You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.05 09:09

Weekly USD/CAD Outlook: 2017, November 05 - November 12 (based on the article)

Dollar/CAD continued experiencing upward pressure amid the top-tier figures from Canada. The upcoming week seems a bit calmer at least if we look at the calendar, but it provides a focus on the housing sector. Where will the C$ go next?

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.16 14:59

USD/CAD Intra-Day Fundamentals: Canada Manufacturing Shipments and range price movement

2017-11-16 13:30 GMT | [CAD - Manufacturing Sales]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Manufacturing Sales] = Change in the total value of sales made by manufacturers.

==========

From official report :

==========

USD/CAD M5: range price movement by Canada Manufacturing Shipments news event

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.17 14:57

USD/CAD Intra-Day Fundamentals: Canada Consumer Price Index and range price movement

2017-11-17 13:30 GMT | [CAD - CPI]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report :

==========

USD/CAD M5: range price movement by Canada Consumer Price Index news event

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.11.29 14:51

Intra-Day Fundamentals - GBP/USD, AUD/USD and USD/CAD: GDP Second Release

2017-11-29 13:30 GMT | [USD - GDP]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - GDP] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

From official report :

==========

GBP/USD M5: range price movement by U.S. Gross Domestic Product news events

==========

AUD/USD M5: range price movement by U.S. Gross Domestic Product news events

==========

USD/CAD M1: range price movement by U.S. Gross Domestic Product news events

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.01 14:36

USD/CAD Intra-Day Fundamentals: Canada GDP and range price movement

2017-12-01 13:30 GMT | [CAD - GDP]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

USD/CAD M15: range price movement by Canada GDP news event

==========

The chart was made on W1 timeframe with standard indicators of Metatrader 5 except the following indicator (free to download):

MaksiGen_Range_Move MTF - indicator for MetaTrader 5

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.05 14:35

USD/CAD Intra-Day Fundamentals: Canada Trade Balance and range price movement

2017-12-05 13:30 GMT | [CAD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

From official report :

==========

USD/CAD M15: range price movement by Canada Trade Balance news event

==========

The charts were made on MT5 with MA Channel Stochastic system uploaded on this post, and using standard indicators from Metatrader 5 together with following indicators:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.06 16:55

USD/CAD Intra-Day Fundamentals: BOC Rate Statement, Overnight Rate and range price movement

2017-12-06 15:00 GMT | [CAD - Overnight Rate]

if actual > forecast (or previous one) = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves.

==========

From official report :

==========

USD/CAD M5: range price movement by BoC Overnight Rate news event

==========

The chart was made on M5 timeframe with standard indicators of Metatrader 5 except the following indicator (free to download):

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.12.08 10:03

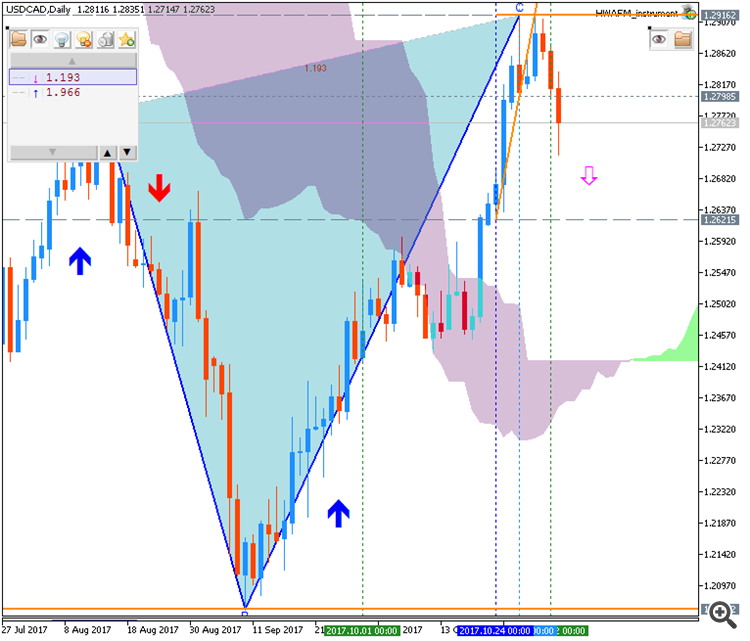

USD/CAD - daily bullish ranging near possible bearish reversal (based on the article)

Daily price is on ranging above Ichimoku cloud in the bullish area of the chart within the following support/resistance levels:

1.2909 resistance level for the bullish trend to be resumed, and

1.2680 support level for the bearish reversal to be started.

============

The chart was made on D1 timeframe with Ichimoku market condition setup (MT5) from this post (free to download for indicators and template) as well as the following indicators from CodeBase: