Review of trades of the Owl Smart Levels strategy for the week from August 21 to 25, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from August 21 to 25, 2023. The trades were made in all assets, but let's talk about everything in order.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

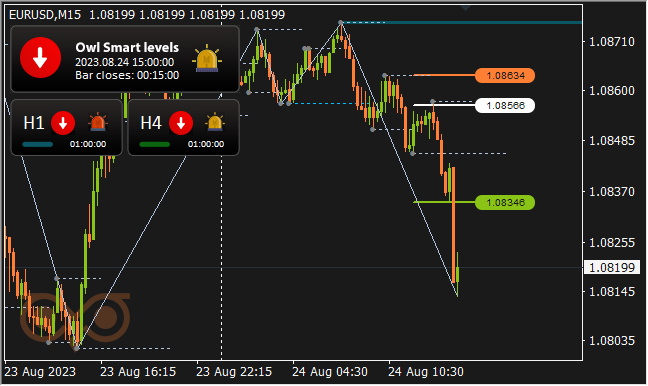

EURUSD review

Almost all Monday and the first half of Tuesday the market was in the dead zone, and the first signal to open a trade on EURUSD for selling was given by the Owl Smart Levels indicator on Thursday in the middle of the day.

Fig. 1. EURUSD SELL 0.22, OpenPrice = 1.08566, StopLoss = 1.08634, TakeProfit = 1.08346, Profit = $48.53.

The trade was closed at TakeProfit and brought a profit of 48$.

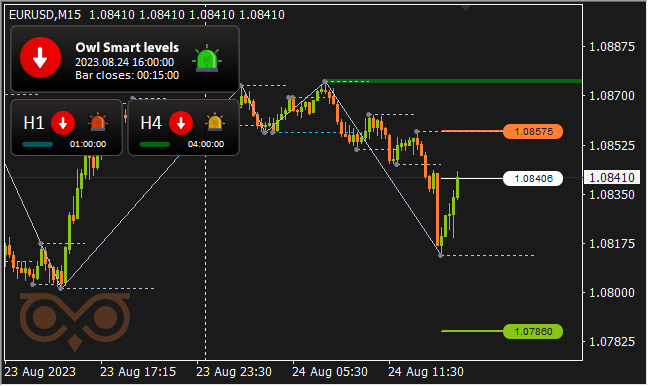

In the same trend, just an hour later the second trade was opened, also for selling.

Fig. 2. EURUSD SELL 0.09, OpenPrice = 1.08406, StopLoss = 1.08575, TakeProfit = 1.07860, Profit = $48.46.

The trade turned out to be also profitable and brought the much favorite by our indicator amount of profit of 48$.

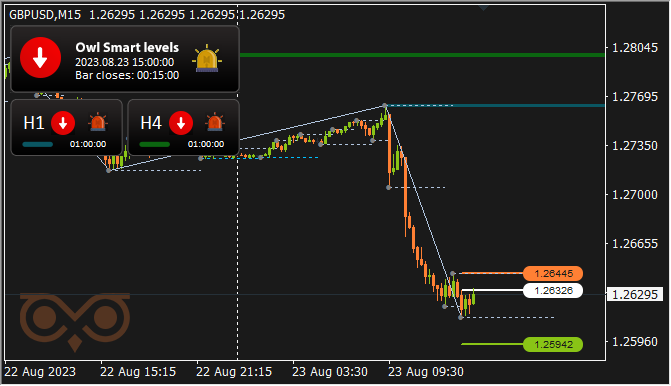

GBPUSD review

On the GBPUSD asset, the Owl Smart Levels indicator suggested opening a trade for buying on Tuesday morning.

Fig. 3. GBPUSD BUY 0.15, OpenPrice = 1.27766, StopLoss = 1.27666, TakeProfit = 1.28090, Profit = -$11.25.

The indicator gave a signal about the necessity to close this trade in advance, and the losses of several dollars were minimized.

The next trade opened on Wednesday afternoon was also unprofitable.

Fig. 4. GBPUSD SELL 0.13, OpenPrice = 1.26326, StopLoss = 1.26445, TakeProfit = 1.25942, Profit = -$15.

The indicator warned by the flip of the big arrow at the last moment, and the trade was closed at StopLoss.

