How to Trade Silver Without the Chaos — and How Silvestor EA Brings Structure

Silver (XAGUSD) is one of the most volatile and opportunity-rich markets available to retail traders. For beginners, that volatility can either be an advantage or a fast way to lose capital.

The difference comes down to one thing: structure.

A silver trading system for beginners must simplify decision-making while strengthening risk control. Silvestor EA does this by structuring entries and exits, automating risk management, simplifying optimization, and removing emotional interference.

If you want exposure to silver without the chaos of manual execution, a structured system with disciplined risk controls is not optional — it’s required.

A silver trading system for beginners must remove confusion, enforce discipline, and provide clear risk control. Without that, new traders fall into common traps:

- Overtrading during volatility spikes

- Moving stop losses emotionally

- Trading against trend direction

- Ignoring session timing

- Inconsistent risk per trade

What a Beginner Silver Trading System Must Have

1) Clear Entry Logic

Signals must be rule-based and consistent. No discretionary “feel” trades.

2) Structured Stop Loss Placement

Stops should be based on price structure, not arbitrary distances.

3) Risk-to-Reward Control

Take profit should be logically derived from stop distance to maintain expectancy.

4) Trade Direction Control

Buy only / sell only / both — depending on conditions.

5) Session Management

Silver behaves differently across sessions. Time filters improve consistency.

6) Capital Protection Rules

Daily loss limits, drawdown controls, and position caps are essential for survival.

Most beginners try to manage all of this manually. That’s where the chaos starts.

How Silvestor EA Removes the Chaos

1) Structured Stop Loss Logic

Instead of guessing where to place stops, Silvestor EA uses structured, price-action-based stop loss methods and configurable structure rules.

- Previous candle structure

- Engulfing logic

- Pinbar logic

- Swing / fractal levels

- Adjustable structure lookback period (enumerated)

- Enumerated SL structure buffer (pip/point offset)

2) Logical Take Profit Derivation

Take profit can be derived directly from stop loss distance (R-multiples). This enforces consistent risk-to-reward without manual decisions.

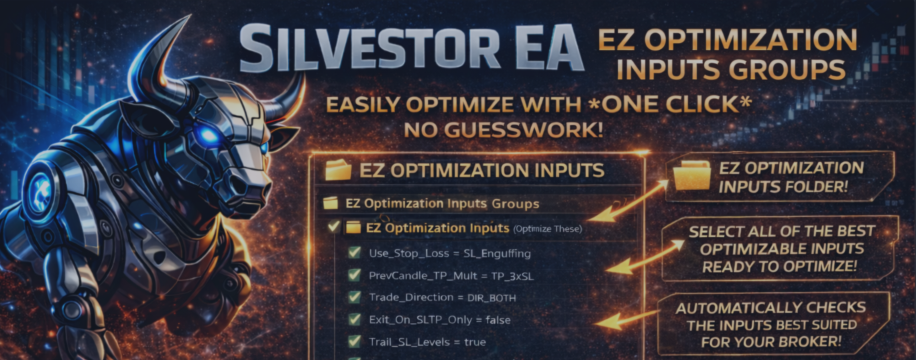

3) EZ Optimization Input Groups (One-Click Setup)

Optimization is where most beginners get stuck. Silvestor EA groups the key optimizable inputs into a dedicated EZ Optimization folder so new traders can tune the system with confidence.

- One-click selection of the core optimization variables

- No guesswork on what inputs to optimize

- Fast optimization using Open Price modeling (signals trigger on new bar formation)

- Validate results on Real Ticks afterward with consistent expectations

4) Risk Protections for Prop Firms and Personal Accounts

Beginners typically fail because they lack guardrails. Silvestor EA includes built-in protections to prevent account damage:

- Maximum daily loss controls

- Maximum daily drawdown % controls

- Minimum equity shutdown protection

- Maximum equity cap (close all)

- Max open positions limit (enumerated)

5) Trade Direction Control

Silver can chop and trend aggressively. Silvestor EA provides a clean direction control: Buy only, Sell only, or Both.

6) Trailing Logic Fix and Profit Management

Silvestor EA can trail stops using structure to reduce emotional trade management. A recent update also fixed an overlooked calculation where engulfing and pinbar trailing was being discarded due to incompatibility with the master trailing activation input introduced in the prior update.

Why Silver Specifically Needs Structure

- Silver can move aggressively during US sessions

- It reacts sharply to USD news events

- Intraday swings are often larger than many forex pairs

Without automation and strict risk controls, beginners tend to close winners too early, let losers run, and chase entries.

Final Thoughts

A silver trading system for beginners must simplify decision-making while strengthening risk control. Silvestor EA does this by structuring entries and exits, automating risk management, simplifying optimization,

and removing emotional interference.

If you want exposure to silver without the chaos of manual execution, a structured system with disciplined risk controls is not optional — it’s required.