Quant Engine

- Experts

- Sergej Maehler

- Versione: 1.6

- Aggiornato: 27 ottobre 2025

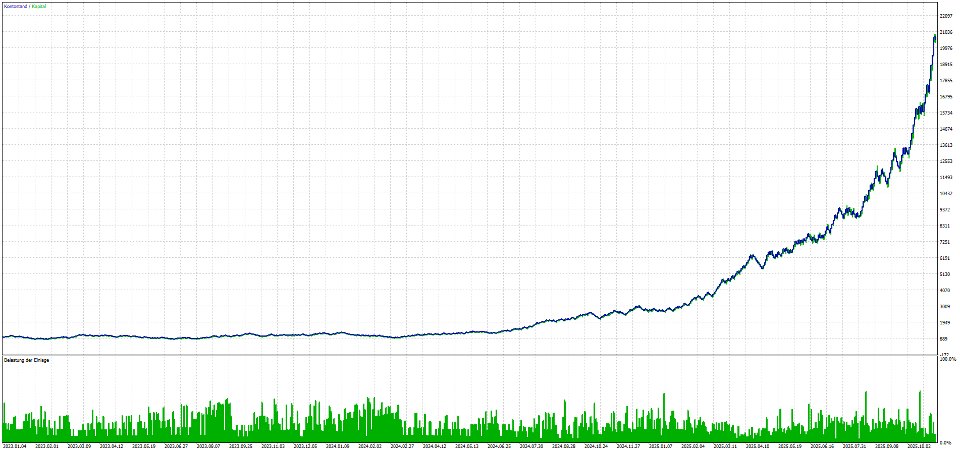

Quant Engine Multi-Layer Trading System with Adaptive Learning

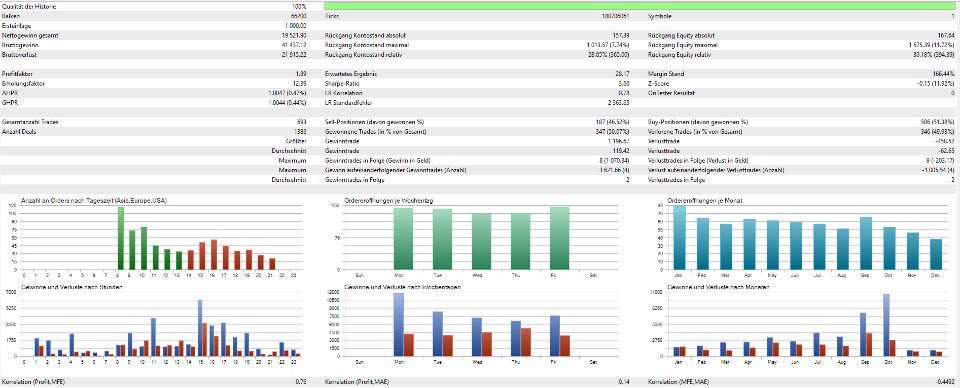

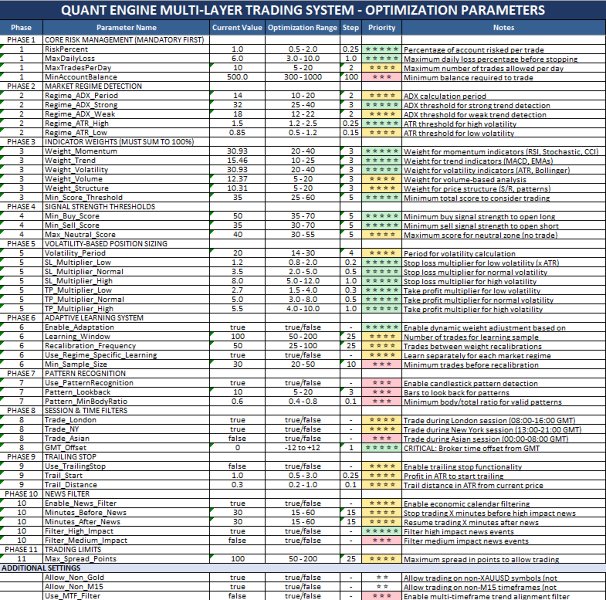

Advanced Multi-Layer trading system for XAUUSD (Gold) on M15 timeframe featuring adaptive weight optimization, intelligent market regime detection, and comprehensive risk management. Combines 10+ technical indicators with dynamic parameter adjustment based on trading performance. No black box—all parameters can be adjusted and optimized independently by the user.

