GOLD STRATEGY THAT TRIPLED MY ACCOUNT USING 'ACRON Supply Demand EA'

Hello traders,

In this post, I am sharing an amazing GOLD H1 timeframe strategy that I created with ACRON Supply Demand EA. It uses a 1:1 Risk:Reward ratio and was fully backtested on an ECN account with low spreads and 500:1 leverage.

This strategy was created exclusively for ACRON Supply Demand users. If you want to use this strategy, just send me a message and I will share the setfile with you.

Both tests were performed on a $10,000 account, using two different risk levels:

-

1.2% per trade

-

1.5% per trade

The goal was to see how the EA performs when the risk is slightly increased while keeping the exact same trade structure and logic.

IMPORTANT NOTE: Check the Risk Per Trade & Drawdown Table at the end of this blog, which shows the recommended risk levels and their expected drawdown ranges.

Product Link: https://www.mql5.com/en/market/product/150278

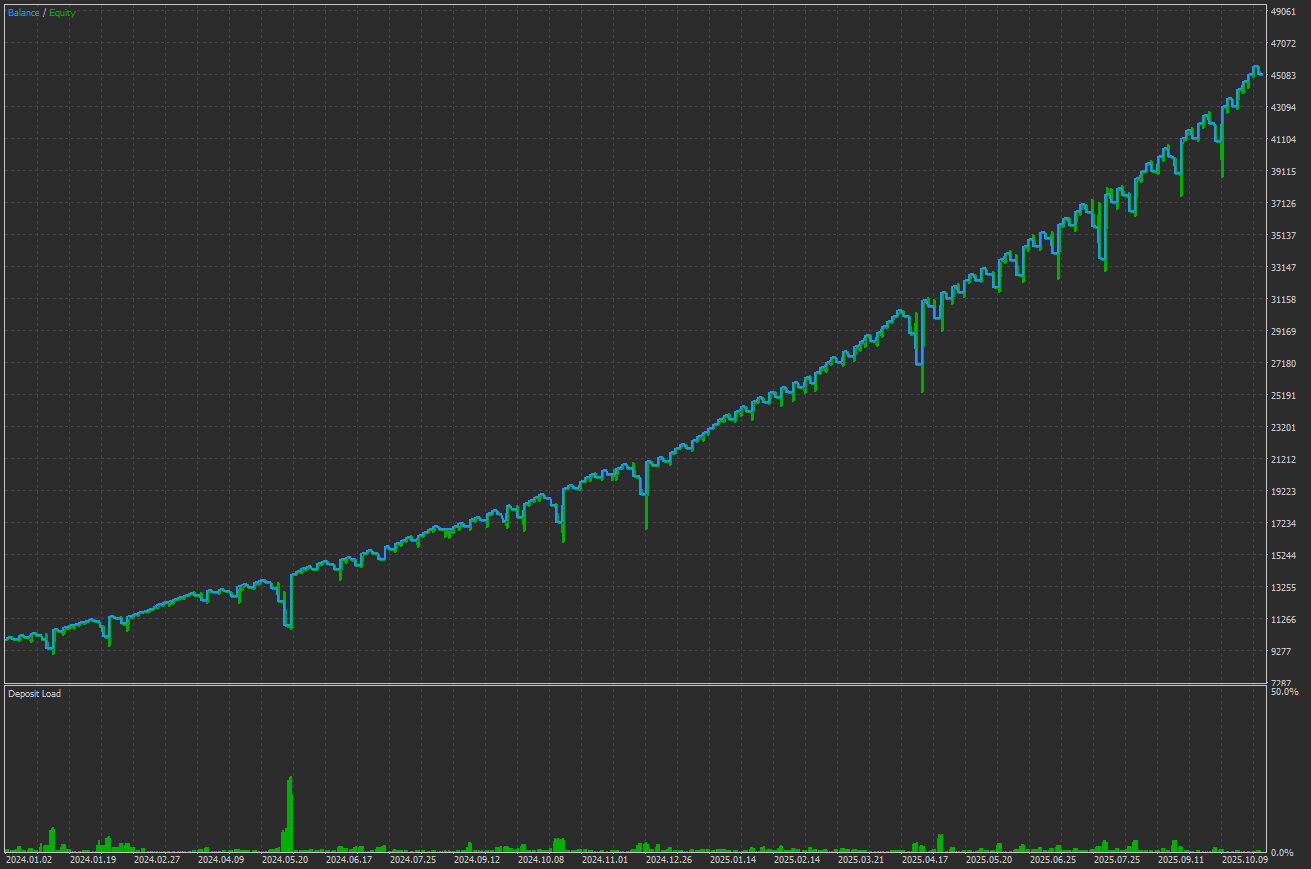

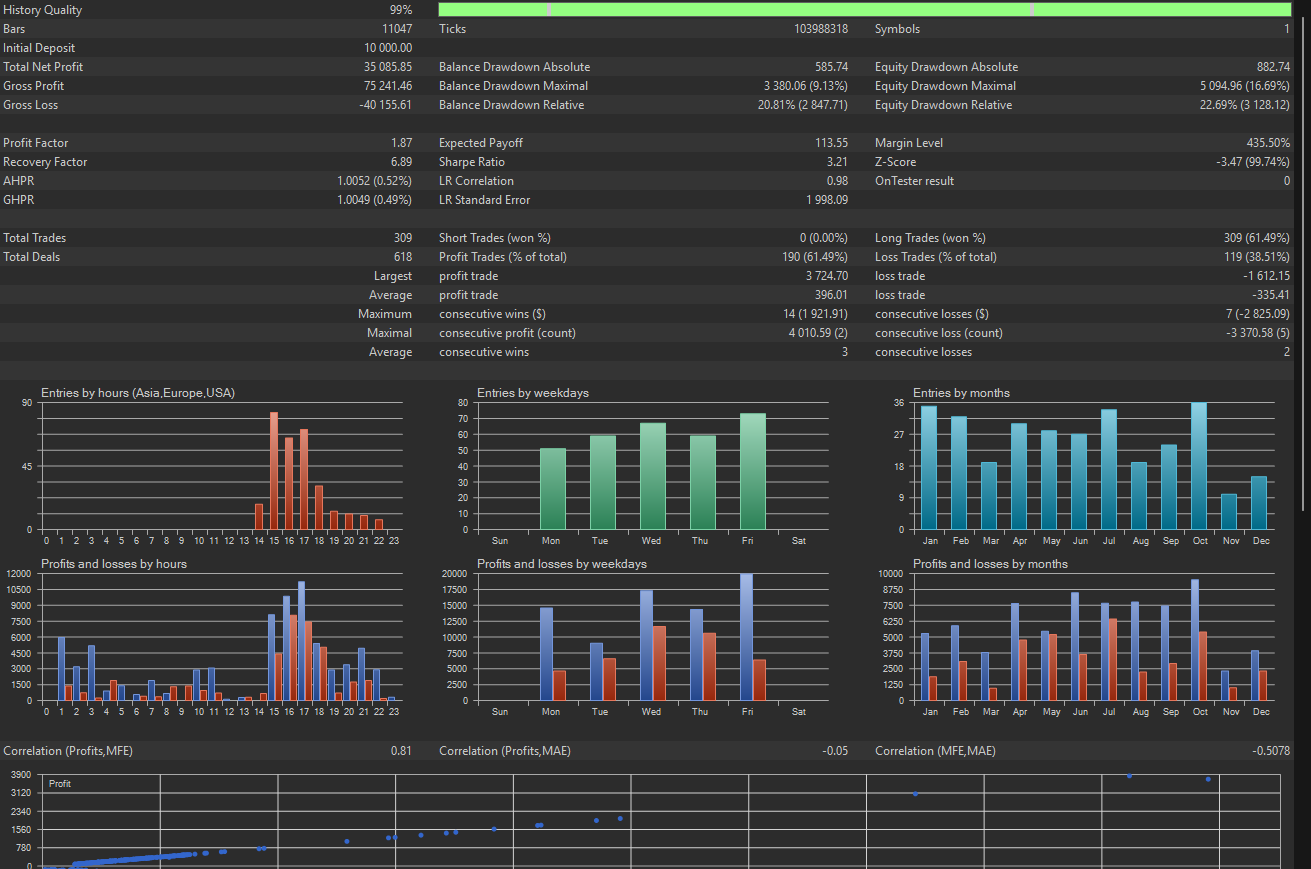

🔸Backtest #1 – 1.2% Risk per Trade

-

Pair: GOLD (XAUUSD)

