Alpha Brent Strategy Tool

- インディケータ

- German Pablo Gori

- バージョン: 1.0

- アクティベーション: 6

Alpha Bren Strategy Tool: Technical and Functional Documentation

Alpha Bren Strategy Tool is an institutional-grade analytical suite specifically engineered for energy traders seeking a competitive advantage in the Brent Crude Oil market. This indicator integrates high-precision algorithms with Smart Money Concepts (SMC) and real-time macroeconomic analysis.At the core of the system lies the Kurisko 4 Stochastic System, a quadruple-impulse configuration designed to accurately identify trend exhaustion and continuation points while effectively filtering market noise inherent to the commodities sector.

Key Features

-

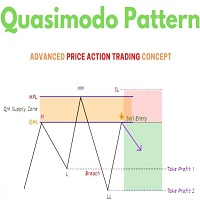

Smart Money Concepts (SMC): Automated detection of Order Blocks (OB), Fair Value Gaps (FVG), and Liquidity Zones to identify high-probability entry levels.

-

Real-Time Correlation Engine: Analyzes the interdependencies between Brent Crude, WTI, the Dollar Index (DXY), the S&P 500, and Gold, providing a comprehensive cross-market perspective.

-

Multi-Timeframe Analysis (MTF): Automatic convergence of timeframes (M15, H1, H4) to ensure entries are aligned with the broader institutional trend.

-

Inventory and Seasonality Data: Integrated tracking of EIA/API reports alongside historical seasonal patterns specific to the energy sector.

-

Interactive Dashboard: A professional interface displaying market regime, trend strength, signal scoring, and correlation status.

-

Advanced Risk Management: Automated Stop Loss levels based on ATR, three Take Profit targets, and a dynamic Trailing Stop system.

Signal Scoring Methodology

The indicator assigns a quantitative score to each signal based on several critical factors:

-

Trend confluence across multiple timeframes.

-

Correlation status (inverse correlation with DXY and direct with WTI).

-

Presence of SMC patterns (Order Block mitigation).

-

Positioning relative to VWAP and psychological price levels.

-

Advanced volatility and volume filters.

Note: Alerts are generated only when the Score exceeds the user-defined threshold, ensuring that only high-quality setups are executed.

Main Parameters

-

Signal Sensitivity: Adjustable modes including Precise, Balanced, or Aggressive.

-

Minimum Score: A quality filter for entry signal validation.

-

Core Settings: Specific optimizations tailored to oil market volatility.

-

Correlations: Symbol configuration for accurate inter-market analysis.

-

Alerts: Full notification suite including Sound, Push, and Email alerts.

Usage Recommendations

-

Supported Symbols: Brent Oil (EB, BRENT, LCO).

-

Primary Timeframes: M5, M15, and H1 for core analysis.

-

Operational Modes: "Balanced" mode is recommended for standard trading, while "Precise" is optimized for funded accounts or conservative risk management.

Implementation Instructions

-

Configuration: When loading the indicator, verify that correlation symbols (WTI, DXY, etc.) match the exact naming convention of your trading platform.

-

Interface: The dashboard is interactive and scrollable; it can be repositioned anywhere on the chart via click-and-drag.

-

Validation: It is highly recommended to perform preliminary testing in the Strategy Tester (Visual Mode) to familiarize yourself with the signal logic and dashboard metrics.

Legal Notice: Trading financial derivatives involves significant risk. This indicator is a technical analysis support tool and does not guarantee future profits. Always trade within your risk tolerance and personal responsibility.

Upgrade your trading experience: This professional analytical suite is provided as part of our standard toolkit. To unlock premium institutional data feeds, ultra-low latency execution, and exclusive expert insights, consider upgrading to our Elite Pro Tier. Enhance your strategy with the precision tools used by industry leaders.

PROMOTIONAL PRICE. TAKE ADVANTAGE NOW BEFORE THE PRICE INCREASES.