Review of trades of the Owl Smart Levels strategy for the week from August 28 to September 1, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from August 28 to September 1, 2023. Markets have been highly volatile sometimes, but let's talk about everything in order.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review

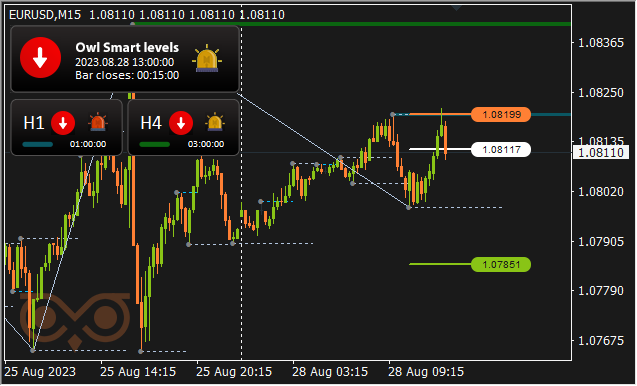

The Owl Smart Levels indicator gave the first signal to open a trade on EURUSD on Monday in the middle of the day.

Fig.1 . EURUSD SELL 0.18, OpenPrice = 1.08117, StopLoss = 1.08199, TakeProfit = 1.07851, Profit = -$15.

Unfortunately, the indicator did not have time to react to the market fluctuation, and the trade was closed at StopLoss, bringing a loss of 15$.

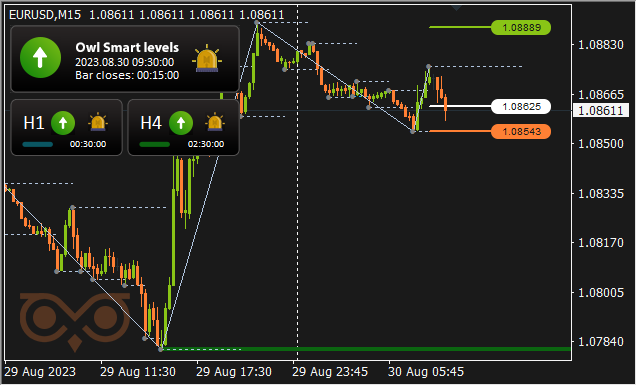

The first half of Tuesday the market was in the dead zone. The next trade was opened on Wednesday.

Fig. 2. EURUSD BUY 0.21, OpenPrice = 1.08625, StopLoss = 1.08543, TakeProfit = 1.08889, Profit = -$11.74.

The reversal of the indicator's big arrow warned to close the trade and it saved a few dollars.

The second half of Thursday the market was in the dead zone, and the next trade was opened on Friday.

Fig. 3. EURUSD BUY 0.09, OpenPrice = 1.08503, StopLoss = 1.08315, TakeProfit = 1.09111, Profit = -$17.50.

The screenshot clearly shows how long the candles are on the M15 timeframe and how high the volatility is in a quite large range, four candles from the level raise the price up and two candles lower it back to the previous mark down. In this situation, the indicator did not have time to give a signal and the trade closed at StopLoss.

GBPUSD review

The Owl Smart Levels indicator did not offer to open any trades on the GBPUSD asset, which probably saved some money on the highly volatile and unpredictable market. On Monday, Tuesday and Thursday the market was in the dead zone, and there were no trades at other times as well.

AUDUSD review

The market spent Monday in the dead zone, and Owl Smart Levels gave a signal to open a trade for buying AUDUSD on Wednesday morning.

Fig. 4. AUDUSD BUY 0.12, OpenPrice = 0.64592, StopLoss = 0.64470, TakeProfit = 0.64986, Profit = -$5.66.

The trade was "canceled" in time by a big arrow of the indicator and brought a loss of a little more than 5$.

On Thursday, the market spent most of the day in the dead zone, and no more trades were opened on the asset.

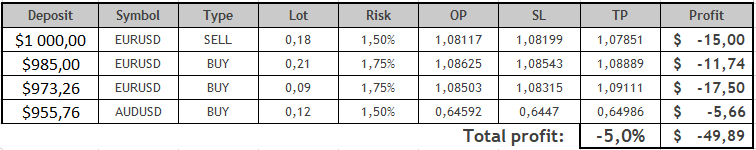

Results:

So, on the last trading week there were 4 trades, which happens very rarely, and all of them were unprofitable. High volatility of the markets in two cases did not allow the indicator to give a timely signal to close trades, and also, what is even more important, did not give an opportunity to choose perspective entry points. Well, August is traditionally a hard month in trading, especially its last week with the passing to September.

The final table of the last week looks, let's say, not the best, although we know that there are no 100% guarantees in trading.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

- From August 21 to 25, 2023, Total: +1.8%

- From August 14 to 18, 2023, Total: +2.3%

- From August 7 to 11, 2023, Total: +0.9%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.