RSI Flow Trend

- Experts

- Francisco Javier Correa Ariztia

- Versione: 3.50

- Attivazioni: 5

RSI Trend Flow – Optimized for BTCUSD M5

RSI Trend Flow is a high-precision algorithmic trading system designed to capitalize on strong trends by identifying pullbacks. Additionally, this EA utilizes a strict Stop Loss and dynamic risk management per trade.

While the algorithm is versatile enough for any volatile asset (Gold, Nasdaq, Major Pairs), its default parameters have been specifically tuned and optimized for Bitcoin (BTCUSD) on the 5-minute (M5) chart, leveraging crypto volatility to capture rapid movements. However, it can be optimized for any asset and timeframe.

How It Works:

-

Trend Identification: Uses a crossover of two EMAs (Exponential Moving Averages) to determine the dominant direction. If the short-term EMA crosses above the long-term EMA, it signals a buy. The opposite behavior signals a sell.

-

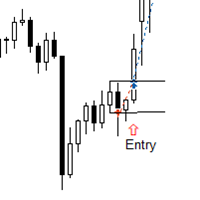

Pullback Entry: Waits for the RSI to reach oversold levels (for buys) or overbought levels (for sells) within the trend, ensuring a better entry price.

-

Smart Filters: Includes advanced filters, such as avoiding buys near the ATH (All-Time High) or trading in zones too far from the last EMA crossover, to secure optimal pricing.

-

Dynamic Exits: Secures profits using Trailing Stop and Break Even based on volatility (ATR).

Key Features:

-

No Martingale / No Grid: Each trade has a unique Stop Loss.

-

Automatic Risk Management: Automatically calculates lot size based on the risk percentage you define (e.g., 1% per trade).

-

Adapted to Volatility: SL and TP are dynamic, calculated using the ATR indicator.

Parameter Guide:

1. General Settings

-

Magic Number: Unique identifier for trades. Change it if you use the EA on multiple charts of the same pair.

-

Long EMA Bars: Period used to define the main trend (Default: 10).

-

Short EMA Bars: Fast period for crossovers (Default: 5).

-

Default Volume: Backup lot size if automatic calculation fails or risk is set to 0.

2. Buy Settings (Long)

-

RSI Buy Activation: RSI value below which the robot looks to buy (Oversold Zone).

-

Distance from ATH (%): Prevents buying if the price is too close to the All-Time High, avoiding entries at absolute ceilings.

-

Distance from Last EMA Cross: Minimum distance required from the last trend change to confirm its strength.

3. Sell Settings (Short)

-

RSI Sell Activation: RSI value above which the robot looks to sell (Overbought Zone).

-

Distance from Last EMA Cross: Minimum distance required from the bearish crossover to validate the entry.

4. Management and Exit

-

Activate Stop Loss: Sets a fixed SL based on market structure (recent Highs/Lows).

-

Activate Trailing Stop: Moves the SL in favor of the trend to lock in profits.

-

Activate Break Even: Moves the SL to the entry price after reaching a certain profit level.

-

Activate Take Profit: Sets a fixed profit target.

-

Activate EMA Cross: Immediately closes the trade if the EMAs cross in the opposite direction (Trend reversal).

-

ATR Multiplier from Extreme: Defines how far the initial SL is placed relative to the most recent High/Low.

-

Trailing / Break Even Multipliers: Follow-up sensitivity based on ATR.

-

RR Ratio: Risk/Reward ratio used to calculate the Take Profit.

-

Risk per Trade (%): Percentage of balance to risk in a single trade. If set to 1.0, the EA calculates the lot size so that you only lose 1% if the SL is hit.

Recommendations:

-

If you wish to use low risk per trade (1%-2%), I recommend having a minimum of 2,000 USD in your trading account. If a trade is riskier than specified by the user, it will not be executed.