You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

AUDIO - Weekend Edition with John O'Donnell

The Ambassador of Opportunity, John O’Donnell joins Merlin Rothfeld for an interesting look at the criteria that normally appears in the markets during a topping period, as well as data which occurs during a bottoming market. John also looks at some of the major headwinds for investors and markets going forward.

Credit Agricole - EUR: The End Of Complacency (based on efxnews article)

"EUR came off at the start of the new week after the talks between Greece and its creditors in Brussels were abandoned after only 45 minutes yesterday. Our central case is still for a compromise to be found most likely in the form of a partial bailout extension in exchange for the implementation of some of the reforms. Market uneasiness could grow ahead of the Eurogroup meeting and keep the downside pressure on EURUSD in place for now."

Trading News Events: U.K. Consumer Price Index (based on dailyfx article)

An uptick in the headline & core U.K. Consumer Price Index (CPI) may spur fresh monthly highs in GBP/USD as it raises the Bank of England’s (BoE) scope to remove the record-low interest rate sooner rather than later.

What’s Expected:

Why Is This Event Important:

BoE Governor Mark Carney may sound increasingly hawkish over the coming months as the central bank head anticipates stronger price growth in the second-half of 2015, and we may see a growing number of Monetary Policy Committee (MPC) officials prepare U.K. households & businesses for higher borrowing-costs as the economy gets on a firmer footing.

However, waning confidence paired with falling input costs may continue to drag on price growth, and a dismal CPI print may undermine the near-term breakout in GBP/USD as market participants push back bets for a BoE rate hike.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Headline & Core Inflation Upticks in May

- Need green, five-minute candle following the release to consider a long British Pound trade.

- If market reaction favors bullish sterling trade, long GBP/USD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bearish GBP Trade: Consumer Prices Fall Short of Market Forecast- Need red, five-minute candle to favor a short GBP/USD trade.

- Implement same setup as the bullish British Pound trade, just in the opposite direction.

Potential Price Targets For The ReleaseGBPUSD Daily

- GBP/USD may continue to retrace the decline from May as

it breaks out of the triangle/wedge formation carried over from the

previous month, with the pair showing a net 2015-gain for the first time

since May 22.

- Interim Resistance: 1.5780 (38.2% retracement) to 1.5814 (May high)

- Interim Support: 1.5400 handle to 1.5420 (78.6% expansion)

Impact that the U.K. Core CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2015.06.16

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 68 pips price movement by GBP - CPI news event

SEB - Intraday Outlooks For EUR/USD, USD/JPY, GBP/USD, AUD/USD (based on efxnews article)

EUR/USD: Still respecting dynamic support. The high end of the (bullishly tilted) short-term "Cloud" (1.1175) remains an obstacle for bears - standing in the way for a move down to the 1.1049/36 pivot area. While nearby nitty-gritty discrepancies in range are sorted out the intraday stretches are located at 1.1150 & 1.1375.

Credit Agricole- 'Where To Sell Euro Relief Rally?' (based on efxnews article)

The impact of the Eurogroup’s failure to achieve a Greek settlement over the weekend will be temporarily supplanted as investors turn their attention towards tomorrow’s FOMC announcement. We remain USD bulls as the FOMC should strike a more constructive tone raising rate hike expectations. Latest soft US data have not changed our opinion.

To the contrary, our call remains for Fed lift-off in September with a bias towards further FOMC front-loading. Such front loading behaviour post-FOMC should push USD funding costs higher thereby dragging EUR/USD lower. Even USD/JPY should be ‘pulled off the side-lines’ after Kuroda’s overnight clarification to see the pair re-test and then break 124.0 in the week ahead.

Returning to the Eurozone and the stakes surrounding the June 18 EMU finance ministers are now even higher. With many acknowledging Greece to now hold the superior bargaining position, investors will be looking for further potential creditor concessions this week to stave off fears of a default.

