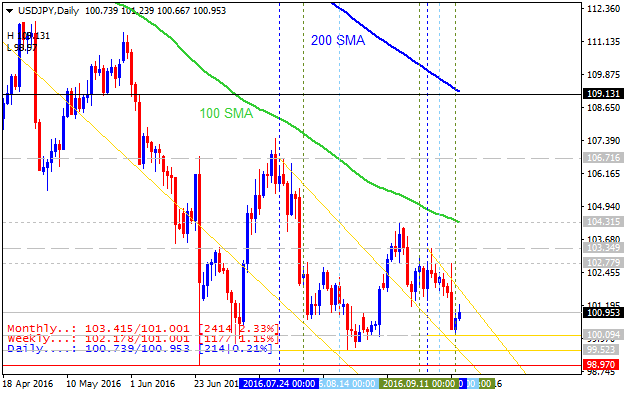

USD/JPY: End Of Week Technicals - Ranging Bearish Near Bullish Reversal

This trading week ended with some interesting daily/intra-day results

and setups for USD/JPY so, let's describe some of the interesting

moments for this pair.

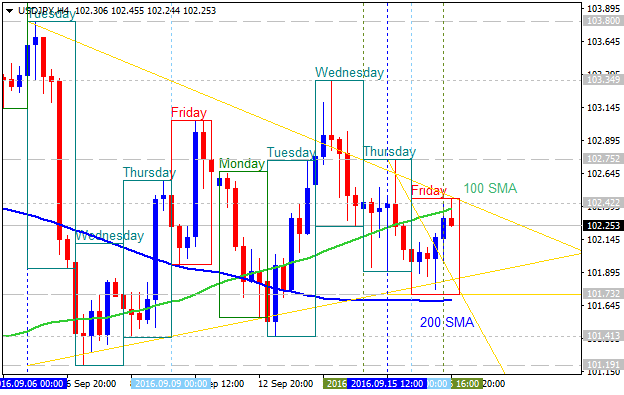

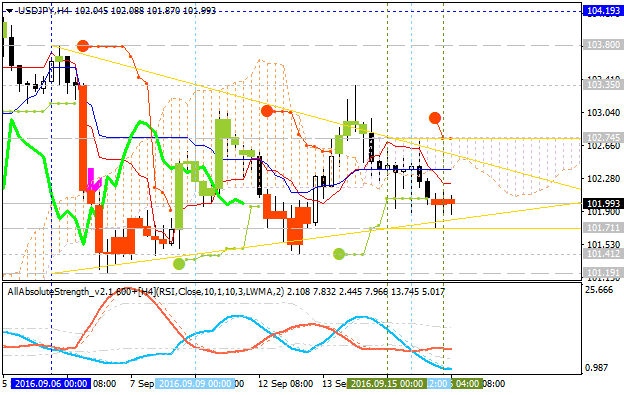

D1 price is on primary bearish market condition: the price is on ranging within 103.80 bullish reversal resistance level and 101.19 bearish continuation level. Symmetric triangle pattern was fomred by the price to be crossed for the direction of the trend, and Absolute Strength indicator is evaluating the bearish ranging to be continuing in the near future.

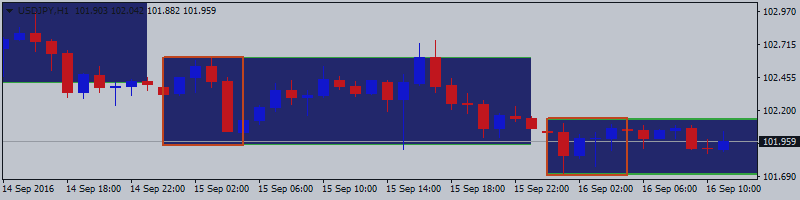

H4 price is on ranging near Ichimoku cloud: price broke this cloud to below once again for the possible bearish reversal:

- Chinkou Span line crossed the price from above to below for good possible breakdown in the near future.

- Descending triangle pattern was formed by the price to be crossed to below for the bearish trend to be continuing.

- Absolute Strength indicator is evaluating the trend as the ranging bearish in the near future.

If H4 price breaks 102.74 resistance level on close bar from below to above so the reversal of the price movement from the ranging bearish to the primary bullish market condition will be started.

If not so the price will be on bearish ranging within the levels.

- Recommendation for long: watch close H4 price to break 102.74 for possible buy trade

- Recommendation

to go short: watch H4 price to break 101.19 support level for possible sell trade

- Trading Summary: ranging bearish

| Resistance | Support |

|---|---|

| 102.74 | 101.41 |

| 103.35 | 101.19 |

| 104.19 | N/A |

SUMMARY : bearish