You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Weekly GBP/USD Outlook: 2017, November 12 - November 19 (based on the article)

GBP/USD was looking for a new direction after that dovish hike from the BoE and as Brexit talks are trying to get out of the ditch. The upcoming week features three top-tier publications: inflation, jobs, and retail sales.

Shares price is on bullish breakout since the August 2015: the price is breaking resistance level at 218.64 to above for the bullish trend to be continuing.

==========

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicator from CodeBase:

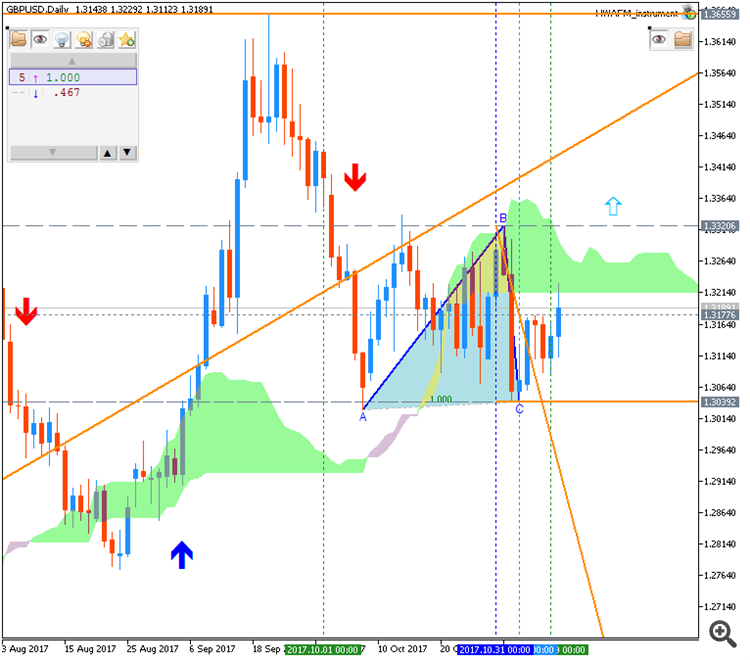

GBP/USD - bullish ranging within narrow levels for direction (based on the article)

Daily price is above 200 SMA to be on ranging near and below 55 SMA: the price is within 1.3039/1.3229 s/r levels for the bullish trend to be resumed or for the correction to the bearish reversal to be started.

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

USD/CNH Intra-Day Fundamentals: China Industrial Production and range price movement

2017-11-14 02:00 GMT | [CNY - Industrial Production]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

==========

From ecns article :

==========

USD/CNH M5: range price movement by China Industrial Production news event

==========

The chart was made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Bitcoin Gold had recovered modestly (based on the article)

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and range price movement

2017-11-14 09:30 GMT | [GBP - CPI]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report :

==========

GBP/USD M5: range price movement by U.K. Consumer Price Index news event

==========

The chart was made on MT5 with MACD Scalping system uploaded on this post and this post, and using standard indicators from Metatrader 5 together with following indicators:

AUD/USD Intra-Day Fundamentals: Australian Labour Price Index and range price movement

2017-11-15 00:30 GMT | [AUD - Wage Price Index]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Wage Price Index] = Change in the price businesses and the government pay for labor, excluding bonuses.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Labour Price Index news event

==========

The chart was made on H4 timeframe with standard indicators of Metatrader 4 except the following indicator (free to download):

USD/JPY - daily bullish ranging; 114.73 is the key (based on the article)

Daily price is above 200 peiod SMA in the primary bullish area of the chart: the price is on ranging within 114.73 resistance level for the bullish trend to be resumed and 113.08 support level for the secondary correction to be started.

By the way, if the price breaks 111.89 support level to below on daily close bar so the bearish reversal of the daily price movement will be started with 111.02 daily target to re-enter.

==========

The chart was made on D1 timeframe with standard indicators of Metatrader 4 except the following indicators (free to download):

Intra-Day Fundamentals - EUR/USD, NZD/USD and GOLD: U.S. Advance Retail Sales

2017-11-15 13:30 GMT | [USD - Retail Sales]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

From cnbc article :

==========

EUR/USD M5: range price movement by U.S. Retail Sales news events

==========

NZD/USD M5: range price movement by U.S. Retail Sales news events

==========

XAU/USD M5: rrange price movement by U.S. Retail Sales news events

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

AUD/USD Intra-Day Fundamentals: Australian Employment Change and range price movement

2017-11-16 00:30 GMT | [AUD - Employment Change]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[CNY - CPI] = Change in the number of employed people during the previous month.

==========

From official report :

==========

AUD/USD M5: range price movement by Australian Employment Change news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4: