You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Weekly Outlook: 2017, November 05 - November 12 (based on the article)

The US dollar was mixed across the board despite big events in markets. Will this continue? The upcoming week features events from all over the world. Here are the highlights for the upcoming week.

Weekly EUR/USD Outlook: 2017, November 05 - November 12 (based on the article)

EUR/USD was looking for a new direction in a busy week. What’s next? The common currency faces yet another busy week with PMIs, trade balance and more. Here is an outlook for the highlights of this week.Weekly GBP/USD Outlook: 2017, November 05 - November 12 (based on the article)

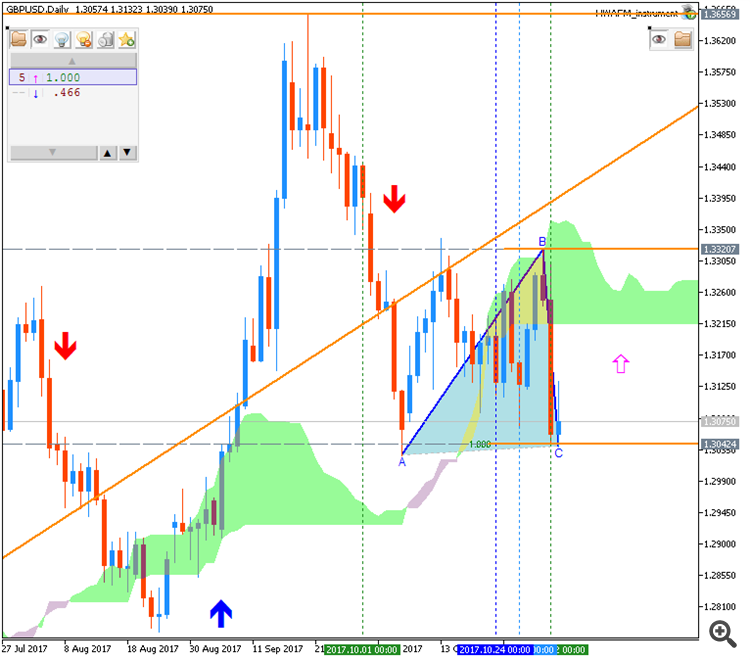

GBP/USD had a mixed week amid big events. The upcoming week may be calmer but still, consists of important events. The trade balance and industrial output stand out. Here are the key events.

Weekly USD/JPY Outlook: 2017, November 05 - November 12 (based on the article)

Dollar/yen got used to the 113 handle early in the week and attempts to settle above 114 were heavily fought by sellers. The Fed decision, the nomination of a new Fed Chair and the NFP all moved the pair, but the ranges were not challenged.

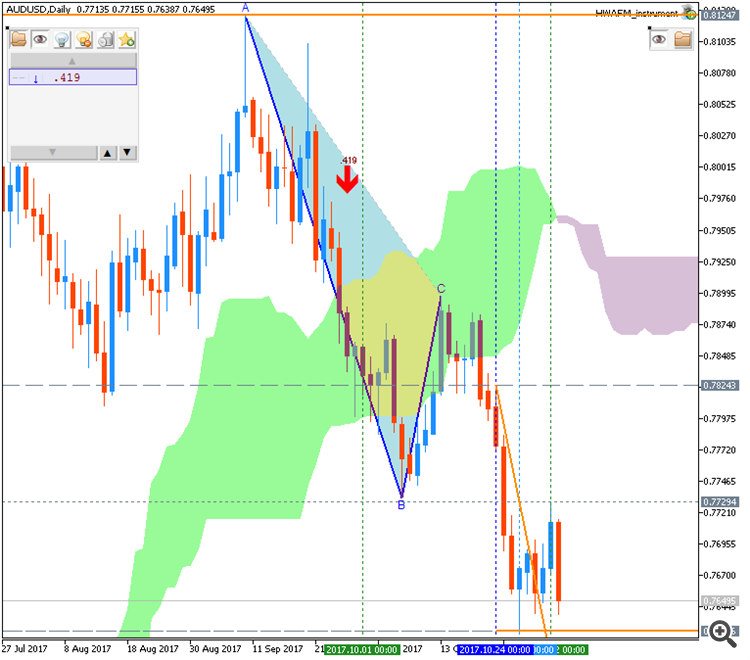

Weekly AUD/USD Outlook: 2017, November 05 - November 12 (based on the article)

The Australian dollar struggled to recover amid mixed data. The highlight of the upcoming week is undoubtedly the rate decision by the RBA. Will they hint about a rate cut?. Here are the highlights of the week.

