Why Trend-Following and Price Action Systems with High Risk-Reward Are Safer for Long-Term Investing

In algorithmic trading, there is a persistent myth:

In reality, this is one of the most dangerous misconceptions — especially when it comes to long-term investing and portfolio-based trading.

Most systems with an extremely high Win Rate (80–95%) are scalpers or short-term strategies with low or even negative Risk-Reward, which means they are fundamentally working against mathematical expectation.

Let’s break down why.

1. Mathematical Expectation Is the Core of Any Trading System

Any trading strategy can be reduced to a simple formula:

Expected Value (EV)

The key takeaway is simple:

Win Rate alone is meaningless if Risk-Reward is below 1.

Example 1 — A “Beautiful” Scalping System

-

Win Rate: 90%

-

Risk-Reward: 0.5

-

9 winning trades: +1 each

-

1 losing trade: −10

Result:

Despite a very high Win Rate, the system is unprofitable.

Example 2 — A Trend-Following System

-

Win Rate: 35–45%

-

Risk-Reward: 3–6

-

4 losing trades: −1 each

-

2 winning trades: +6 each

Result:

Fewer trades, fewer emotions — significantly better long-term performance.

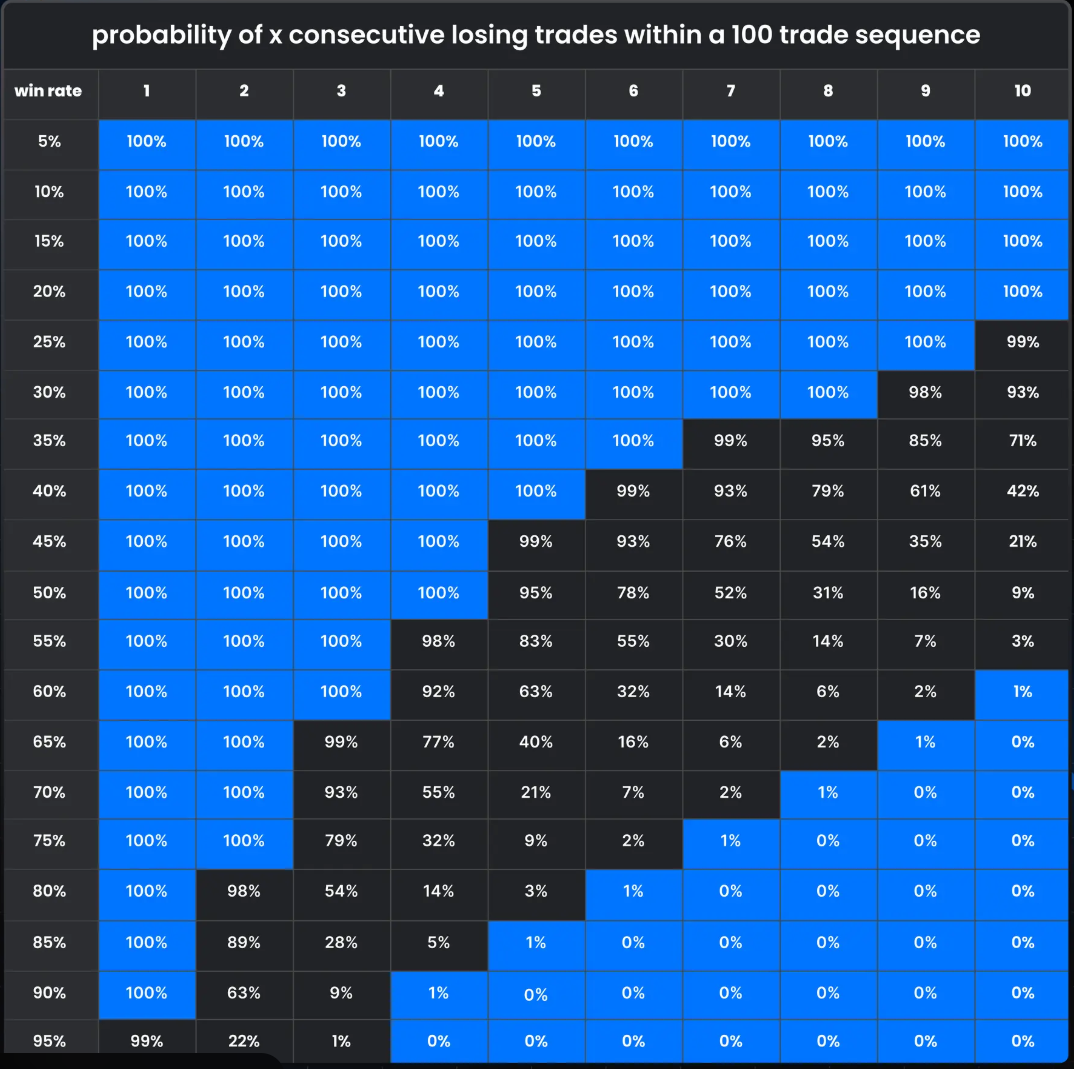

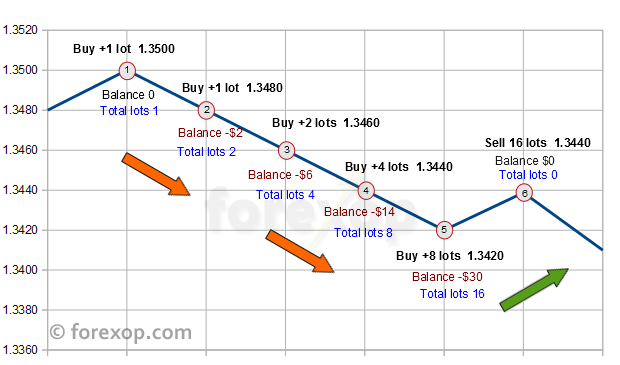

2. Why High Win Rate Creates an Illusion of Stability

Systems with very high Win Rate usually share the same characteristics:

-

small take-profits

-

rare but very large losses

-

strong dependence on:

-

spreads

-

liquidity

-

news events

-

broker execution quality

-

Such systems:

-

often look impressive over short periods

-

fail during regime shifts or abnormal market conditions

-

behave like a time bomb — stable until a single event destroys months or years of profits

This is not investing.

It is negative expectancy trading masked by psychological comfort.

