Aletheia — Test Phase v1 Wrap-Up, Web App Preview, and v2 Kick-Off

Hi everyone,

A quick update on Aletheia, my AI-driven research & trading project.

✅ Test Phase v1 — Summary

-

Period: early July → 3 Aug 2025 (~1.5 months).

-

Risk model: fixed 0.5% per trade.

-

Performance: +$2,274.02 net (≈ +4.55% on 50k). Profit factor 2.98, win rate 65% (13/20), largest win $889.92, largest loss −$256.93.

-

Drawdown: Max balance DD 0.67% (−$339.55).

-

Positioning: 20 shorts, 0 longs during v1.

-

End snapshot: Balance $52,274.02, Equity $52,803.14 at report time.

Full Trade History and Account reports are attached so you can audit every ticket.

🧭 Aletheia Web App — Public Preview

Explore how Aletheia turns global news into reasoned hypotheses and curated, broker-agnostic trade setups.

🧩 How the agent works (Home)

- Always-on monitor → enrich → hypothesis tree → evidence engine → position synthesis → execution & governance.

- Gatekeeper checks at key handoffs; clear status and outcomes.

📊 Dashboard

- KPIs & trendlines (win/loss, RR distribution, exposure, setup throughput).

- Global Impact Map (country-level choropleth by mentions, zoom/hover, top regions).

- Coverage by sectors, themes, regions; recent notable events and results.

🧠 Event Explorer

- Filters: Quick (Today / This week / This month) and Advanced (date range, themes, regions, sectors, text search, outcomes).

- Event page: context & expansion (entities/regions/sectors/themes), progress, decisions, branch & position counts.

- Branch page: hypothesis details, evidence & citation trail, gatekeeper verdicts, direction & latency, plus generated positions.

💹 Trade Setup Explorer

- Filters: date, symbol(s), direction, status (open/closed/expired/discarded), result labels (e.g., tp2_hit , sl_hit ).

- Inline charts and compact cards (thesis, entries/targets/stops, risk model, current status).

- One-click open to the originating event or branch trail.

⚡ Quick Actions

- Dashboard → metrics & map

- Event Explorer → events → branches → evidence

- Trade Setups → browse & audit outcomes

👉 Web App: https://aletheia.giize.com

🔍 4 Example Setups From v1

Below are four real tickets from v1. Click the trail link to inspect the full reasoning in the app.

🟢 CRWD (Crowdstrike Holdings Inc) - 📍 Entry: 450.62 | TP1: 430.40 ✅ TP2: 410.18 ✅

Catalyst: Palo Alto Networks is in talks to acquire CyberArk in a deal valued at approximately $20 billion, potentially reshaping the cybersecurity market.

Reasoning trail: https://aletheia.giize.com/Event_Explorer?event=9594&branch=26994

