Credit Agricole: 'Where To Sell Euro Relief Rally? - Post-FOMC should push USD funding costs higher thereby dragging EUR/USD lower'

Returning to the Eurozone and the stakes surrounding the June 18 EMU finance ministers are now even higher. With many acknowledging Greece to now hold the superior bargaining position, investors will be looking for further potential creditor concessions this week to stave off fears of a default."

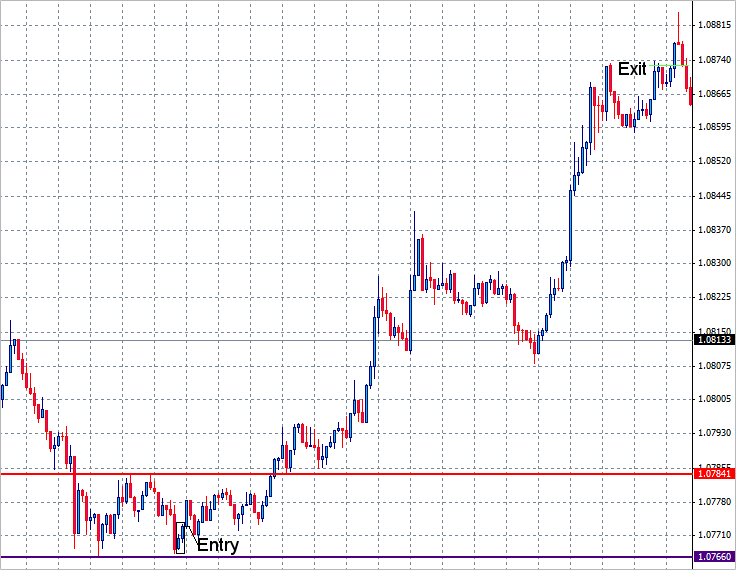

"Are such concessions realistic? ‘Yes’ would be our answer and thus the probability of a EUR relief-rally remains high. However those bearish EUR investors with all but the shortest outlooks need not be overly worried, as such a relief-rally would likely trigger renewed selling."

'Indeed we envisage such selling could quickly reemerge before 1.15 in EUR/USD and 1.30 in EUR/JPY.'