3. Why Trend and Price Action Are Structurally More Robust

Trend-following and Price Action systems are built on a fundamentally different logic:

-

losses are accepted quickly and controlled

-

profits are not artificially capped

-

the system benefits from price asymmetry and market expansion phases

Key advantages:

-

positive mathematical expectancy

-

adaptability to different market regimes

-

no dependence on ultra-precise entries

Important principle:

The market does not owe you a high Win Rate.

It owes you enough movement to cover your losses and generate asymmetry.

That is exactly what trend-following systems are designed to capture.

4. Risk-Reward as a Quality Filter

A high Risk-Reward ratio automatically:

-

protects the trading account

-

reduces the impact of losing streaks

-

improves long-term statistical stability

Structural Comparison

| Parameter | High Win Rate Scalper | Trend / Price Action |

|---|---|---|

| Win Rate | Very high (80–95%) | Moderate (30–50%) |

| Risk-Reward | < 1 | 2–6 |

| Drawdowns | Rare but deep | Controlled |

| Market sensitivity | Very high | Low |

| Suitable for investing | ❌ | ✅ |

5. Examples of High Risk-Reward Systems

In practice, this approach is implemented in systems such as:

-

Strategy B (Product page: https://www.mql5.com/en/market/product/156340)

A trend-oriented system focused on strong impulses with strictly limited risk. -

Gold Action (Product page: https://www.mql5.com/en/market/product/157767)

A Price Action–based trend system for gold, with rare entries but strong profit asymmetry. -

The Golden Mean (Product page: https://www.mql5.com/en/market/product/163388)

A universal trend-following system applicable to:-

gold

-

cryptocurrencies

-

stock indices

-

equities

-

One core logic — multiple asset classes.

Minimal overfitting due to working with direction and structure, not market noise.

