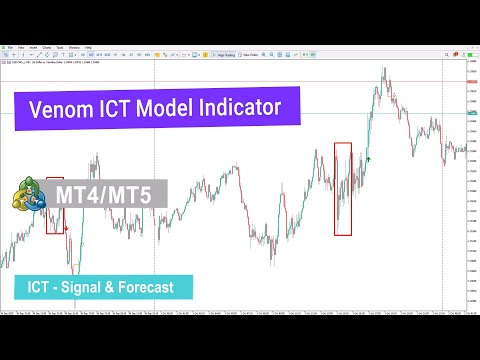

Venom ICT Model Indicator MT4

- Utilità

- Mehnoosh Karimi

- Versione: 3.1

- Attivazioni: 10

Venom ICT Model Indicator for MetaTrader 4

The Venom ICT Model Indicator for MetaTrader 4 is developed based on three core market concepts: Liquidity, Time, and Price, following the Venom strategy within the ICT (Inner Circle Trader) methodology.

This indicator focuses on identifying high-probability trading opportunities by analyzing liquidity sweeps and structural shifts during the most important trading session of the day—the New York session.

New York Session Range Identification

The indicator automatically detects the initial New York market range between 08:00 and 09:30 New York time and highlights this zone using a red box on the chart.

This range serves as a key reference area for liquidity analysis.

After the official New York session open at 09:30, price typically breaks one side of this range to absorb liquidity. Following this liquidity grab, the indicator generates:

- Green arrows for buy signals

- Red arrows for sell signals

These signals are designed to appear after false breakouts and confirmed structural shifts.

Venom ICT Model Indicator Specifications

The general specifications of the Venom ICT Model Indicator are outlined in the table below:

| Feature | Description |

| Indicator Categories | Signal & Forecast MT4 Indicators |

| Platform | MetaTrader 4 |

| Trading Skill Level | Advanced |

| Indicator Type | Breakout MT4 Indicators |

| Timeframe | Multi-Timeframe |

| Trading Style | Day Trading |

| Supported Markets | Forex |

Venom ICT Model Indicator at a Glance

The Venom ICT Model Indicator combines several key ICT concepts to identify false breakouts and optimal entry paths, including:

- Market Structure Shift (MSS)

- Change in State of Delivery (CISD)

- Fair Value Gap (FVG)

By focusing on liquidity zones, the indicator helps traders distinguish between genuine market moves and deceptive price manipulations.

Bullish Trend Analysis

In a bullish scenario, such as the CAD/JPY pair on the 15-minute timeframe, the indicator highlights a false breakout below the liquidity zone’s low.

After this liquidity sweep:

- Price reacts aggressively upward

- A Market Structure Shift (MSS) is confirmed

- Price respects a Fair Value Gap (FVG)

Once these conditions align, the indicator issues a buy entry signal, indicating a high-probability bullish reversal.

Bearish Trend Analysis

In a bearish setup, such as USD/CHF on the 15-minute timeframe, the Venom ICT Model identifies a short corrective move followed by a false breakout above the range high.

Key confirmations include:

- Absorption of buy-side liquidity

- Formation of a Market Structure Shift (MSS)

- Rejection from the Fair Value Gap (FVG) zone

After these confirmations, the indicator provides a sell entry signal, aligning with the prevailing bearish structure.

Conclusion

The Venom ICT Model Indicator (ICT Venom) is a specialized trading tool built on the principles of liquidity, time, and price. Its primary function is to identify false breakouts, liquidity sweeps, and structural reversals with high precision.

By integrating Liquidity Zones, MSS, CISD, and FVG, this ICT-style indicator effectively filters out fake market moves and highlights valid trading opportunities.

Moreover, its emphasis on the initial New York session range makes it particularly effective for day traders seeking accurate entry and exit points during high-liquidity market conditions.