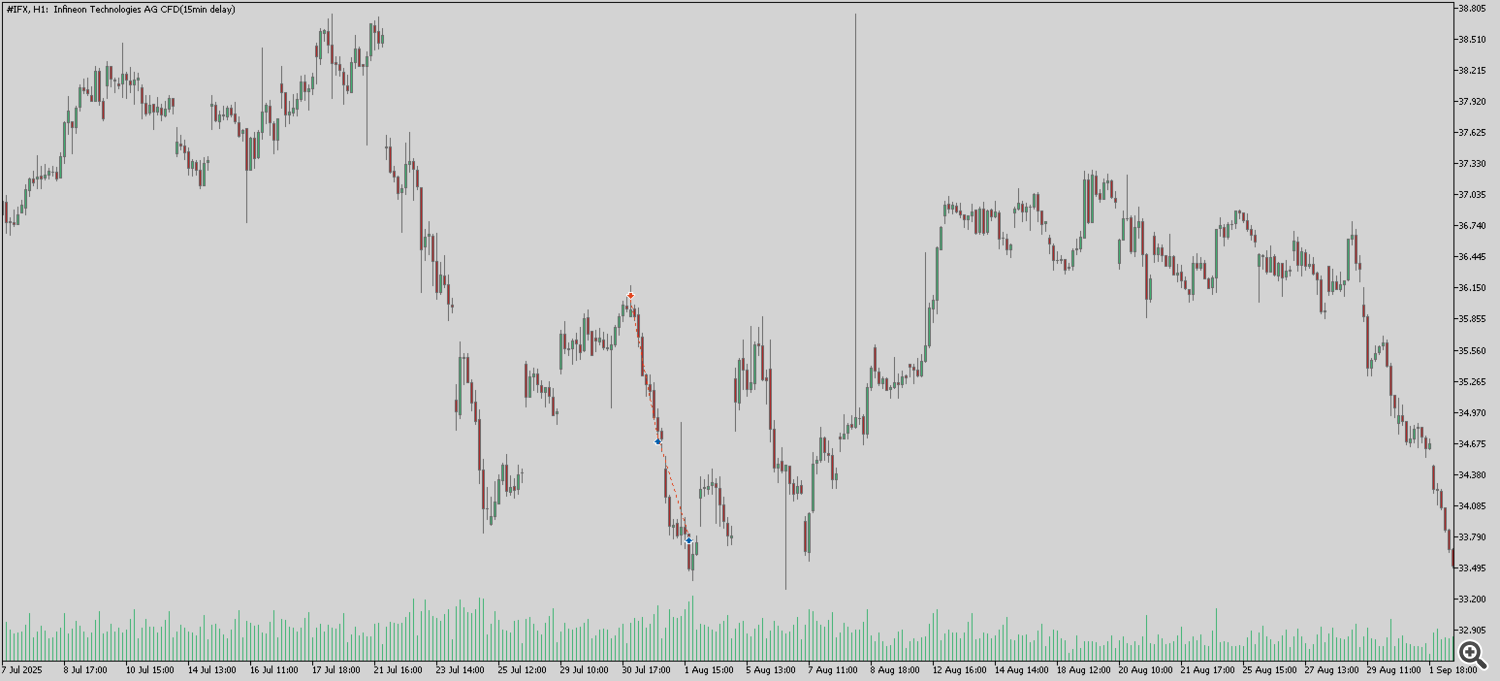

🟢 IFX (Infineon Technologies AG) - 📍 Entry: 35.949 | TP1: 34.823 ✅ TP2: 33.697 ✅

Catalyst: Intel cancels planned semiconductor fabrication projects in Germany and Poland and consolidates testing and assembly operations in Vietnam and Malaysia.

Reasoning trail: https://aletheia.giize.com/Event_Explorer?event=8483&branch=24067