Are such concessions realistic? ‘Yes’ would be our answer and thus the probability of a EUR relief-rally remains high. However those bearish EUR investors with all but the shortest outlooks need not be overly worried, as such a relief-rally would likely trigger renewed selling.

Indeed we envisage such selling could quickly reemerge before 1.15 in EUR/USD and 1.30 in EUR/JPY.

UBS for EUR: 'Greece Closer To The Brink' (based on efxnews article)

Should the Greek government and its international partners fail to reach an agreement in the emergency meetings scheduled for the coming days, a further escalation in the crisis would seem likely, argues UBS.

"This could well include changes to the ECB's provision of Emergency Liquidity Assistance (ELA) and capital controls, which would likely destabilise sentiment and put a heavy burden on the Greek economy, the banking system, and government finances – while not necessarily prompting the Syriza government to agree to Troika demands," UBS adds.

Bank of England Officials Unanimous in Keeping Rates on Hold (based on abcnews article)

Minutes from the Monetary Policy Committee meeting ending June 3 showed policymakers were mindful that "headwinds to growth" had begun to ease. The minutes show that over time, the interest rate to "keep the economy operating at normal levels of capacity," was likely to rise from the record low of 0.5 percent.

The Office of National Statistics also reported Wednesday that Britain's unemployment rate for the three months ending in April was 5.5 percent, down from 5.7 percent for the months to January.

AUDIO - Talking Stocks with Tillie Allison

Tillie joins Merlin for a show filled with listener questions! Topics range from how to adapt to current market conditions, to using options in sideways markets. Tillie offers her insights into the stocks OMG, TBT, TLT, SBUX, and how she dealt with losses and trade plans early on in her trading career.

if actual > forecast (or previous data) = good for currency (for USD in our case)

[USD - Federal Funds Rate] = Interest rate at which depository institutions lend balances held at the Federal Reserve to other depository institutions overnight. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

"The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions."

"When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

MetaTrader Trading Platform Screenshots

EURUSD, M5, 2015.06.17

MetaQuotes Software Corp., MetaTrader 5

EURUSD M5: 111 pips price range movement by USD - Federal Funds Rate news event

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2015.06.17

MetaQuotes Software Corp., MetaTrader 5

GBPUSD M5: 120 pips price range movement by USD - Federal Funds Rate news event

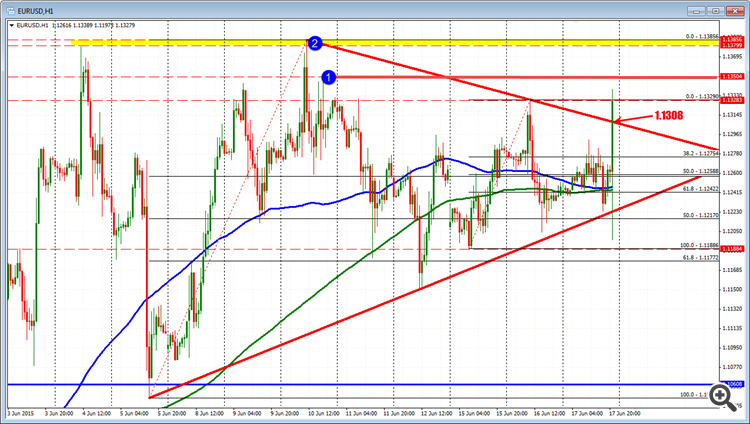

Forex technical analysis: EURUSD above trend line. Now close support/Risk (based on forexlive article)

The next targets at 1.1350 and 1.1385The EURUSD has moved higher as Yellen shows more constraint than aggressiveness in her commentary The pair is above the upper trend line at 1.1308 and this is now the risk for the pair with 1.1350 and 1.1385 targets. The FOMC is the focus and that is supportive for the pair. But sentiment can shift as stories end and we go back to Greece. So define your risk. The 1.1308 is the close level to watch for longs (risk).