Societe Generale is suggesting to be short with CAD and NZD. Short with CAD and NZD means the following:

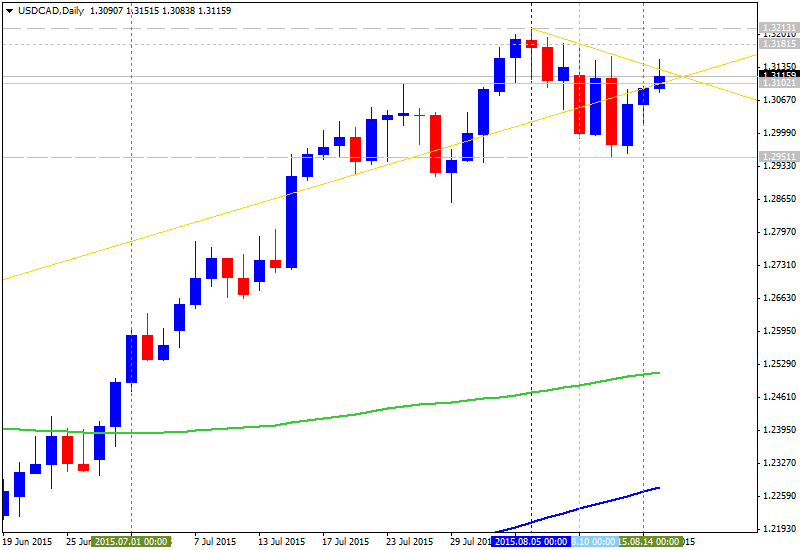

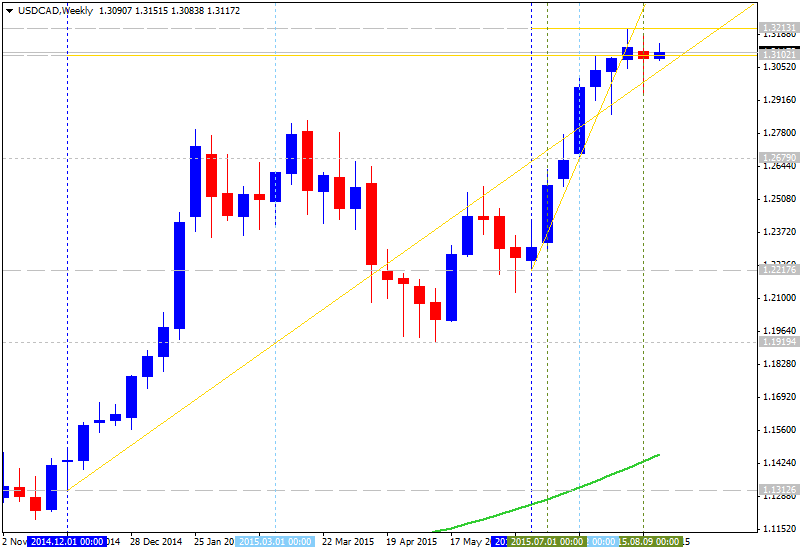

- long USDCAD;

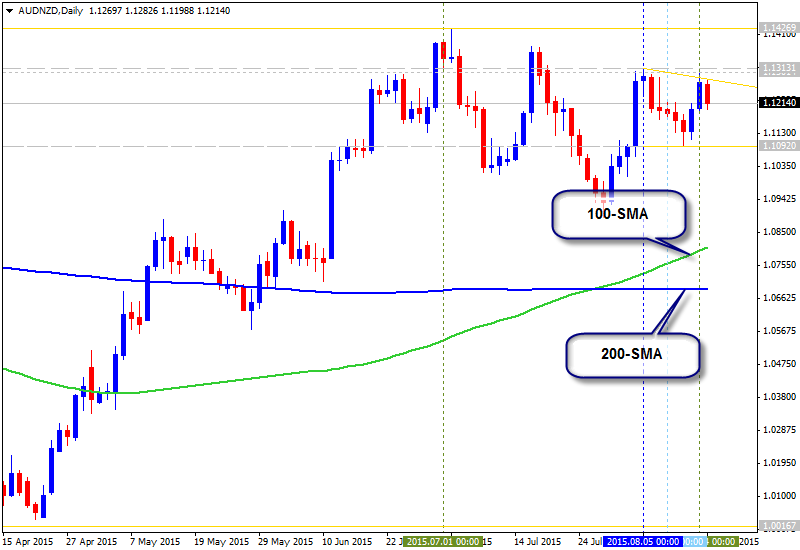

- long AUDNZD;

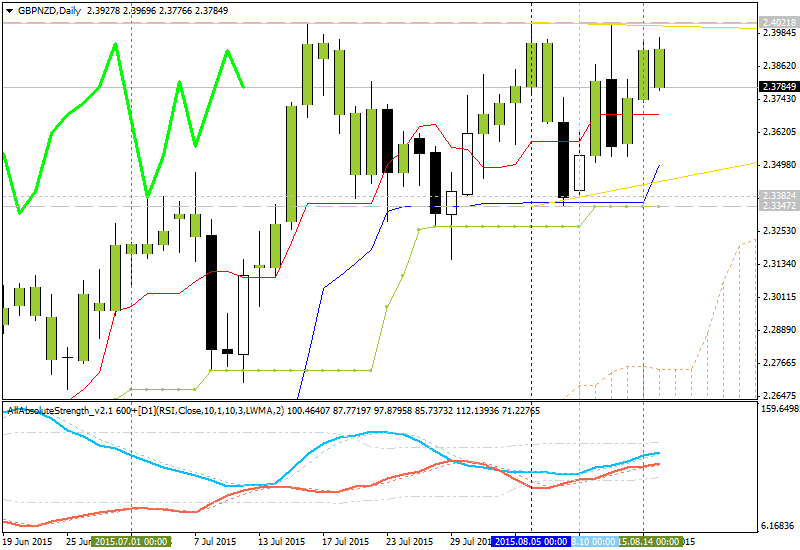

- long GBPNZD;

