You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

USD/CAD Intra-Day Fundamentals: Canada International Merchandise Trade and range price movement

2017-10-05 13:30 GMT | [CAD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

From official report :

==========

USD/CAD M5: range price movement by Canada International Merchandise Trade news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Facebook - weekly ranging bullish; 173.86/161.56 are the keys (based on the article)

The share price on the weekly chart is on primary bullish market condition: price is located above Ichimoku cloud during the many years with the strong bullish trend. For now, the price is on local ranging within 173.86/161.56 support/resistance levels waiting for the bullish trend to be continuing or for the secondary correction to be started.

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

S&P 500 - strong bullish in intra-day; 2,551 is the key (based on the article)

The price on the H4 price is above Ichimoku cloud for the primary bullish trend: price is testing 2,551 resistance level to above for the bullish trend to be continuing.

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Intra-Day Fundamentals - EUR/USD and USD/CNH: Non-Farm Payrolls

2017-10-06 13:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From official report :

==========

EUR/USD M5: range price movement by Non-Farm Payrolls news events

==========

USD/CNH M5: range price movement by Non-Farm Payrolls news events

==========

Chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Gold - intra-day ranging bearish (based on the article)

The price on H4 chart is below 100 SMA/200 SMA ranging area: price is on bearish ranging within 1,282 resistance level for the rally to be started and 1,260 support level for the bearish trend to be continuing

$1290-$1310 might be an initial zone of resistance. Any strength would be seen as corrective with the potential for another leg lower of similar size and length as the $97 per ounce down trend."

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Weekly Outlook: 2017, October 08 - October 15 (based on the article)

The US dollar remained strong and enjoyed mostly upbeat data. Can we expect further gains? The focus remains on the greenback with the FOMC minutes, US retail sales and the all-important inflation figures Here are the highlights for the upcoming week.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Weekly EUR/USD Outlook: 2017, October 08 - October 15 (based on the article)

EUR/USD was under pressure once again, dropping for the second week in a row. The upcoming week’s highlight is a speech by Mario Draghi. Here is an outlook for the highlights of this week.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Weekly GBP/USD Outlook: 2017, October 08 - October 15 (based on the article)

GBP/USD extended its falls amid Brexit uncertainty and unimpressive economic data. Will it head below 1.30? The upcoming week features industrial output, the trade balance and more. Here are the key events for GBP/USD.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

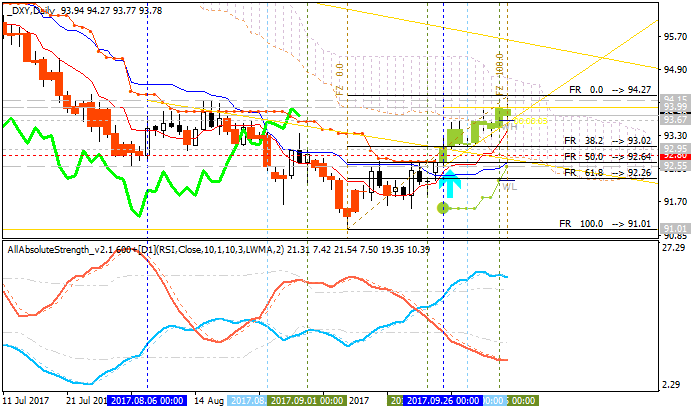

Weekly Fundamental Forecast for Dollar Index (based on the article)

Dollar Index - "The week ahead offers plenty of fodder for continued speculation. Minutes from September’s FOMC meeting will help clarify policymakers’ thinking but a wealth of commentary since the sit-down has already established a clearly hawkish bias. That stance is by no means unanimous, but the driving core of the rate-setting committee seems to buy the case for on-coming reflation and the resulting need to tighten."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

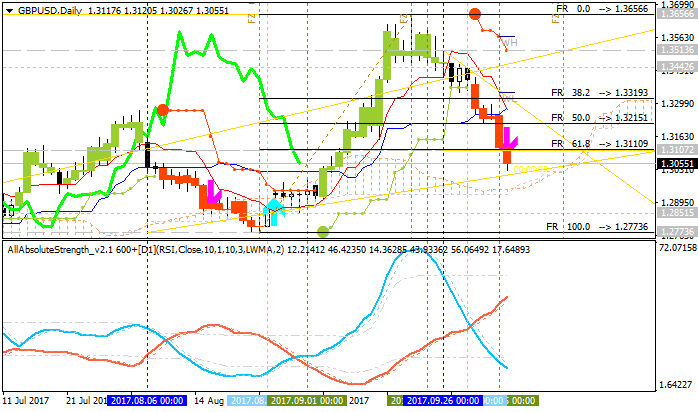

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "Then there’s the economic data. In the past week, purchasing managers’ indexes for the UK construction and manufacturing sectors in September were both weaker than expected. However, the PMIs are seen as “soft” data and the week to come sees “hard” – or official – data on industrial production, manufacturing output and trade. If they turn out stronger than predicted, that could revive forecasts, which are already high, that a UK interest rate increase is just around the corner. It has to be said, though, that this all seems rather unlikely and the more probable outcome is a further slide in GBP/USD, particularly if there are any hints from the Bank of England that now may not be the right time to raise rates after all. Note too that IG Client Sentiment data are currently sending out a bearish signal."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).