Smart Swing Breakout

- Experts

- Karisma Putra Purwanto

- Version: 5.0

- Updated: 24 June 2025

- Activations: 5

👤 Who Is This EA For — And Why?

This EA is designed for disciplined traders who value logic, control, and adaptability in volatile markets.

✅ Ideal for:

-

Swing Traders

Who rely on structural breakouts, not just indicators — this EA detects real swing highs/lows with configurable rules. -

Price Action Enthusiasts

Who prefer clean charts and want automation based on candle logic, structure shifts, and momentum confirmation. -

Risk-Conscious Traders

Who demand strict risk management — with ATR-based SL/TP, dynamic lot sizing, break-even, and daily drawdown protection. -

Session-Based Traders

Who only want to trade during active market hours (Asia, London, NY, or overlaps) — all fully customizable. -

Advanced Users & Developers

Who want a modular EA with clear code structure, logging, label visuals, and optional filters (MACD, EMA, RSI, etc.).

❌ Not Recommended For:

-

Impatient scalpers who expect dozens of trades per day.

-

Traders looking for unrealistic win rates or "holy grail" strategies.

-

Those unwilling to forward test or optimize parameters based on instrument behavior.

🔍 If you're a trader who understands that logic and timing matter more than luck — Smart Swing Breakout EA was built for you.

💡 Concept Behind the Smart Swing Breakout EA (MT4)

This Expert Advisor is built on a swing structure breakout strategy — ideal for traders who love price action and clean risk management.

🔎 How It Works:-

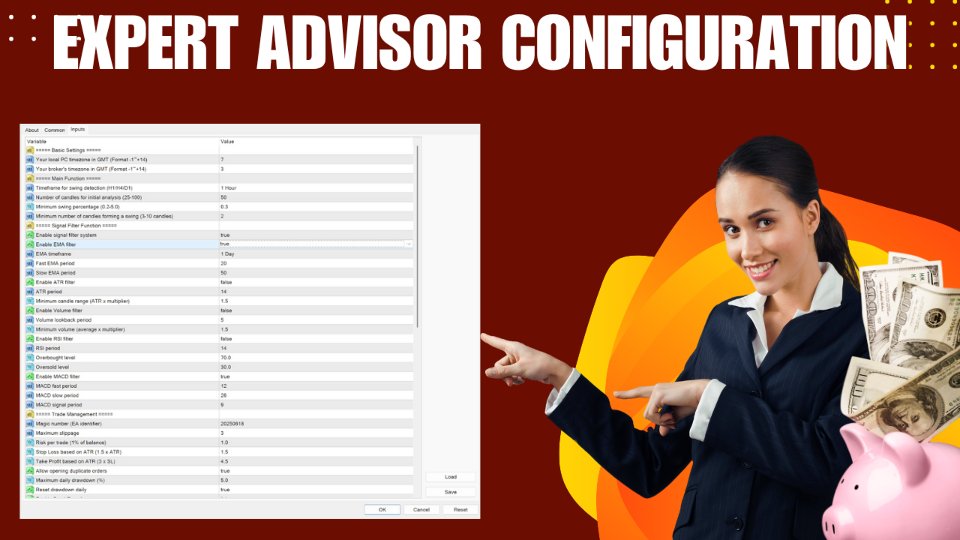

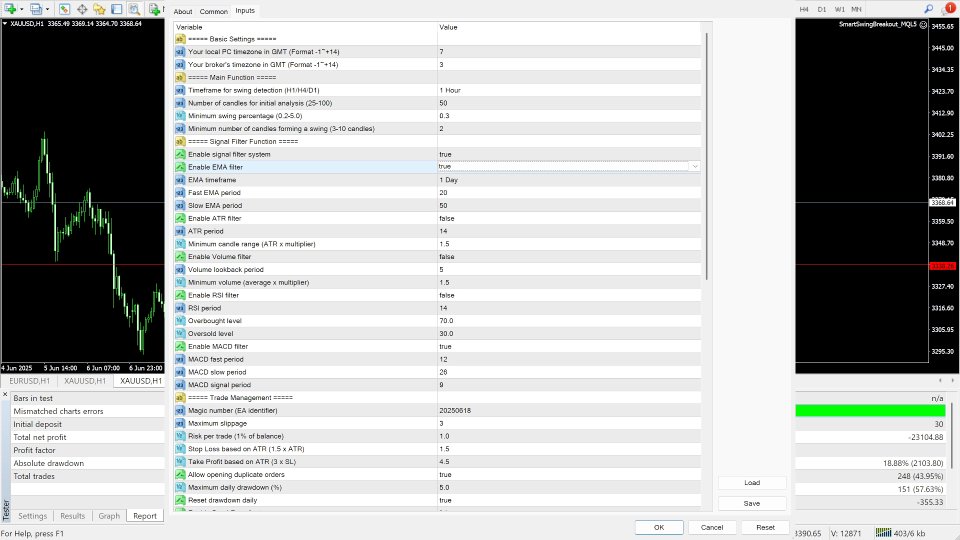

✅ Swing High/Low Detection

Detects key swing points based on duration, price movement %, and market structure. -