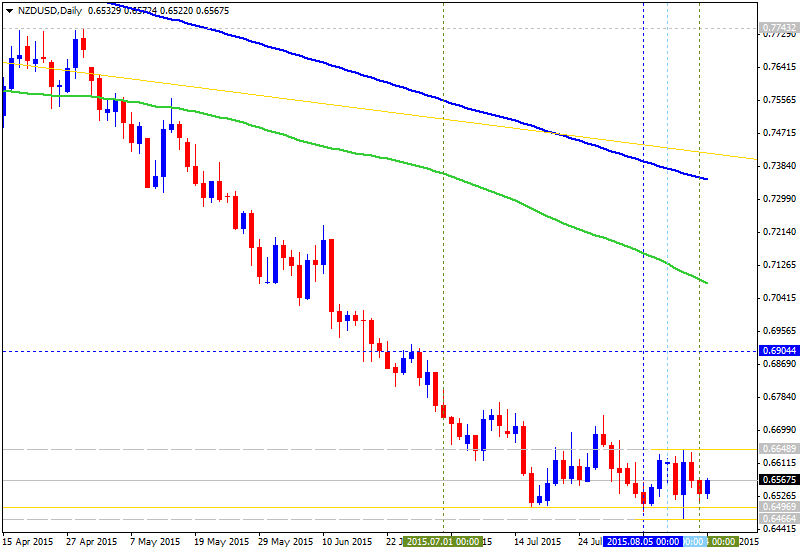

- short NZDUSD;

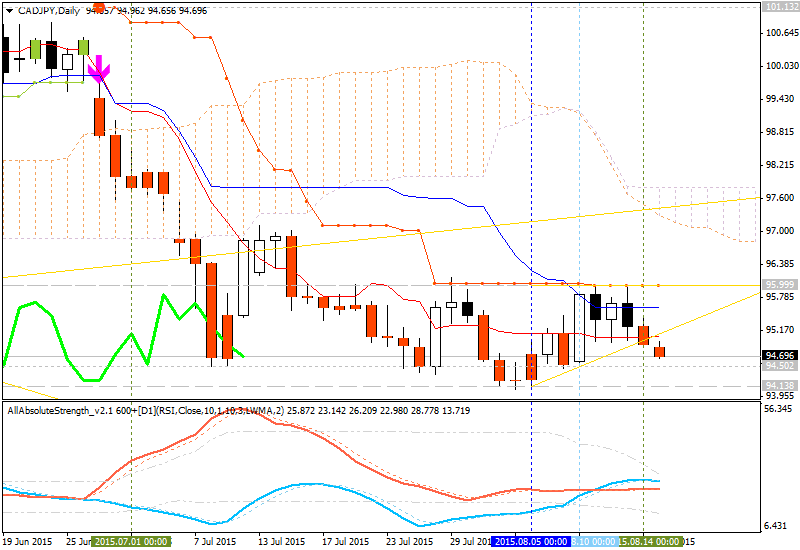

- short CADJPY;

- and more ...

Why short in CAD and NZD? Societe Generale explained that this is because of the following: yuan is in flat, oil is down, and other Asian currencies are nervous:

-

"As for FX trading to start the week, it’s the Asian FX and oil price weakness which grabs the eye, and so we persist with shorts in CAD and NZD. Long USD/CAD, AUD/NZD, and GBP/NZD appeal."

- "A token CAD/JPY short for a combination of soft oil and a retreat by global equity markets at the back end of August, also makes sense."

Let's evaluate this forecasting.

USDCAD: long - the price is on bullish condition with 1.3213 as the neatest resistance, and with symmetric triangle pattern which is crossing by the price from below to above for the bullish trend.

AUDNZD: long - 100-SMA crossed 200-SMA from below to above for the bullish trend to be continuing. If the price breaks 1.1426 resistance so this may be good signal for long.

GBPNZD: long - but it may be questionable. Daily price is on bullish between 2.3347/2.4021, and this is 674 pips (4-digit pips) range. We do not think that the primary bullish trend will be continuing this week without any ranging situation: the price will be traded within the levels this week anyway.

NZDUSD: short - the price is below 100-SMA and 200-SMA, and 100-SMA is below 200-SMA - it means that the bearish trend will be continuing. The price just needs to break 0.6496/0.6466 support levels to continuing.\

CADJPY: short - breakdown is going on. I think - the price will break 94.50/94/13 support levels with not a problem at all this week.

Thus, we can say the forecast of Societe Generale based on fundamental analysis is corresponding to the technicala analysis which was made for those pairs now.