You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.16 10:42

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "The bank of England made clear this week that markets are underestimating the possibility of an interest rate hike this year, despite weak GDP and wage growth numbers. The clear message was sent out by governor Carney after Thursday’s MPC meeting and reinforced by a hawkish speech by BOE policy maker Gert Vlieghe, a one-time dove. Cable duly responded hitting a 15-month high and still has room to move to the upside, especially as the USD remains weak."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.22 08:10

GBP/USD - intra-day bullish ranging within 1.3652/1.3451 (based on the article)

Intra-day price on H4 chart is located far above 100-SMA/200-SMA reversal levels in the primary bullish area of the chart. The price is on ranging within 1.3652/1.3451 support/resistance levels for the bullish trend to be continuing or for the secondary correction to be started.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.23 19:16

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "While political uncertainty and sluggish economic growth might argue for a weaker British Pound, it seems unlikely to lose much of the gain made so far this year against the US Dollar, largely because there is a clear risk that the Bank of England will tighten monetary policy at the November 2 meeting of its rate-setting monetary policy committee."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.09.28 14:48

Intra-Day Fundamentals - EUR/USD and GBP/USD: U.S. Gross Domestic Product

2017-09-28 13:30 GMT | [USD - Final GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Final GDP] = Annualized change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

EUR/USD M15: range price movement by U.S. Final GDP news events

==========

GBP/USD M5: range price movement by U.S. Final GDP news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.04 17:27

GBP/USD Intra-Day Fundamentals: UK Services PMI and range price movement

2017-10-04 09:30 GMT | [GBP - Services PMI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry.

==========

From official report :

==========

GBP/USD M5: range price movement by UK Services PMI news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.07 08:33

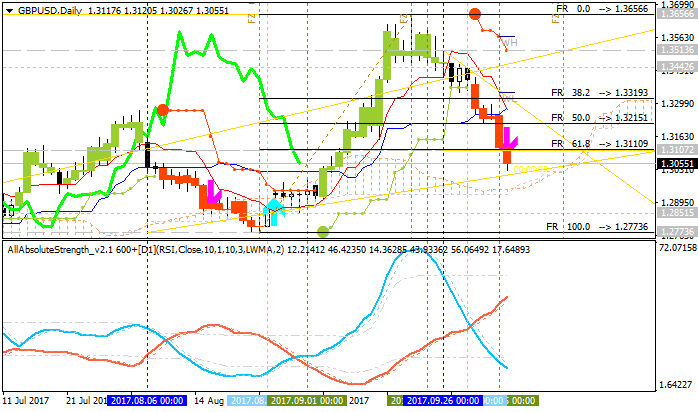

Weekly GBP/USD Outlook: 2017, October 08 - October 15 (based on the article)

GBP/USD extended its falls amid Brexit uncertainty and unimpressive economic data. Will it head below 1.30? The upcoming week features industrial output, the trade balance and more. Here are the key events for GBP/USD.

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.07 16:55

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "Then there’s the economic data. In the past week, purchasing managers’ indexes for the UK construction and manufacturing sectors in September were both weaker than expected. However, the PMIs are seen as “soft” data and the week to come sees “hard” – or official – data on industrial production, manufacturing output and trade. If they turn out stronger than predicted, that could revive forecasts, which are already high, that a UK interest rate increase is just around the corner. It has to be said, though, that this all seems rather unlikely and the more probable outcome is a further slide in GBP/USD, particularly if there are any hints from the Bank of England that now may not be the right time to raise rates after all. Note too that IG Client Sentiment data are currently sending out a bearish signal."

-----------

Chart was made on MT4 using iFibonacci indicator and MaksiGen_Range_Move indicator from CodeBase (free to download).

Forum on trading, automated trading systems and testing trading strategies

GBP/USD Analysis

Money Monsters, 2017.10.10 02:15

what do you think about it?

Forum on trading, automated trading systems and testing trading strategies

GBPUSD TREND

adeyjet4, 2017.10.14 21:56

For some years, GBPUSD have been selling till early this year when it started buying at around the strong support of 1.2035. It have been buying till date. It had bought as high as 1.3655. Last Friday the price closed at 1.3283. The question is, will the trend keep going up? Or it will still test the support at 1.2035 before it finally go up?Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.10.18 08:38

Trading the News: U.K. Employment Change (Claimant Count Change) (based on the article)

The U.K. added another 180K jobs in July, while the Unemployment Rate unexpectedly narrowed to an annualized 4.3% from 4.4% during the same period. Despite the ongoing improvement in the labor market, Average Weekly Earnings held steady at an annualized 2.1% amid forecasts for a 2.3% print, and signs of subdued wage growth may encourage the Bank of England (BoE) to further delay the normalization cycle especially as Brexit clouds the economic outlook with high uncertainty. The batch of mixed data prints weighed on the British Pound, with GBP/USD pulling back from the 1.3300 handle to end the day at 1.3208.

What’s Expected:

How To Trade This Event Risk

Bearish GBP Trade: U.K. Household Earnings Remains Subdued

Bullish GBP Trade: Job, Wage Growth Exceeds Market Forecast

GBP/USD Daily

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

GBP/USD M5: range price movement by U.K. Employment Change news event