📉 Breakout Confirmation

When price breaks above/below swing levels, the EA checks for volume, ATR, RSI, MACD, and EMA filters (optional). -

📌 Order Execution

Uses ATR to calculate dynamic Stop Loss and Take Profit. Risk is based on % of account balance. -

🔁 BreakEven & Trailing Stop

Automatically secures profit once trade reaches a certain TP percentage. -

🕒 Time & Session Filter

Avoids trading during non-volatile periods or weekends. Trades only during selected sessions. -

🛡️ Risk Control

Daily drawdown protection included — EA will stop trading if equity falls below the daily limit. -

👁️ Visual Feedback

Trendlines and swing labels on the chart help you understand market structure and entries.

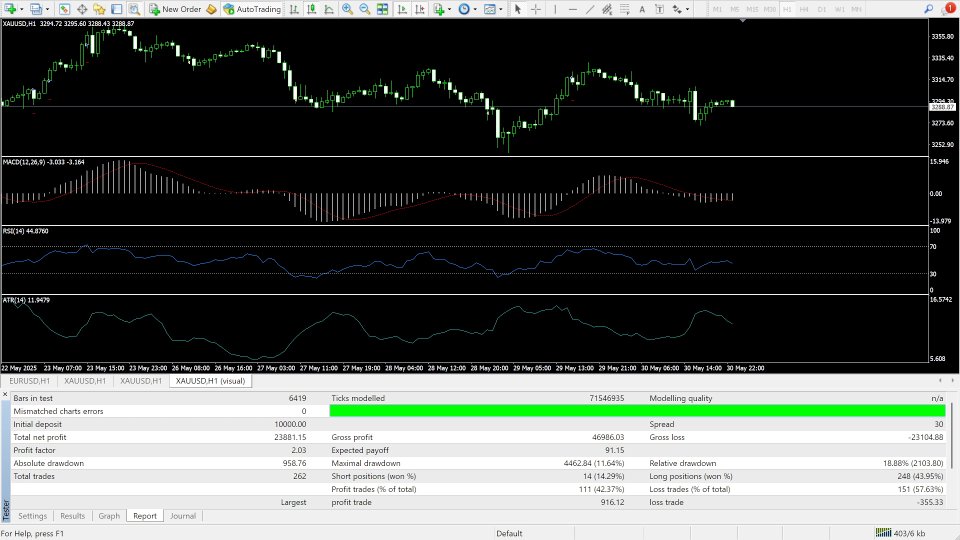

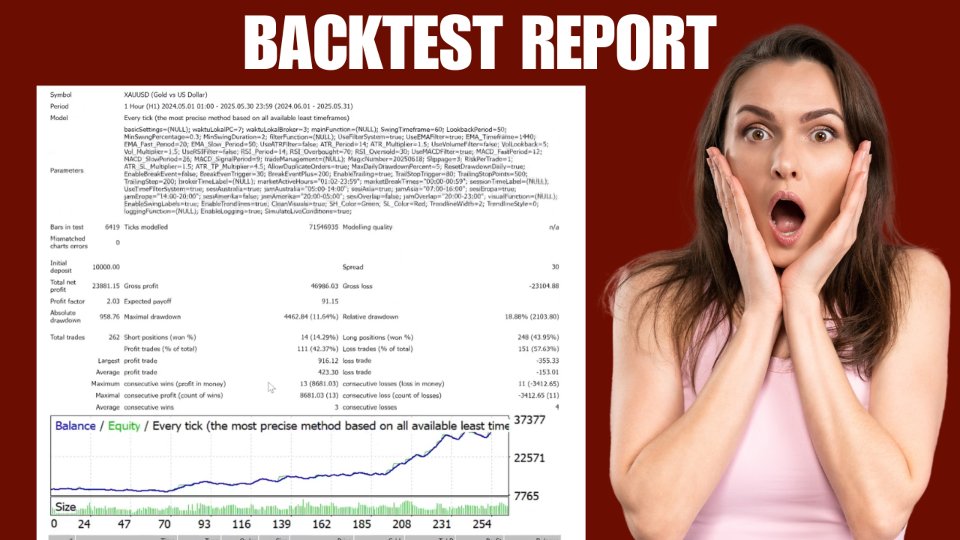

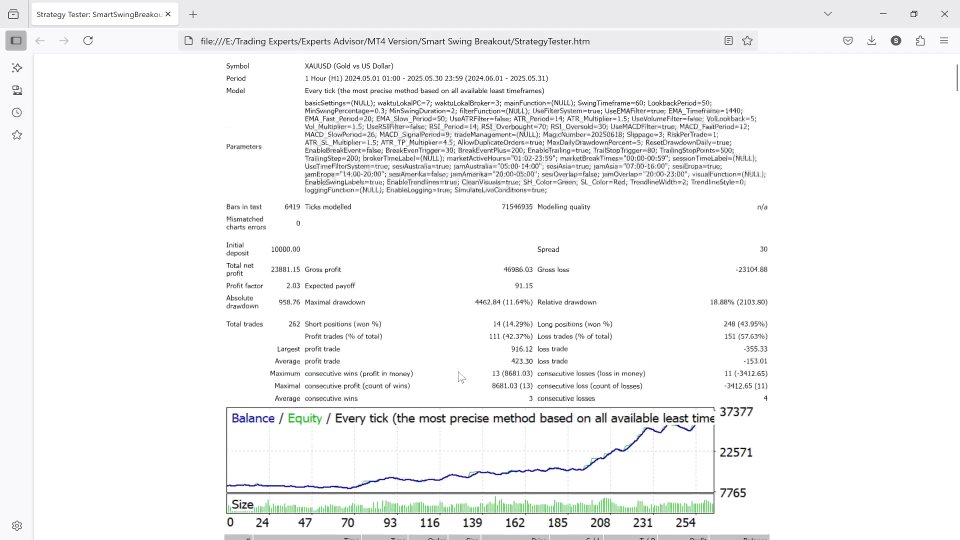

I'm fully aware of how backtesting in MT4 can be misleading if not handled properly — especially regarding time filters, spread behavior, and tick movement.

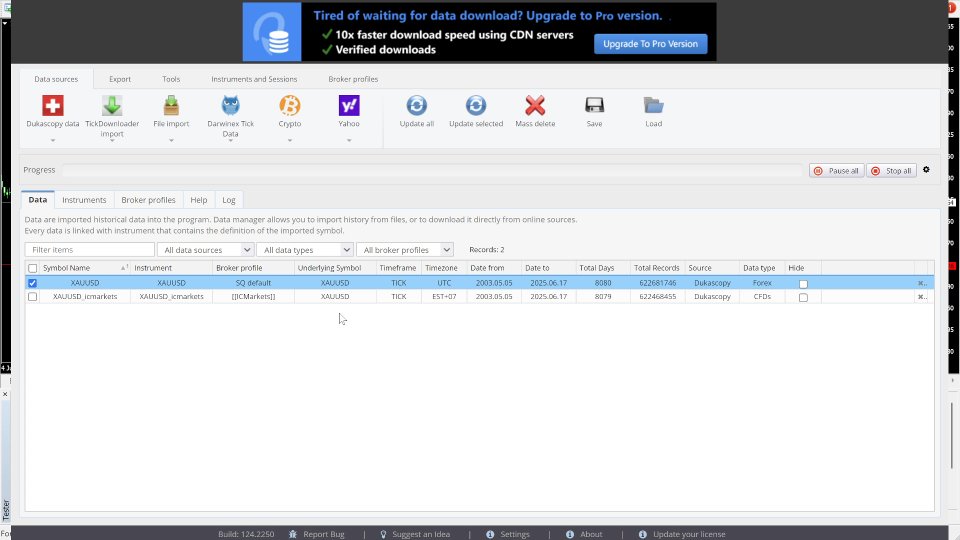

That's why this EA was rigorously tested using real tick data from Quant Data Manager (QDM) to better simulate live trading conditions.

The EA includes an internal simulation of trading hours even during backtest to reflect true market behavior.

🎯 This EA isn't just built to look good in the tester — it's built for real-world performance

✅ 📊 Why EA Backtest Results in MT4 Can Be Very Different from Real Trading

Backtesting in MetaTrader 4 is a powerful tool — but it's not the same as real trading. Here's why your EA might perform great in backtest, but behave differently in a live account:

⚠️ Key Reasons:

-

No Real-Time Constraints

Backtest ignores trading sessions — EA may open trades 24/7 unless you simulate time filters. -

Static Spread

MT4 uses fixed spread; real markets fluctuate, especially during news or off-hours. -

No Slippage

Orders are executed perfectly in backtests — no delays, requotes, or off quotes like in live trading. -

Tick Data Simulation

Unless you use real tick data, MT4 simulates ticks. This affects trailing stop, break-even, and candle-level logic. -

Instant Order Execution

Live brokers may reject, delay, or requote orders — none of this is simulated in backtesting. -

No Network or Margin Errors

Live accounts face trade context errors, margin limits, and freeze levels — ignored in test environment. -

News Events Missing

Economic events, price gaps, and volatility spikes aren't present in historical test data.

🔍 Moral of the story: backtest is a reference, not a guarantee. Always validate your EA in forward testing!