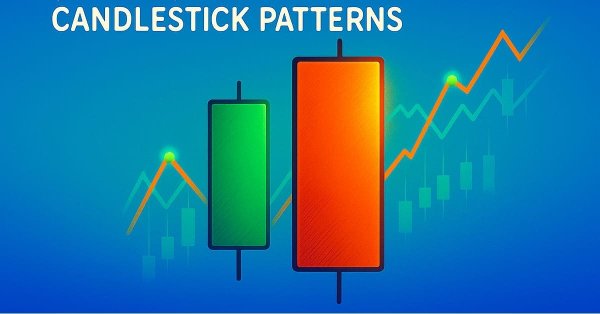

Price Action Analysis Toolkit Development (Part 51): Revolutionary Chart Search Technology for Candlestick Pattern Discovery

This article is intended for algorithmic traders, quantitative analysts, and MQL5 developers interested in enhancing their understanding of candlestick pattern recognition through practical implementation. It provides an in‑depth exploration of the CandlePatternSearch.mq5 Expert Advisor—a complete framework for detecting, visualizing, and monitoring classical candlestick formations in MetaTrader 5. Beyond a line‑by‑line review of the code, the article discusses architectural design, pattern detection logic, GUI integration, and alert mechanisms, illustrating how traditional price‑action analysis can be automated efficiently.

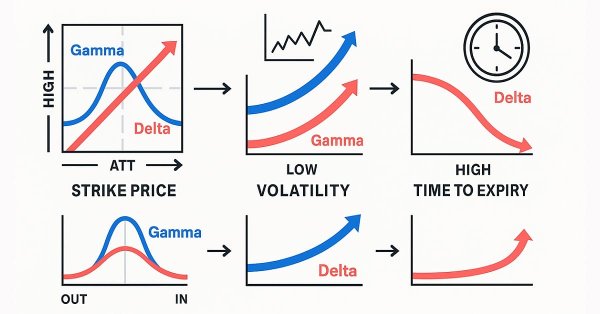

Automating Black-Scholes Greeks: Advanced Scalping and Microstructure Trading

Gamma and Delta were originally developed as risk-management tools for hedging options exposure, but over time they evolved into powerful instruments for advanced scalping, order-flow modeling, and microstructure trading. Today, they serve as real-time indicators of price sensitivity and liquidity behavior, enabling traders to anticipate short-term volatility with remarkable precision.

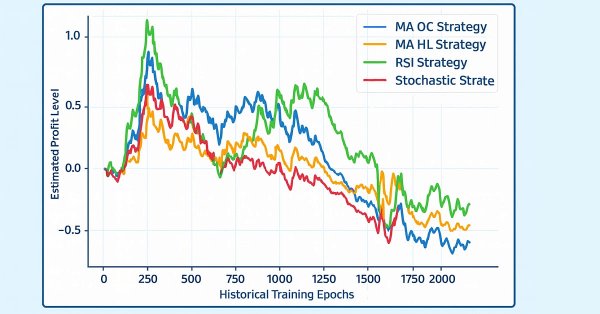

Overcoming The Limitation of Machine Learning (Part 7): Automatic Strategy Selection

This article demonstrates how to automatically identify potentially profitable trading strategies using MetaTrader 5. White-box solutions, powered by unsupervised matrix factorization, are faster to configure, more interpretable, and provide clear guidance on which strategies to retain. Black-box solutions, while more time-consuming, are better suited for complex market conditions that white-box approaches may not capture. Join us as we discuss how our trading strategies can help us carefully identify profitable strategies under any circumstance.

Risk Management (Part 2): Implementing Lot Calculation in a Graphical Interface

In this article, we will look at how to improve and more effectively apply the concepts presented in the previous article using the powerful MQL5 graphical control libraries. We'll go step by step through the process of creating a fully functional GUI. I'll be explaining the ideas behind it, as well as the purpose and operation of each method used. Additionally, at the end of the article, we will test the panel we created to ensure it functions correctly and meets its stated goals.

From Novice to Expert: Predictive Price Pathways

Fibonacci levels provide a practical framework that markets often respect, highlighting price zones where reactions are more likely. In this article, we build an expert advisor that applies Fibonacci retracement logic to anticipate likely future moves and trade retracements with pending orders. Explore the full workflow—from swing detection to level plotting, risk controls, and execution.

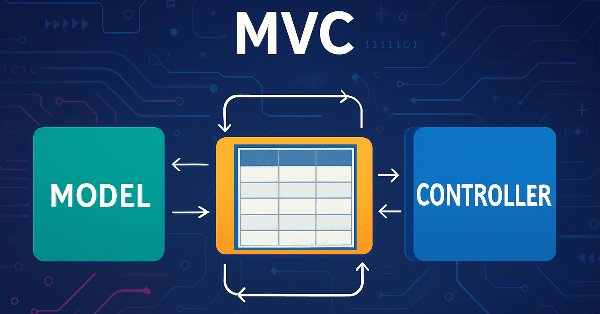

Implementation of a table model in MQL5: Applying the MVC concept

In this article, we look at the process of developing a table model in MQL5 using the MVC (Model-View-Controller) architectural pattern to separate data logic, presentation, and control, enabling structured, flexible, and scalable code. We consider implementation of classes for building a table model, including the use of linked lists for storing data.

Price Action Analysis Toolkit Development (Part 50): Developing the RVGI, CCI and SMA Confluence Engine in MQL5

Many traders struggle to identify genuine reversals. This article presents an EA that combines RVGI, CCI (±100), and an SMA trend filter to produce a single clear reversal signal. The EA includes an on-chart panel, configurable alerts, and the full source file for immediate download and testing.

Self Optimizing Expert Advisors in MQL5 (Part 17): Ensemble Intelligence

All algorithmic trading strategies are difficult to set up and maintain, regardless of complexity—a challenge shared by beginners and experts alike. This article introduces an ensemble framework where supervised models and human intuition work together to overcome their shared limitations. By aligning a moving average channel strategy with a Ridge Regression model on the same indicators, we achieve centralized control, faster self-correction, and profitability from otherwise unprofitable systems.

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

Formulating Dynamic Multi-Pair EA (Part 5): Scalping vs Swing Trading Approaches

This part explores how to design a Dynamic Multi-Pair Expert Advisor capable of adapting between Scalping and Swing Trading modes. It covers the structural and algorithmic differences in signal generation, trade execution, and risk management, allowing the EA to intelligently switch strategies based on market behavior and user input.

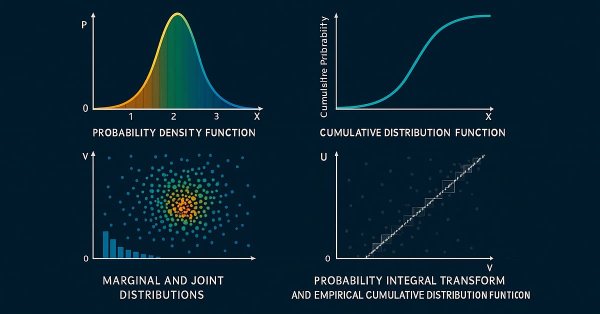

Bivariate Copulae in MQL5 (Part 2): Implementing Archimedean copulae in MQL5

In the second installment of the series, we discuss the properties of bivariate Archimedean copulae and their implementation in MQL5. We also explore applying copulae to the development of a simple pairs trading strategy.

Price Action Analysis Toolkit Development (Part 49): Integrating Trend, Momentum, and Volatility Indicators into One MQL5 System

Simplify your MetaTrader 5 charts with the Multi Indicator Handler EA. This interactive dashboard merges trend, momentum, and volatility indicators into one real‑time panel. Switch instantly between profiles to focus on the analysis you need most. Declutter with one‑click Hide/Show controls and stay focused on price action. Read on to learn step‑by‑step how to build and customize it yourself in MQL5.

Reimagining Classic Strategies (Part 17): Modelling Technical Indicators

In this discussion, we focus on how we can break the glass ceiling imposed by classical machine learning techniques in finance. It appears that the greatest limitation to the value we can extract from statistical models does not lie in the models themselves — neither in the data nor in the complexity of the algorithms — but rather in the methodology we use to apply them. In other words, the true bottleneck may be how we employ the model, not the model’s intrinsic capability.

Market Simulation (Part 05): Creating the C_Orders Class (II)

In this article, I will explain how Chart Trade, together with the Expert Advisor, will process a request to close all of the users' open positions. This may sound simple, but there are a few complications that you need to know how to manage.

The MQL5 Standard Library Explorer (Part 3): Expert Standard Deviation Channel

In this discussion, we will develop an Expert Advisor using the CTrade and CChartObjectStdDevChannel classes, while applying several filters to enhance profitability. This stage puts our previous discussion into practical application. Additionally, I’ll introduce another simple approach to help you better understand the MQL5 Standard Library and its underlying codebase. Join the discussion to explore these concepts in action.

Price Action Analysis Toolkit Development (Part 48): Multi-Timeframe Harmony Index with Weighted Bias Dashboard

This article introduces the “Multi-Timeframe Harmony Index”—an advanced Expert Advisor for MetaTrader 5 that calculates a weighted bias from multiple timeframes, smooths the readings using EMA, and displays the results in a clean chart panel dashboard. It includes customizable alerts and automatic buy/sell signal plotting when strong bias thresholds are crossed. Suitable for traders who use multi-timeframe analysis to align entries with overall market structure.

Self Optimizing Expert Advisors in MQL5 (Part 16): Supervised Linear System Identification

Linear system identifcation may be coupled to learn to correct the error in a supervised learning algorithm. This allows us to build applications that depend on statistical modelling techniques without necessarily inheriting the fragility of the model's restrictive assumptions. Classical supervised learning algorithms have many needs that may be supplemented by pairing these models with a feedback controller that can correct the model to keep up with current market conditions.

From Novice to Expert: Revealing the Candlestick Shadows (Wicks)

In this discussion, we take a step forward to uncover the underlying price action hidden within candlestick wicks. By integrating a wick visualization feature into the Market Periods Synchronizer, we enhance the tool with greater analytical depth and interactivity. This upgraded system allows traders to visualize higher-timeframe price rejections directly on lower-timeframe charts, revealing detailed structures that were once concealed within the shadows.

Black-Scholes Greeks: Gamma and Delta

Gamma and Delta measure how an option’s value reacts to changes in the underlying asset’s price. Delta represents the rate of change of the option’s price relative to the underlying, while Gamma measures how Delta itself changes as price moves. Together, they describe an option’s directional sensitivity and convexity—critical for dynamic hedging and volatility-based trading strategies.

From Basic to Intermediate: Template and Typename (V)

In this article, we'll explore one last simple use case for templates, and discuss the benefits and necessity of using typename in your code. Although this article may seem a bit complicated at first, it is important to understand it properly in order to use templates and typename later.

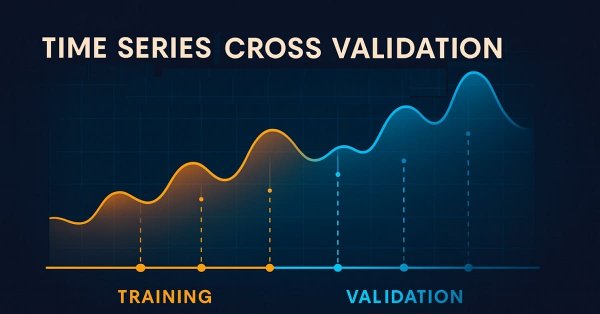

Overcoming The Limitation of Machine Learning (Part 6): Effective Memory Cross Validation

In this discussion, we contrast the classical approach to time series cross-validation with modern alternatives that challenge its core assumptions. We expose key blind spots in the traditional method—especially its failure to account for evolving market conditions. To address these gaps, we introduce Effective Memory Cross-Validation (EMCV), a domain-aware approach that questions the long-held belief that more historical data always improves performance.

Market Simulation (Part 04): Creating the C_Orders Class (I)

In this article, we will start creating the C_Orders class to be able to send orders to the trading server. We'll do this little by little, as our goal is to explain in detail how this will happen through the messaging system.