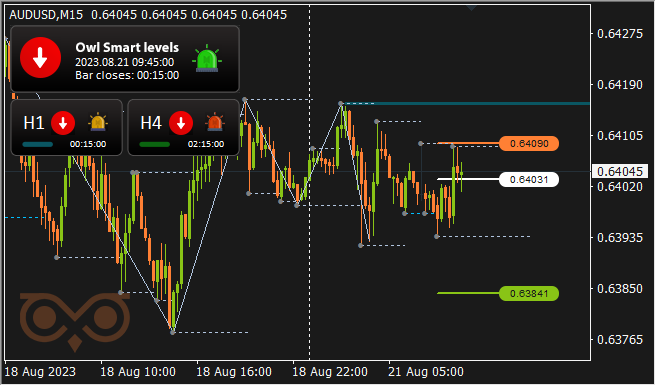

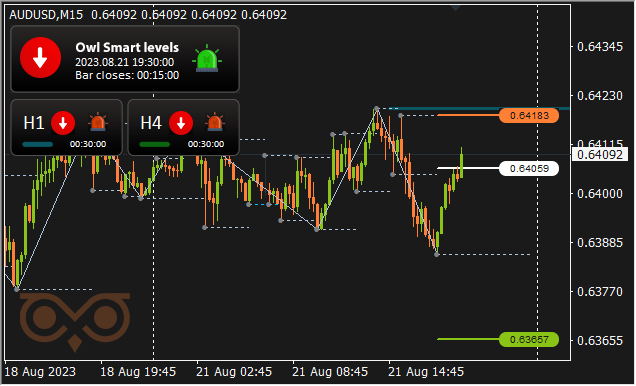

AUDUSD review

The Owl Smart Levels indicator signaled an opportunity to open a trade for selling AUDUSD on Monday morning.

Fig.5. AUDUSD SELL 0.25, OpenPrice = 0.64031, StopLoss = 0.64090, TakeProfit = 0.63841, Profit = -$15.

The trade was closed on StopLoss, as the indicator gave a warning by the reversal of the big arrow on the last candlestick before this level.

The same can be attributed to the next two trades. On Monday evening one more trade was opened to sell the asset.

Fig. 6. AUDUSD SELL 0.14, OpenPrice = 0.64059, StopLoss = 0.64183, TakeProfit = 0.63657, Profit = -$17.50.

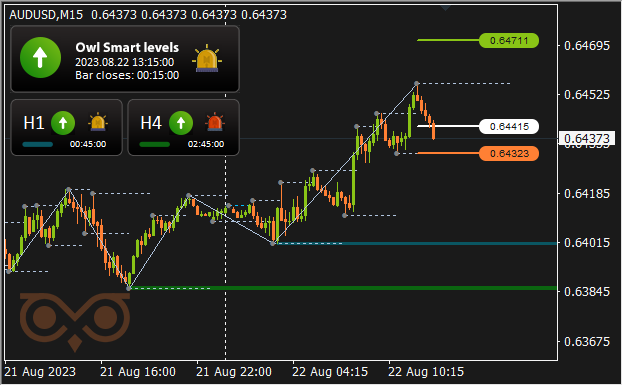

A trade for buying was opened on Tuesday afternoon.

Fig. 7. AUDUSD BUY 0.22, OpenPrice = 0.64415, StopLoss = 0.64323, TakeProfit = 0.64711, Profit = -$20.

Both trades were unprofitable and closed at StopLoss, which was a little better than if we had to close them at the closing price of the candlestick on the reversal of the indicator's big arrow, because the signal was given a little later than we would have liked.

On Thursday the market spent most of the day and the whole day on Friday in the dead zone, and no more trades were opened on the asset.

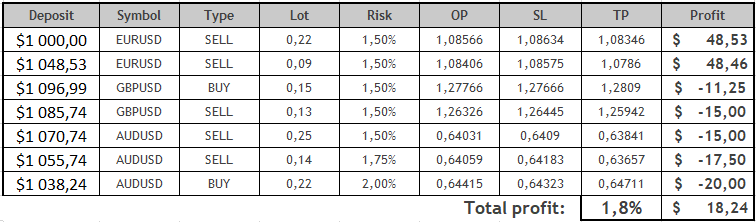

Results:

So, 7 trades were made during the last trading week, the first two of them were profitable. The profitability of profitable trades exceeded the amount of loss as usual, but five negative trades considerably reduced the income from the first two. That is why the final table this time shows a rather modest positive result.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

- From August 14 to 18, 2023, Total: +2.3%

- From August 7 to 11, 2023, Total: +0.9%

- From July 31 to August 4, 2023, Total: +7%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.