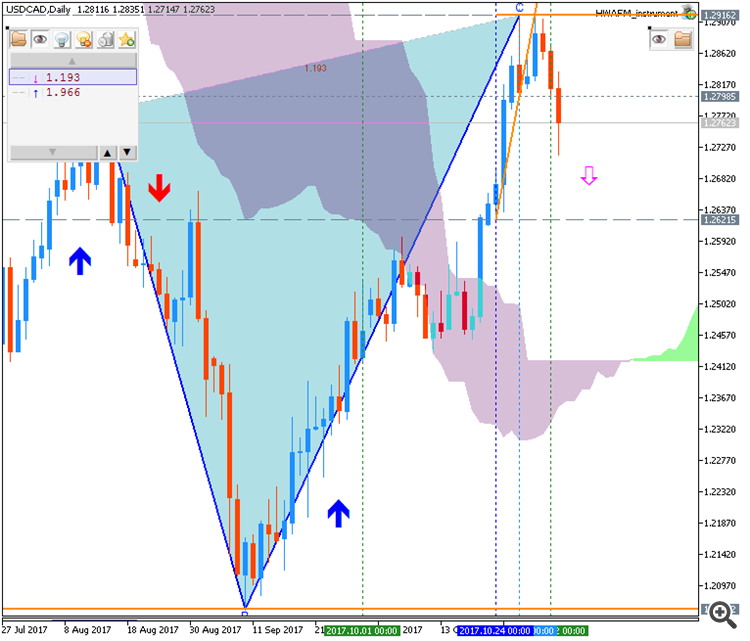

Weekly USD/CAD Outlook: 2017, November 05 - November 12 (based on the article)

Dollar/CAD continued experiencing upward pressure amid the top-tier figures from Canada. The upcoming week seems a bit calmer at least if we look at the calendar, but it provides a focus on the housing sector. Where will the C$ go next?

20 books everyone should read in their 30s (based on the article)

These classic books are worth reading at any age, but the more life experience you have, the more fulfilling you'll find them.

From New York Times bestsellers to cult classics, to stories with motivating life lessons, here are 20 books that everyone should read in their 30s, in no particular order.

Bitcoin's 'bubble' is unlike anything we've seen recently (based on the article)

Financial bubbles are often fully recognizable only after they burst — when it's too late. But the speed of bitcoin's rise has already convinced many that its price is well disconnected from its underlying value.

Bitcoin's price has rocketed 646% in very volatile trading this year as its demand and popularity has grown. As the chart above from Bespoke Investment Group illustrates, the rally has been faster than most other severe bubbles in recent history, including tech and homebuilder stocks.

But there's a key difference between bitcoin's rally now and home prices, for example: The fallout from a potential bitcoin price crash is unlikely to damage the broader economy.

============

Chart was made on MT5 with BrainTrading system (MT5) from this thread (free to download) as well as the following indicators from CodeBase:

All about BrainTrading system for MT5:

Brent Crude Oil - Back To $100 Again (based on the article)

Daily price is on bullish breakout located to be above Ichimoku cloud for 64.42 resistance level to be broken on close daily bar for the daily breakout to be continuing. The next bullish target is monthly bullish resistance level at 84.71.

==========

Chart was made on MT5 with Brainwashing system/AscTrend system (MT5) from this thread (free to download) together with following indicators:

Same system for MT4:

EUR/USD Intra-Day Fundamentals: ECB President Draghi Speaks and range price movement

2017-11-07 09:00 GMT | [EUR - ECB President Draghi Speech]

[EUR - ECB President Draghi Speech] = Opening remarks at the ECB Forum on Banking Supervision, in Frankfurt.

==========

From official report :

==========

EUR/USD M5: range price movement by ECB President Draghi Speech news event

==========

The chart was made on M5 timeframe with standard indicators of Metatrader 5 except the following indicator (free to download):