Dynamic Swing Architecture: Market Structure Recognition from Swings to Automated Execution

This article introduces a fully automated MQL5 system designed to identify and trade market swings with precision. Unlike traditional fixed-bar swing indicators, this system adapts dynamically to evolving price structure—detecting swing highs and swing lows in real time to capture directional opportunities as they form.

The MQL5 Standard Library Explorer (Part 2): Connecting Library Components

Today, we take an important step toward helping every developer understand how to read class structures and quickly build Expert Advisors using the MQL5 Standard Library. The library is rich and expandable, yet it can feel like being handed a complex toolkit without a manual. Here we share and discuss an alternative integration routine—a concise, repeatable workflow that shows how to connect classes reliably in real projects.

Risk Management (Part 1): Fundamentals for Building a Risk Management Class

In this article, we'll cover the basics of risk management in trading and learn how to create your first functions for calculating the appropriate lot size for a trade, as well as a stop-loss. Additionally, we will go into detail about how these features work, explaining each step. Our goal is to provide a clear understanding of how to apply these concepts in automated trading. Finally, we will put everything into practice by creating a simple script with an include file.

Price Action Analysis Toolkit Development (Part 45): Creating a Dynamic Level-Analysis Panel in MQL5

In this article, we explore a powerful MQL5 tool that let's you test any price level you desire with just one click. Simply enter your chosen level and press analyze, the EA instantly scans historical data, highlights every touch and breakout on the chart, and displays statistics in a clean, organized dashboard. You'll see exactly how often price respected or broke through your level, and whether it behaved more like support or resistance. Continue reading to explore the detailed procedure.

Bivariate Copulae in MQL5 (Part 1): Implementing Gaussian and Student's t-Copulae for Dependency Modeling

This is the first part of an article series presenting the implementation of bivariate copulae in MQL5. This article presents code implementing Gaussian and Student's t-copulae. It also delves into the fundamentals of statistical copulae and related topics. The code is based on the Arbitragelab Python package by Hudson and Thames.

Overcoming The Limitation of Machine Learning (Part 5): A Quick Recap of Time Series Cross Validation

In this series of articles, we look at the challenges faced by algorithmic traders when deploying machine-learning-powered trading strategies. Some challenges within our community remain unseen because they demand deeper technical understanding. Today’s discussion acts as a springboard toward examining the blind spots of cross-validation in machine learning. Although often treated as routine, this step can easily produce misleading or suboptimal results if handled carelessly. This article briefly revisits the essentials of time series cross-validation to prepare us for more in-depth insight into its hidden blind spots.

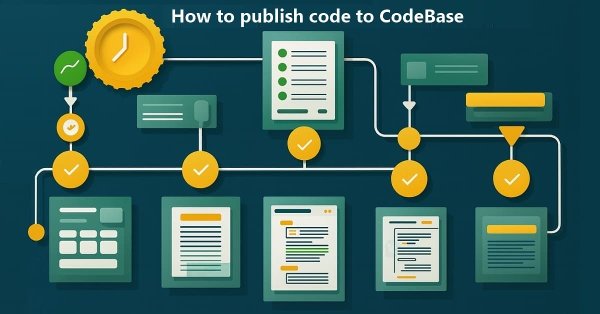

Moving to MQL5 Algo Forge (Part 4): Working with Versions and Releases

We'll continue developing the Simple Candles and Adwizard projects, while also describing the finer aspects of using the MQL5 Algo Forge version control system and repository.

From Novice to Expert: Market Periods Synchronizer

In this discussion, we introduce a Higher-to-Lower Timeframe Synchronizer tool designed to solve the problem of analyzing market patterns that span across higher timeframe periods. The built-in period markers in MetaTrader 5 are often limited, rigid, and not easily customizable for non-standard timeframes. Our solution leverages the MQL5 language to develop an indicator that provides a dynamic and visual way to align higher timeframe structures within lower timeframe charts. This tool can be highly valuable for detailed market analysis. To learn more about its features and implementation, I invite you to join the discussion.