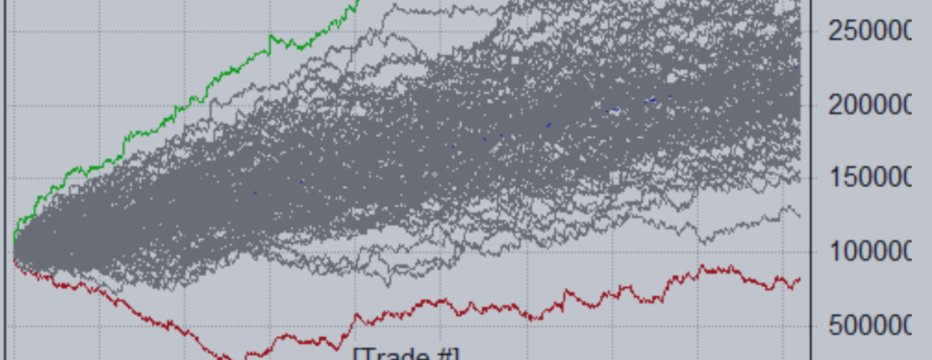

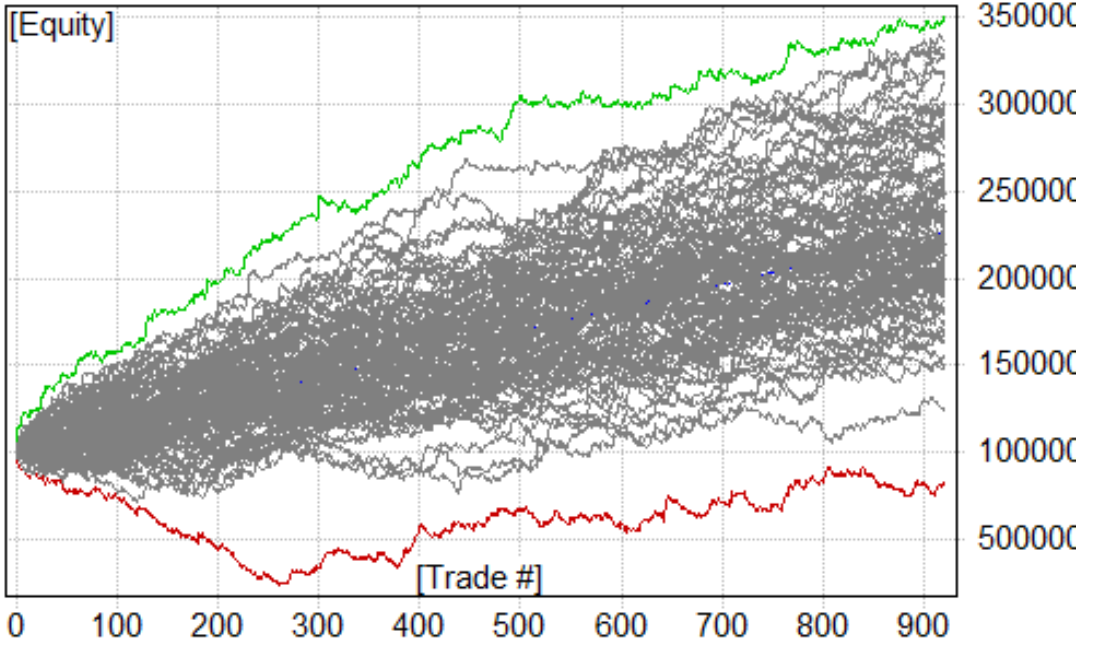

6. Why These Systems Are Better for Portfolio Trading

Trend-following systems with high Risk-Reward:

-

combine well with each other

-

have low entry correlation

-

produce smoother equity curves over long horizons

This makes them:

-

suitable for long-term investing

-

effective building blocks for diversified portfolios

-

applicable on both netting and hedging accounts

Conclusion

In simple terms:

High Win Rate appeals to psychology.

High Risk-Reward satisfies mathematics.

Markets do not reward traders for being right often.

They reward traders who make more when they are right than they lose when they are wrong.

That is why trend-following and Price Action systems remain

one of the most robust and sustainable approaches for long-term trading and investment.