Grid Harvester MT5 Free

- エキスパート

- Grzegorz Korycki

- バージョン: 6.80

- アップデート済み: 1 3月 2021

WARNING: Product is out of support!

Free version of the grid strategy! Identical strategy to the full version, the only limitation is the number of positions.

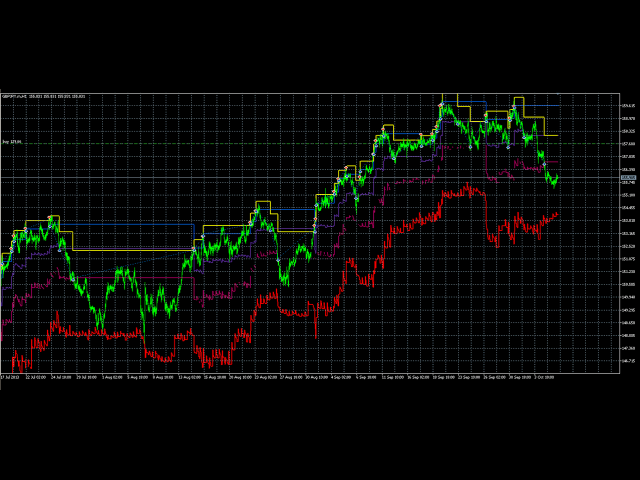

Its goal is to harvest most out of trending market (on automatic mode) taking advantage of corrections in trends. It can be also used by experienced traders on manual trading. This kind of system is being used by most successful social traders having 500+ paid subscribers.

Combine your trading experience with this automatic strategy! It contains grid for GBPJPY that is easily scalable on other currencies.

You can also build grid on your own from scratch!

The strategy also supports stop loss option. You can use equity-based stop loss setting percentage of equity to be protected in one transaction.

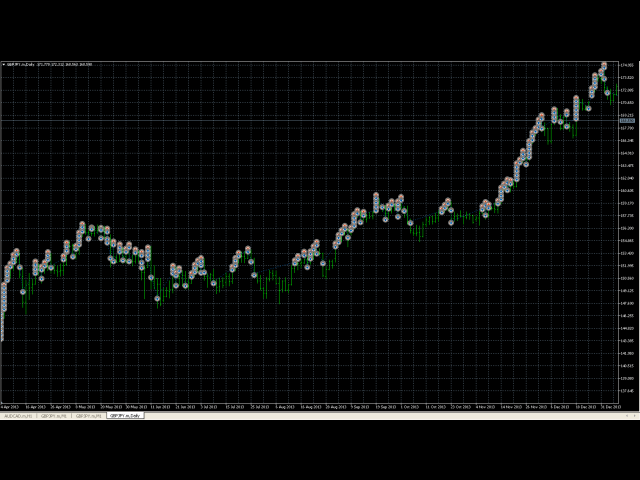

- Test it on GBPJPY 06.2012 - 11.2013 at any timeframe (every tick).

- Other pairs: CHFJPY, EURJPY, CADJPY, USDJPY.

Can be also tested on any other currency pair with a trending market (for example, GBPUSD 06.2013-11.2013) or oscillating market. Better would be using more tight grid on GBPUSD and follow day's trend if not in oscillation mode. In oscillation mode use 8-16 MAs to oscillate around.

The Expert Advisor is very easy to configure. Send me private messages for more details or watch the MetaTrader 4 version video tutorial.

All options have a long description giving an example of what can be accomplished with certain options.

Become a successful signal provider with tons of subscriptions or simply trade your own account and make big profits with a well-known system.

Watch YouTube presentation and screen-shots.

JPY pairs are good for automated trading as Japan is facing default and inflating its currency (yet it does not guarantee success).

The strategy has both MetaTrader 4 and MetaTrader 5 versions.

Great EA