MQL5 MT5 LINK https://www.mql5.com/en/market/product/164510

HOW THE EA WORKS (HIGH-LEVEL LOGIC)

BTC Vortex Nexus uses volatility-adapted price engines and multi-layer safety filters to enter trades only when market conditions validate structure and liquidity.

At key reference points, the EA evaluates signal integrity, expected slippage, and execution cost before generating orders.

The system activates only when:

-

Volatility patterns match statistically defined ranges

-

Risk exposure remains aligned with predefined thresholds

-

Spread and slippage are within safe execution bands

The EA prepares both bullish and bearish scenarios, confirming price structure before engagement. There is no martingale, grid, or unsanctioned averaging logic embedded.

ARCHITECTURE OVERVIEW — SAFETY FIRST

BTC Vortex Nexus incorporates layered protections:

-

Dynamic lot sizing tied to balance and free margin

-

Spread/slippage thresholds to avoid poor fills

-

Broker rule validation (stop levels, freeze levels)

-

Volume and price-action filters to ensure quality conditions

-

Automatic cleanup of obsolete pending orders

Trade requests are rejected before execution if any safety condition fails.

This approach prevents:

-

Over-leveraging

-

Unexpected margin calls

-

Erratic broker behavior on illiquid spikes

RISK MANAGEMENT FRAMEWORK

Risk is controlled across three dimensions:

1. Lot Calculation

Lot sizes scale based on account, risk profile, and recent volatility to preserve equity.

2. Trade Structure

Every trade uses defined Stop Loss and Take Profit, supplemented by volatility-adjusted targets.

3. Exposure Caps

Limits prevent excessive margin allocation for a single trade or symbol cluster.

This design makes the EA suitable for small, medium, and institutional accounts running BTCUSD.

INPUT PARAMETERS — WHAT YOU CAN ADJUST

Core Risk Settings

Strategy Controls

Execution Protections

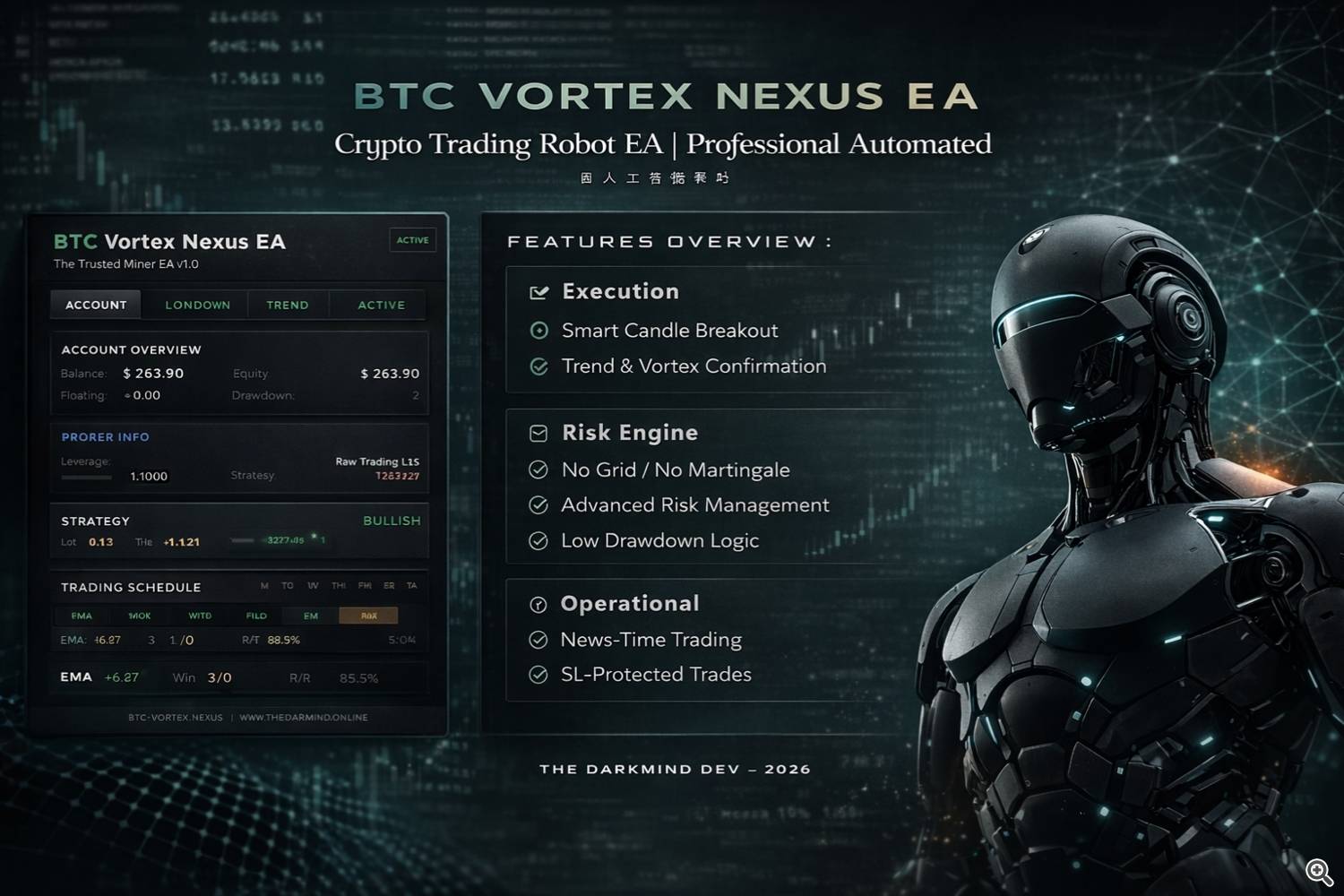

EA PANEL — HOW TO READ IT

Header Area

Shows EA name, version, market regime signal, and trade state.

Broker Card

Displays broker name, leverage, and spread status.

Account Metrics

Balance, equity, floating P/L, and drawdown shown in real time.

Strategy Metrics

Shows calculated lot size, selected risk profile, and active filters.

Directional Card

Shows pressure bias confirmation — used as confirmation, not prediction.

Performance Card

Weekly trades, wins/losses, profit, drawdown percent, and win rate.

WHAT THIS EA IS DESIGNED FOR

-

Traders prioritizing capital preservation and discipline

-

BTC traders seeking rule-based automation

-

Accounts requiring strict risk controls

-

Automation without constant oversight

WHAT THIS EA IS NOT

-

A high-frequency scalper

-

A grid or martingale system

-

A signal copier

-

A “set-and-forget” hype tool

NEWS AND VOLATILITY HANDLING

BTC Vortex Nexus does not pause during key events.

Design is based on market reaction, not prediction.

-

Uses pending logic and confirmation gates

-

Auto-blocks trades when execution conditions deteriorate

-

Treats news volatility as another market state, not a trigger

During spikes:

-

Excessive spreads → trade blocked

-

Margin risk increases → trade blocked

-

Broker limits triggered → trade blocked

FINAL NOTE

BTC Vortex Nexus is a tool, not a guarantee.

Performance depends on broker conditions, account size, leverage, and risk configuration.

The EA enforces discipline automatically — without emotion, without improvisation, and without chasing losses.