22 Januari 2016 12:35 AM

FXStreet (Guatemala) - USD/JPY has been better bid in a better risk environment instigated on the ECB and now massaged out of the markets while the Chinese crisis has started to stabilize.

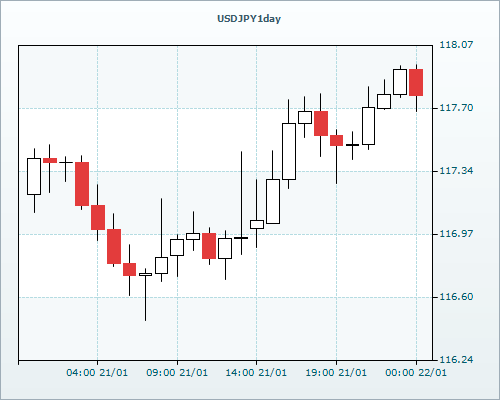

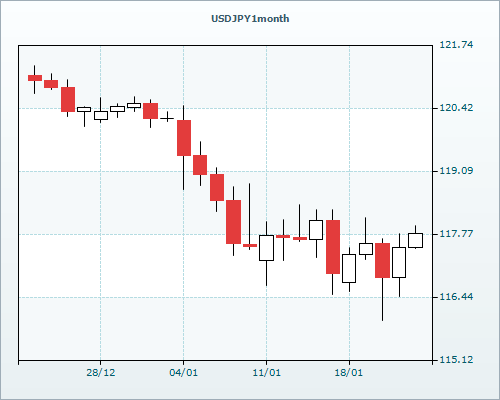

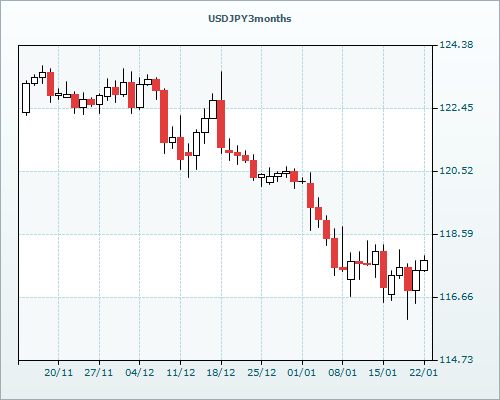

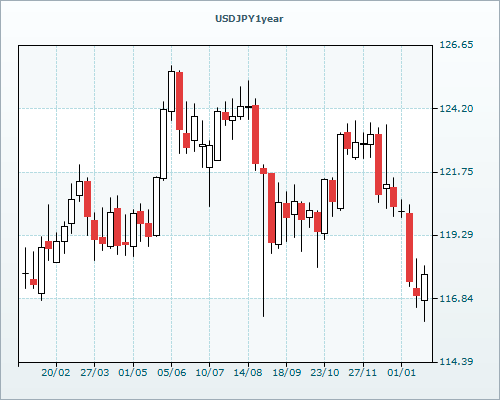

The recovery from the 116 handle has been convincing on the daily chart making higher lows and highs back on towards the 118 handle as risk has been improving. However, not all are convinced that the risk appetite can continue to recover, and just today George Soros has voiced his concerns and says that China is headed for a hard landing and who is also bettering that the Fed cannot hike again.

Meanwhile, we await the FOMC and BoJ coming up. There is sentiment building that the Central Bank will need to cut rates in respect of their inflation target and how lower oil, perhaps unable to recover in the medium term, will set the economy back and this too should add fuel to the rally in the major, targeting the psychological 120 handle. However, analysts at Bank of Tokyo Mitsubishi suggested that next week's BoJ will not reverse risk-off.

USD/JPY levels

Technically, USD/JPY has been in recovery since the aforementioned lows and after eroding the 2014-2016 support line at 116.49 and the 116.15 August 2015 low. However, the major is embarking on the 118 handle and has the 20 DMA at 118.46 on its radar. Failures below here leaves the downside exposed and a break below the aforementioned key support levels opens up the 114.00/113.95 zone, being the 23.6% retracement of the entire move up from the 2011 low.

USD/JPY has been better bid in a better risk environment instigated on the ECB and now massaged out of the markets while the Chinese crisis has started to stabilize.