-

Timeframe: H1

-

Period: 2024–2025

-

Initial Deposit: $10,000

-

Total Net Profit: $34,673

-

Total Growth: +340%

-

Max Drawdown: 22.69%

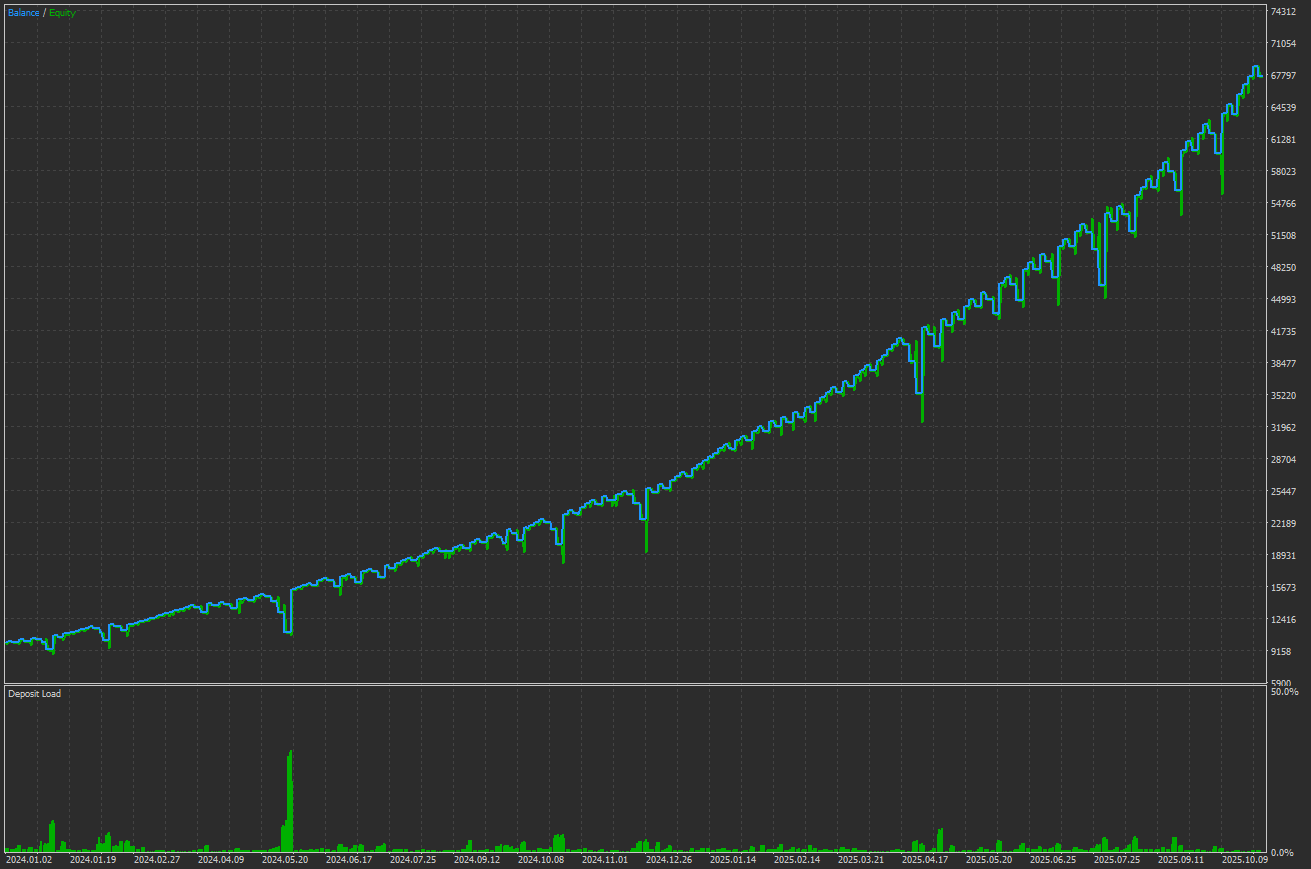

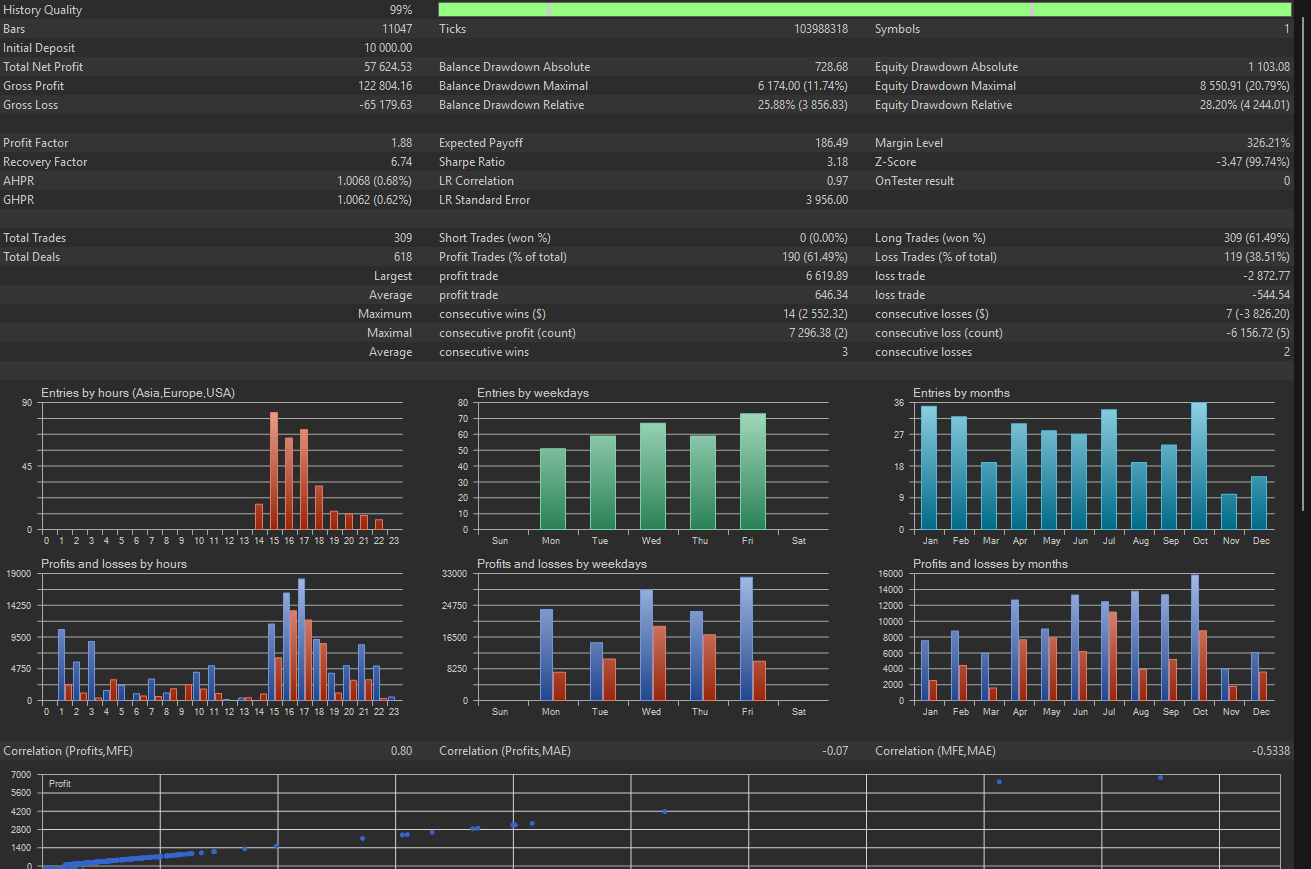

🔹Backtest #2 – 1.5% Risk per Trade

-

Pair: GOLD (XAUUSD)

-

Timeframe: H1

-

Period: 2024–2025

-

Initial Deposit: $10,000

-

Total Net Profit: $57,624

-

Total Growth: +570%

-

Max Drawdown: 28.2%

On the following photos you are able to see the Graph and the Backtest Report from the Strategy Tester using 1.5% Risk per trade.

✅ Risk-Per-Trade Ranges Based on Max Drawdowns Limits

➡️ Up to 10% Drawdown – Percentage Risk per Trade: 👉 0.50

Max Monthly Symbol Relative DD(%): 👉 10

➡️ 10% to 15% Drawdown – Percentage Risk per Trade: 👉 0.73

Max Monthly Symbol Relative DD(%): 👉 15

➡️ 15% to 20% Drawdown – Percentage Risk per Trade: 👉 0.99

Max Monthly Symbol Relative DD(%): 👉 20

➡️ 20% to 25% Drawdown – Percentage Risk per Trade: 👉 1.24

Max Monthly Symbol Relative DD(%): 👉 25

➡️ 25% to 30% Drawdown – Percentage Risk per Trade: 👉 1.49

Max Monthly Symbol Relative DD(%): 👉 30

How to Use This Risk & Drawdown Table

This table helps you choose the correct Percentage Risk per Trade based on the drawdown level you are comfortable with. As risk per trade increases, expected drawdown also increases, so this table gives you a safe, recommended value for each drawdown range.

Max Monthly Symbol Relative DD (%) is an important input parameter inside the ACRON Supply Demand EA, and it should always be used as a safety net. This setting defines the maximum drawdown (in percentage) that the EA is allowed to reach within a single month for the selected symbol. If the EA hits this limit, it will automatically stop opening new trades, protecting your account from deeper losses during difficult or unexpected market conditions. Using this parameter is highly recommended, because even strong and profitable strategies can experience temporary losing periods. By setting a realistic monthly drawdown limit based on your preferred risk per trade, you ensure that the EA does not exceed the level of risk you are comfortable with.

To make this protection work, you must set:

Enable Monthly Symbol Relative DD = true

If this option is disabled, the EA will not use the safety net and will continue trading even if your monthly drawdown exceeds your limit.

For example, if you want to keep your drawdown below 15%, the table suggests using around 0.73% risk per trade, and setting Max Monthly Symbol Relative DD (%) = 15. Conservative traders can focus on the 10% range, while aggressive traders may use the 25–30% range.