Intelligent Trading System

- Multi-Indicator Analysis: Combines RSI, MACD, Stochastic, CCI, Multiple EMAs (8, 21, 50, 200), Bollinger Bands, ADX, and ATR for comprehensive market analysis

- Weighted Scoring System: Evaluates market conditions across 5 categories (Momentum, Trend, Volatility, Volume, Structure) with customizable weights

- Signal Strength Analysis: Advanced signal filtering ensures only high-quality trades with configurable buy/sell strength thresholds

Adptive Learning System

- Dynamic Weight Adjustment: Automatically adjusts indicator weights based on historical performance Performance Tracking: Records up to 100 trades with detailed score breakdown per indicator category

- Smart Recalibration: Recalculates optimal weights every N trades (default: 50) using blend factor for smooth transitions

- Regime-Based Learning: Tracks win rates across 6 different market regimes for context-aware optimization

Professional Risk Management

- One Position: No grids, no averaging: Each position is protected by self-adjusted stop loss and take profit

- Percentage-Based Position Sizing: Risk per trade as % of account balance

- Daily Loss Limit: Automatic trading suspension when daily loss threshold is reached

- Maximum Trades Per Day: Configurable limit to prevent overtrading

- Minimum Account Balance: Built-in protection against underfunded accounts

- Trailing Stop: ATR-based trailing stop to protect profits

Economic Calendar Integration

- Native MQL5 Calendar API: Uses official MetaTrader 5 economic calendar

- News Filter: Automatically pauses trading before/after major news events

- Impact Level Filtering: Separate filters for High, Medium, and Low impact news

- Customizable Time Window: Define minutes before/after news to avoid trading

Session-Based Trading

- Auto-GMT Detection: Automatically detects broker's GMT offset

- Three Major Sessions: Asian (0-8 GMT), London (8-10 GMT), New York (13-17 GMT)

- Flexible Configuration: Trade one, multiple, or all sessions

- Session Status Display: Real-time session information on chart

Advanced Features

- Multi-Timeframe Confirmation: Optional H1 confirmation filter for stronger signals

- Candlestick Pattern Recognition: Detects Hammer, Shooting Star, Bullish/Bearish Engulfing patterns

- Spread Filter: Prevents trading during excessive spread conditions

- Margin Safety Checks: Multiple layers of margin verification before opening positions

- Comprehensive Logging: Detailed log output for analysis and debugging

- On-Chart Display: Live information

Session Filter

- Trade London Session: 08:00 GMT - 16:00 GMT

- Trade New York Session: 13:00 GMT to 22:00 GMT

- Trade Asian Session: 00:00 GMT - 08:00 GMT

- GMT Offset (0 = Auto-detect)

Technical Specifications

- Platform: MetaTrader 5

- Instrument: XAUUSD (Gold)

- Timeframe: M15 (optimized)

- Order Type: Market execution

- Slippage Control: Built-in deviation management

- Margin Requirements: Conservative (max 70% margin usage per trade)

How Adaptive Learning Works

- Trade Recording: Each trade is recorded with entry price and all indicator scores

- Performance Tracking: System tracks which indicators performed well in winning/losing trades

- Statistical Analysis: After N trades, calculates win rate and profit factor per indicator category

- Weight Recalibration: Adjusts weights based on performance (30% new + 70% old for smooth transition)

- Normalization: Ensures weights always sum to 100%

- Continuous Improvement: Uses new weights for subsequent trades

- Wide Stop-Losses

- Predictive analytics that guarantee future performance

- Holy grail strategies

- Guaranteed profit systems

Recommended Usage

- Test thoroughly on demo account (minimum 3-4 weeks)

- Start with conservative risk settings (0.5-1% per trade)

- Monitor performance regularly

- Adjust parameters based on your risk tolerance

- Use VPS for 24/7 operation recommended

Recommended Settings

- Working trading pair: XAUUSD (GOLD)

- Timeframe: M15

- Recommended deposit: $1000+

- Minimum deposit: $500 (high-risk trading)

- Minimum leverage: 1:30

- Works with any broker, although an ECN broker with low spreads is recommended

- A Virtual Private Server (VPS) can be used for a 24/7 uptime

What makes Quant Engine different?

Adaptability: Learns from past performance to optimize parameters

Safety First: Multiple layers of risk management and margin protection

Professional Grade: Built with institutional-level risk management principles

No Overselling: Realistic expectations - no "get rich quick" promises

Comprehensive: Combines technical analysis, risk management, and market awareness

Remember: No trading system is perfect. Use proper risk management, test thoroughly, and never risk more than you can afford to lose.

Good work ! This ea delivers good results in trending markest .