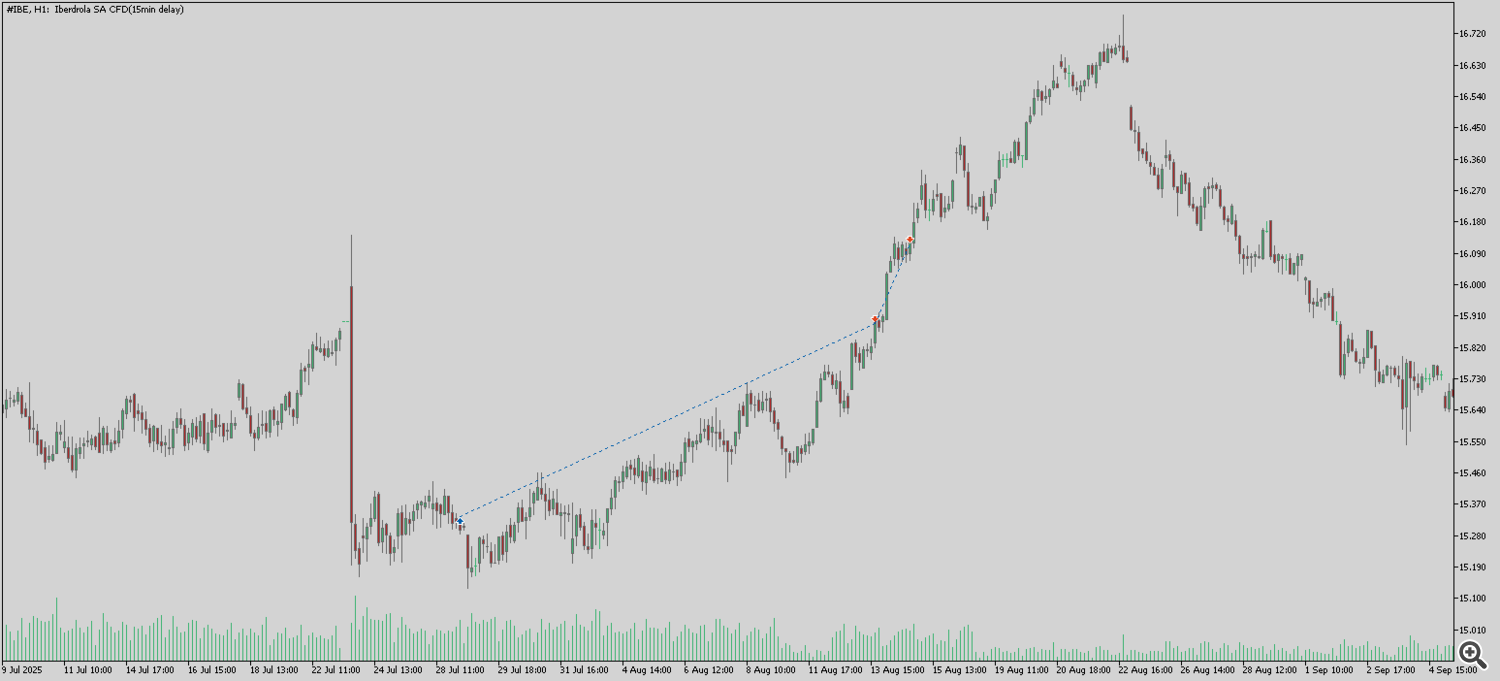

🟢 IBE (Iberdrola SA) - 📍 Entry: 15.32 | TP1: 15.69 ✅ TP2: 16.06 ✅

Catalyst: Government raises maximum price paid to wind farm developers for electricity.

Reasoning trail: https://aletheia.giize.com/Event_Explorer?event=8384&branch=23805