Reusing Invalidated Orderblocks As Mitigation Blocks (SMC)

In this article, we explore how previously invalidated orderblocks can be reused as mitigation blocks within Smart Money Concepts (SMC). These zones reveal where institutional traders re-enter the market after a failed orderblock, providing high-probability areas for trade continuation in the dominant trend.

Market Simulation (Part 03): A Matter of Performance

Often we have to take a step back and then move forward. In this article, we will show all the changes necessary to ensure that the Mouse and Chart Trade indicators do not break. As a bonus, we'll also cover other changes that have occurred in other header files that will be widely used in the future.

How to publish code to CodeBase: A practical guide

In this article, we will use real-life examples to illustrate posting various types of terminal programs in the MQL5 source code base.

Price Action Analysis Toolkit Development (Part 44): Building a VWMA Crossover Signal EA in MQL5

This article introduces a VWMA crossover signal tool for MetaTrader 5, designed to help traders identify potential bullish and bearish reversals by combining price action with trading volume. The EA generates clear buy and sell signals directly on the chart, features an informative panel, and allows for full user customization, making it a practical addition to your trading strategy.

Time Evolution Travel Algorithm (TETA)

This is my own algorithm. The article presents the Time Evolution Travel Algorithm (TETA) inspired by the concept of parallel universes and time streams. The basic idea of the algorithm is that, although time travel in the conventional sense is impossible, we can choose a sequence of events that lead to different realities.

Post-Factum trading analysis: Selecting trailing stops and new stop levels in the strategy tester

We continue the topic of analyzing completed deals in the strategy tester to improve the quality of trading. Let's see how using different trailing stops can change our existing trading results.

Developing Advanced ICT Trading Systems: Implementing Signals in the Order Blocks Indicator

In this article, you will learn how to develop an Order Blocks indicator based on order book volume (market depth) and optimize it using buffers to improve accuracy. This concludes the current stage of the project and prepares for the next phase, which will include the implementation of a risk management class and a trading bot that uses signals generated by the indicator.

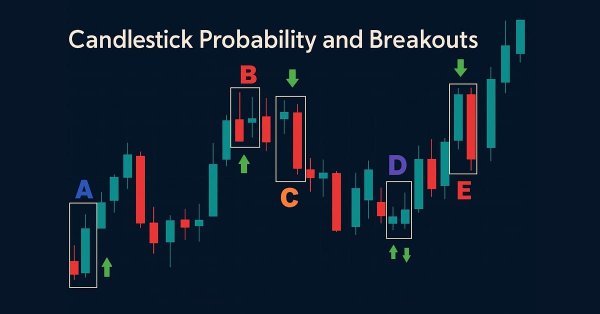

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

Enhance your market analysis with the MQL5-native Candlestick Probability EA, a lightweight tool that transforms raw price bars into real-time, instrument-specific probability insights. It classifies Pinbars, Engulfing, and Doji patterns at bar close, uses ATR-aware filtering, and optional breakout confirmation. The EA calculates raw and volume-weighted follow-through percentages, helping you understand each pattern's typical outcome on specific symbols and timeframes. On-chart markers, a compact dashboard, and interactive toggles allow easy validation and focus. Export detailed CSV logs for offline testing. Use it to develop probability profiles, optimize strategies, and turn pattern recognition into a measurable edge.

Reimagining Classic Strategies (Part 16): Double Bollinger Band Breakouts

This article walks the reader through a reimagined version of the classical Bollinger Band breakout strategy. It identifies key weaknesses in the original approach, such as its well-known susceptibility to false breakouts. The article aims to introduce a possible solution: the Double Bollinger Band trading strategy. This relatively lesser known approach supplements the weaknesses of the classical version and offers a more dynamic perspective on financial markets. It helps us overcome the old limitations defined by the original rules, providing traders with a stronger and more adaptive framework.

Visual assessment and adjustment of trading in MetaTrader 5

The strategy tester allows you to do more than just optimize your trading robot's parameters. I will show how to evaluate your account's trading history post-factum and make adjustments to your trading in the tester by changing the stop-losses of your open positions.