was given by the Owl Smart Levels indicator only on Tuesday morning.

Fig. 1. EURUSD SELL 0.26, OpenPrice = 1.09034, StopLoss = 1.09091, TakeProfit = 1.0885, Profit = -$15.

Unfortunately, the first trade was unsuccessful and closed with a small loss.

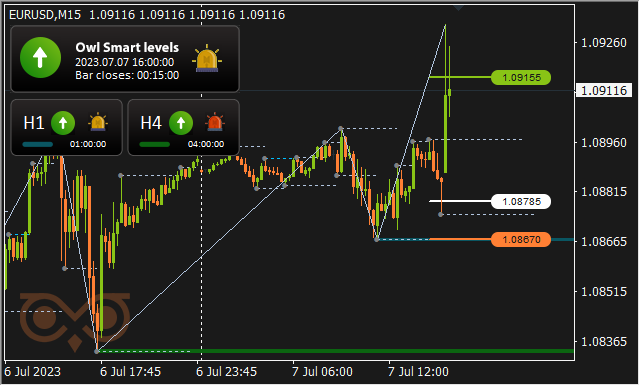

The market spent the second half of Wednesday, Thursday and the first half of Friday in the dead zone, but the indicator still managed to find one trade on Friday.

Fig. 2. EURUSD BUY 0.15, OpenPrice = 1.08785, StopLoss = 1.0867, TakeProfit = 1.09155, Profit = $56.30.

After opening a trade for buying on the signal of Owl Smart Levels the price rapidly went up by more than 300 points, so the trade was closed by TakeProfit soon.

GBPUSD review

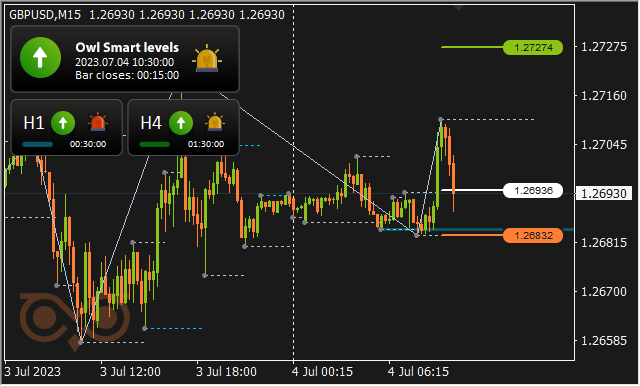

The market spent Monday in a dead zone, and Owl Smart Levels suggested opening a trade for buying GBPUSD asset on Tuesday morning.

Fig. 3. GBPUSD BUY 0.14, OpenPrice = 1.26936, StopLoss = 1.26832, TakeProfit = 1.27274, Profit = $48.75

The trade went in a classic way, although it took some time for it to close at the TakeProfit level.

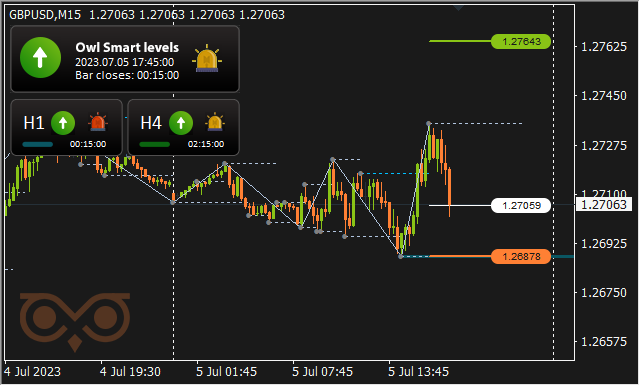

Most of the Wednesday the market spent in the dead zone, but the second trade on the asset on Wednesday evening was opened, and in a similar "pattern" and also in the plus.

Fig. 4. GBPUSD BUY 0.08, OpenPrice = 1.27059, StopLoss = 1.26878, TakeProfit = 1.27643, Profit = $48.40.

The trade closed at TakeProfit and brought the traditional profit of $48.

On Thursday evening the indicator offered to open one more trade for selling, but not profitable this time.

Fig. 5. GBPUSD BUY 0.05, OpenPrice = 1.27297, StopLoss = 1.26982, TakeProfit = 1.28315, Profit = -$11.24.

The trade was closed at the indicator's prompting, and the loss was minimized.

The last trade was opened on Friday also to buy.

Fig. 6. GBPUSD BUY 0.20, OpenPrice = 1.27352, StopLoss = 1.26982, TakeProfit = 1.28315, Profit = -$17.50.

The trade was a loss, and that's the end of trading with GBPUSD last week.

AUDUSD review

There were no trades on AUDUSD. The market spent the first half of the day on Tuesday in the dead zone, and then on Wednesday it was the same during the whole day. On Thursday and Friday there were no signals at the trading time considered (excluding the night time from 23.00 to 08.00).

Results:

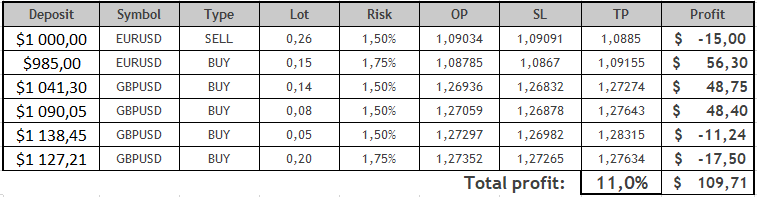

Thus, a total of 6 trades were opened during the last trading week. One for selling and five for buying. Three of them were closed by TakeProfit with good profit. Loss was fixed on the other three. Thanks to the mathematical component of the Owl Smart Levels strategy the profitability of a profitable trade exceeded the result of a loss-making one more than three times, so the final table looks quite acceptable.

The week brought more than $100 or 11% to the deposit, and, although a stable income is much more important than one-time records, we will follow with interest the developments in the next week, keeping in mind the question: will the indicator be able to break through $200 bar in one trading week of the summer season? Well, let's see how the trade will look like and what trades the Owl Smart Levels will offer us.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.