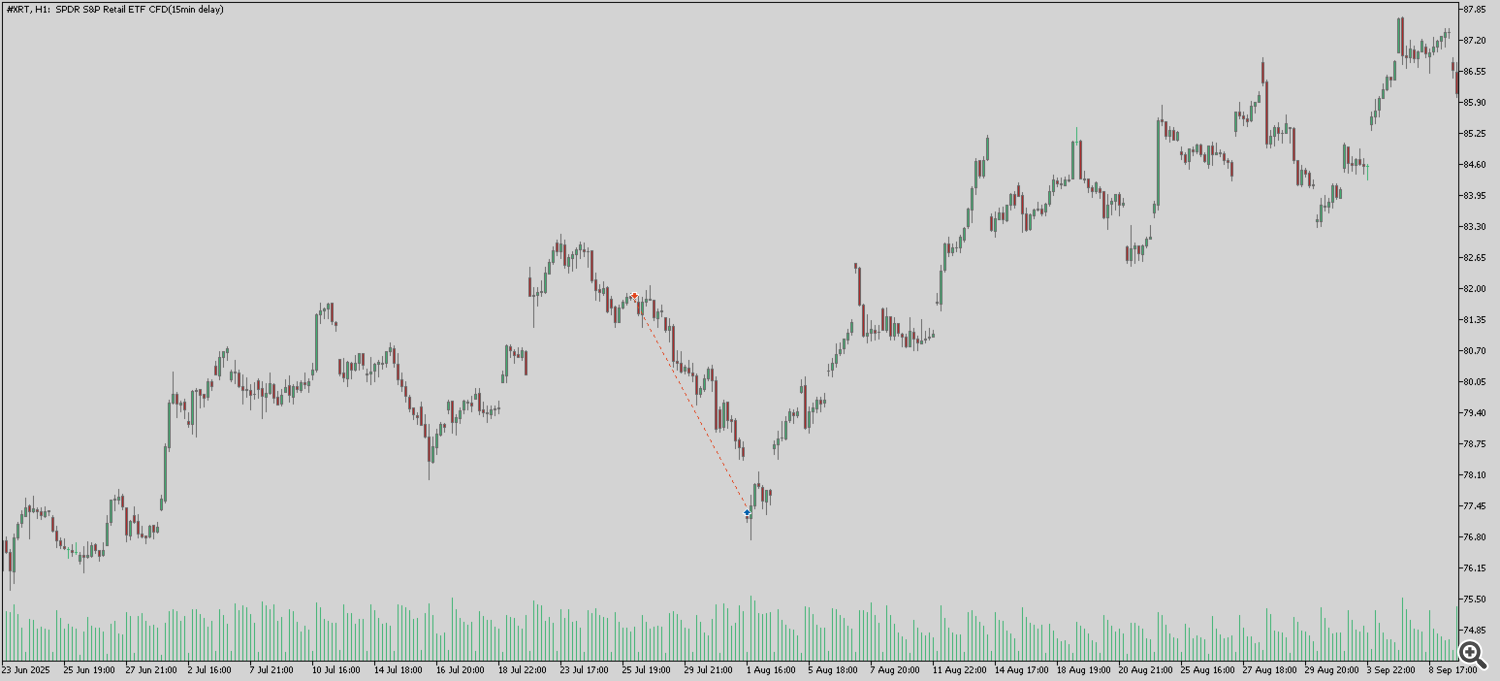

🟢 XRT (SPDR S&P Retail ETF) - 📍 Entry: 81.8 | TP1: 80.01 ✅ TP2: 78.22 ✅

Catalyst: U.S. companies raised prices for goods and services in July, citing tariffs as a key factor contributing to inflationary pressures.

Reasoning trail: https://aletheia.giize.com/Event_Explorer?event=8392&branch=23833

🔄 What changed after pausing v1

-

New Reasoning Auditor (continuous learning).

Scans the entire reasoning trail to validate that analyses are grounded in solid evidence. Continuously updated as more setups and outcomes arrive.

Why it matters: filters out weak, indirect logic and favors direct, causal impact between event → asset. -

Evidence gating tightened (carried forward).

Stricter source quality & recency checks; patterns linked to v1 losses are down-weighted or blocked.

Why it matters: reduces speculative, wide narratives slipping into setups. -

Websearch coverage & parsing improved.

Broader domain support + better parsers increase successful extractions and citation depth.

Why it matters: more (and cleaner) sources, fewer blind spots. -

Symbol Matcher upgraded.

Tighter ticker/venue mapping and conflict resolution to cut symbol mismatches.

Why it matters: improves asset targeting accuracy before orders are formed. -

Targets & RR optimizer (from v1 history).

Re-tuned target selection using all historical setups: shorter entry→SL, longer entry→TP1/TP2 distances.

Why it matters: raises average expected R while controlling downside. -

MT5 execution safety (lot-step aware).

Orders that were too large for broker constraints are now auto-split into smaller tickets so risk per setup remains exact.

Why it matters: consistent position sizing → more robust live behavior. -

Partial-closure reliability fix.

Edge cases that failed to trigger TP1/TP2 partials have been corrected; state sync improved.

Why it matters: predictable profit-taking and cleaner P/L attribution. -

Setup QA pass (carried forward).

Validator rejects vague or duplicate theses; enforces clarity before anything can become a trade.

Why it matters: higher-quality setups, fewer noisy entries.

Expected v2 effect: Fewer but higher-conviction trades, tighter risk, clearer audit trails.

🚀 Test Phase v2 — Starting Now

I’m kicking off v2 with the updated pipeline and the new web app.

Join v2: if you’d like to follow along, review setups, or stress-test reasoning, jump in:

-

Discord (official): https://discord.gg/r5j7jNtfBF — live updates, feedback threads, and Q&A.

📎 Attachments

-

Trade History Report (v1) — screenshots (HTML file type not supported here).

-

Trade Running Report (v1) — screenshots (HTML file type not supported here).