Killzone Liquidity Sweep EV

- Experts

- Enrique Valeros Muriana

- 버전: 1.53

- 업데이트됨: 18 11월 2025

Killzone Liquidity Sweep EA Pro

by EV Trading Labs

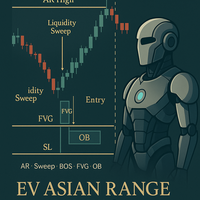

This Expert Advisor is based on institutional concepts (Smart Money / ICT methodology) and focuses on identifying and executing high-probability setups during the London and New York killzones. The system combines directional bias, liquidity sweep confirmation, and precision stop entries aligned with institutional trading logic.

The algorithm operates on the M15 timeframe and trades only when the market shows a clean directional structure confirmed by EMA 50, EMA 100, and EMA 200. This avoids trading in consolidation and counter-trend situations. It uses the previous session’s high or low to detect liquidity sweeps and waits for a reversal candle with clear rejection before placing stop entries.

Once conditions align, the EA places pending stop orders for precision execution:

-

Buy Stop above the reversal candle high

-

Sell Stop below the reversal candle low

Stop Loss is automatically set one pip beyond the opposite candle extreme, with the option to define all parameters in pips or raw points. Entries can include an additional entry buffer to reduce false triggers.

Trade management features include trailing stop, break-even activation, and optional fixed take profit. The system can be restricted to one trade or one pending order per session, maintaining disciplined exposure. All session times (London and New York killzones) are user-configurable based on broker server time.

Operational filters include:

-

Maximum spread control

-

Session window validation

-

Automatic pending order removal after the session

-

Magic Number isolation

-

Backtest and optimization support

The EA is optimized for markets that exhibit clean session structure such as EURUSD, GBPUSD, and XAUUSD, and can be adapted to indices (NAS100 / US30) by switching to point-based parameters. ECN brokers and low-latency environments are recommended.

Review: Killzone Liquidity Sweep EV Killzone Liquidity Sweep EV is one of the most impressive free Expert Advisors I’ve tested. It applies institutional trading logic with precision, focusing on liquidity sweeps during the London and New York killzones. Entries are clean and disciplined, with pending stop orders placed only after liquidity grabs and reversal confirmation. Risk management is robust, with stop losses, trailing stops, break-even activation, and spread filters ensuring safe execution. On major currency pairs (EURUSD, GBPUSD, XAUUSD), the EA delivers consistent setups with reduced noise. On indices such as NASDAQ, S&P500, and GER DAX, it adapts smoothly using point-based parameters, handling volatility effectively while maintaining structure. The ability to restrict trades to one per session adds further discipline, making it suitable for both algorithmic and discretionary traders. Strengths include: Institutional-grade logic and session-based precision Adaptability across FX majors and leading indices Strong risk controls and trade management features Backtest and optimization support for refined setups For a free EA, Killzone Liquidity Sweep EV stands out as professional, reliable, and versatile. With refined set files from the designer, it could easily rival premium systems—already, it is one of the best free EAs in my opinion.