REVIEW OF TRADES OF THE OWL SMART LEVELS STRATEGY FOR THE WEEK FROM MARCH 6 TO 10, 2023

The past holiday on March 8 has not affected the trading chart of the last week, and in this review we will look at trades performed on the strategy Owl – smart levels on EURUSD, GBPUSD and AUDUSD for all five trading days from March 6 to 10, 2023.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review.

First of all, let me remind you that operating with the Owl Smart Levels Indicator involves ignoring certain trading signals, and this is one of them:

Fig. 1. Example of ignoring a signal. The signal starts at the moment of the second candle closing from the beginning of the white line – the trading signal line. But if one of the two candles has already crossed the signal line the signal should be ignored.

As usual, we start trading in the new week at 8:00 GMT and do not consider signals received before that.

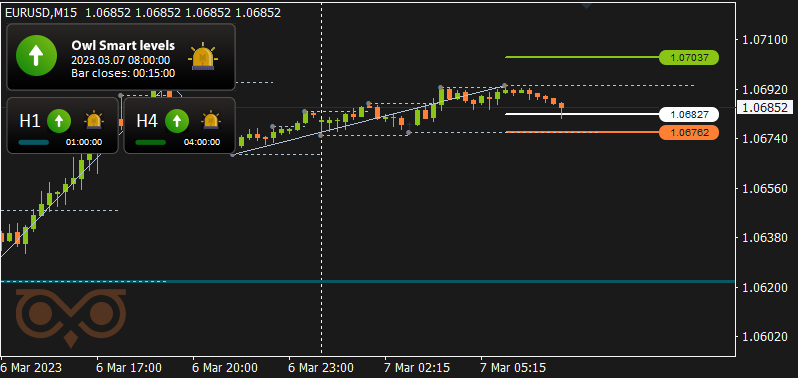

Fig. 2. EURUSD BUY 0.34, OpenPrice=1.06796, StopLoss=1.06752, TakeProfit=1.0694, Profit=+49.09$

The first trade to buy EURUSD closed as positive on TakeProfit and brought quite a good profit, while the second one failed (Fig. 3).

Fig. 3. EURUSD BUY 0.23, OpenPrice=1.06827, StopLoss=1.06762, TakeProfit=1.07037, Profit=-15$

Since the middle of the day on 08.03.2023 the market was in the dead zone for almost a day, which was displayed by the indicator, and the next trade was shown on 09.03.2023 at 13:45.

Fig. 4. EURUSD BUY 0.14, OpenPrice=1.05608, StopLoss=1.05481, TakeProfit=1.06018, Profit=+56.50$

Unfortunately, this trade was closed only the next morning, and we had to miss two or three interesting signals on potentially profitable trades, while it was open.

GBPUSD review.

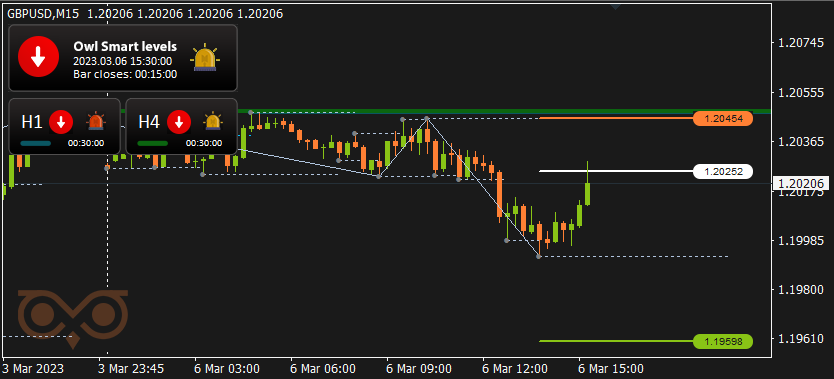

By Monday afternoon the market moved out of the dead zone and the Owl Smart Levels Indicator showed a possibility of the first successful trade:

Fig. 5. GBPUSD SELL 0.07, OpenPrice=1.20252, StopLoss=1.20454, TakeProfit=1.20395, Profit=-9.24$

The chart has changed its direction, but Owl Smart Levels has managed to warn about it (Fig. 6), and those who follow the rules of working with the indicator had time to close the trade, for example, at the level of 1.20395, in order not to crash an open position by StopLoss.

Fig. 6. The trade was closed earlier when the Valable ZigZag Indicator changed its direction upwards.

Thanks to the warning of the indicator it was possible to quickly close the position and stay in the plus position on this single trade.

AUDUSD review.

All three trades on AUDUSD were loss-making taking away some profits but not fundamentally affecting the weekly trading results.

Fig. 7. AUDUSD SELL 0.14, OpenPrice=0.65851, StopLoss=0.65957, TakeProfit=0.65507, Profit=-15$

Fig. 8. AUDUSD SELL 0.20, OpenPrice=0.65880, StopLoss=0.65954, TakeProfit=0.65642, Profit=-15$

Fig. 9. AUDUSD SELL 0.13, OpenPrice=0.65805, StopLoss=0.65907, TakeProfit=0.65477, Profit=-15$

Summing up the results.

The week was quite calm and closed on the plus side but, unfortunately, we missed some profitable trades on EURUSD following the rule of working with the Owl Smart Levels Indicator - do not open a new trade until the current one is closed - and, although it looks like we missed some profits, it is better not to experiment with this rule as it often works in favor of the trader and ensures saving the deposit.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.