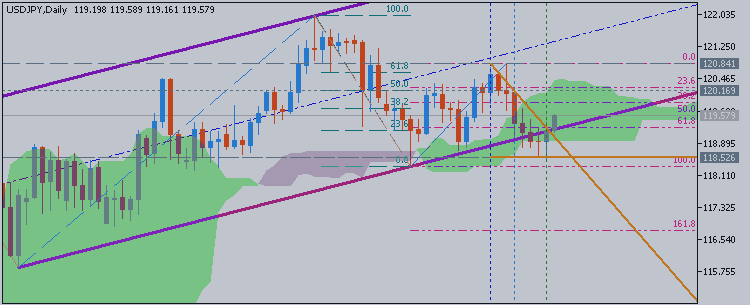

Technical Analysis - USDJPY ranging market condition for all the timeframes started with H1; bearish breakout for H4

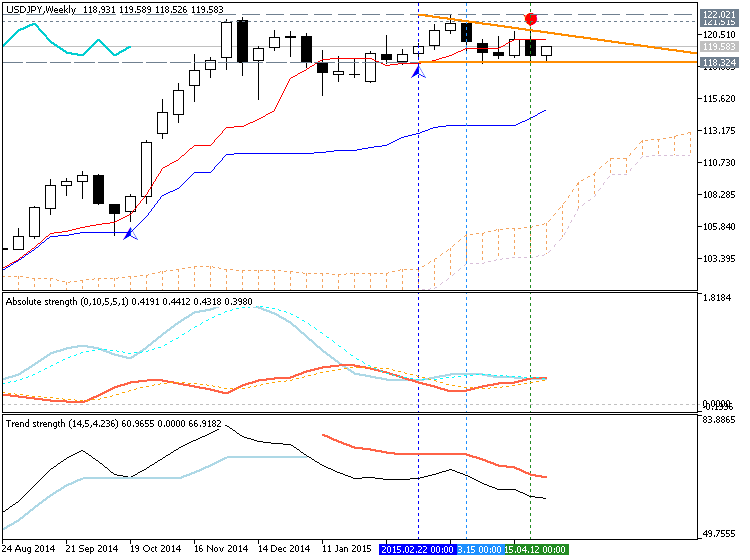

- Tenkan-sen line is located above Kijun-sen line of Ichimoku

indicator with 122.02 resistance and 118.32 support levels on W1 timeframe for the uptrend to be continuing.

- AbsoluteStrength indicator and TrendStrength indicators are in contradiction with each other showing the possible sideway market condition for W1 price to be ranging between 118.32 support and 122.02 resistance levels for W1 timeframe.

- "USDJPY has been consolidating tightly recently, as the pair even formed a long-term triangle formation on the daily chart. The pair has created higher lows and found resistance at the 121.00 handle, forming an ascending triangle chart pattern".

- "Data from the US economy has been mostly disappointing last week, forcing the dollar to return most of its recent gains. There are no top-tier releases from the US and Japan this week but risk aversion might lead to renewed support for the dollar, as the Greek debt talks don’t appear to be reaching a resolution just yet".

- D1 price is on ranging market condition with market rally started inside Ichimoku cloud/kumo within the primary bearish and with Chinkou Span line is going to the price from below to above for good possible future breakout and possible reversal to the primary bullish.

Trend:

- H4 - brearish breakout

- D1 - market rally within the bearish

- W1 - ranging bullish

- MN1 - ranging bullish