Sigma PROP

- Experts

- Piotr Stepien

- Version: 1.0

- Activations: 15

After years of in-depth research, development, and rigorous testing, Sigma PROP was created – an advanced Expert Advisor (EA) written in MQL5 and specifically designed for both prop firm challenges and professional trading accounts.

Unlike conventional EAs that require manual setup on each symbol, Sigma PROP only needs to be attached to EUR/USD. From there, it automatically manages trading across AUD/CAD, AUD/NZD, and NZD/CAD, applying its strategy seamlessly across all required pairs.

For brokers using non-standard symbol names (e.g., suffixes like _m, .pro, or others), simply enter the exact symbol format in the Inputs tab to ensure correct operation both in live trading and during backtesting.

Why “Sigma PROP”?

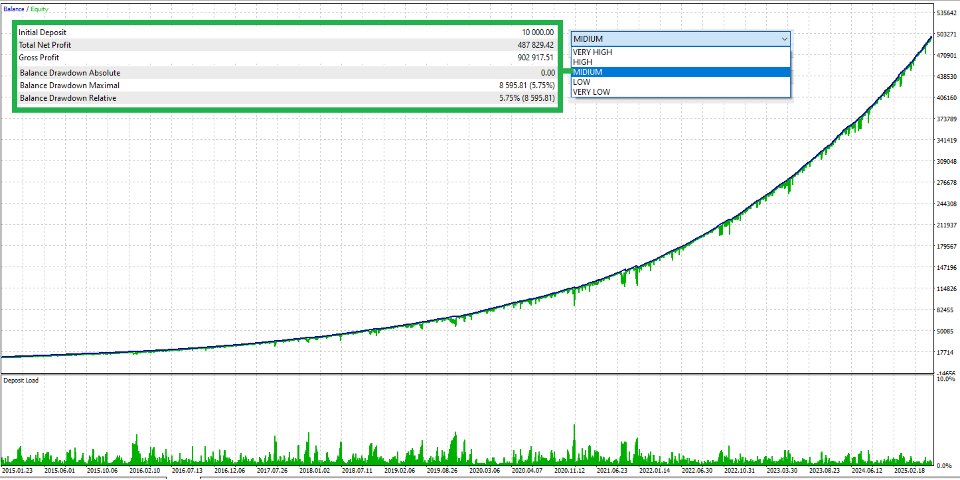

The name reflects its design philosophy: Sigma represents a systematic, statistical approach to the market, while PROP highlights its optimization for prop firm requirements – low drawdown, stable returns, and robust adaptability.

Sigma PROP applies a mean reversion strategy combined with an advanced system for detecting market exhaustion points. Using ATR-based filters and proprietary algorithms, it identifies when prices have deviated excessively and capitalizes on the natural tendency of the market to return to equilibrium.

Key Features of Sigma PROP

1. Strategy Based on Mean Reversion and Market Exhaustion

-

Identifies overextended price movements and market exhaustion points.

-

Uses ATR and other proprietary filters to validate trade opportunities.

-

Positions are managed dynamically with trailing stops and smart exit logic.

2. Risk Management Optimized for Prop Firms

-

Adjustable risk levels in the Inputs tab – from very low to very high.

-

Default risk set to medium, offering balanced performance.

-

Each trade protected with both stop loss and take profit.

-

Ultra-low drawdown profile, making it ideal for prop firm challenge rules.

3. Automatic Multi-Pair Execution

-

Attach EA only to EUR/USD – it will automatically manage AUD/CAD, AUD/NZD, and NZD/CAD.

-

No need for multiple chart setups.

-

For non-standard broker symbols, enter the exact symbol name in Inputs.

4. Flexibility Across Account Types

-

Best suited for larger accounts or prop firm challenges thanks to very low drawdown.

-

Can also be used on standard retail or cent accounts.

-

Minimum recommended deposit: 1,000 USD (higher is better depending on risk).

-

Minimum leverage: 1:30 or higher.

5. Optimized and Ready to Use

-

Fully optimized and plug & play – no need for additional setup.

-

Includes professional-grade parameters for advanced users.

-

Verified positive results on both in-sample and out-of-sample testing.

-

For faster testing: use M1 OHLC mode in the Strategy Tester – results remain consistent with every-tick testing.

Why Use Sigma PROP?

-

Prop Firm Ready: Designed with very low drawdown and stable performance.

-

Automated Multi-Pair Trading: Manage three pairs from a single chart.

-

Dynamic Risk Control: Choose between very low and very high risk.

-

Robust Strategy: Based on mean reversion and advanced market exhaustion detection.

-

Efficient Testing: Quick and reliable results with M1 OHLC backtests.

-

Proven Stability: Positive in both in-sample and out-of-sample performance.

Summary

Sigma PROP is a next-generation EA built for traders who value stability, precision, and professional-grade performance. Its core mean reversion strategy, combined with advanced volatility and exhaustion filters, ensures accurate entries and disciplined exits. With its automatic multi-pair functionality, prop firm-optimized risk profile, and low drawdown design, Sigma PROP stands out as a powerful solution for serious traders.

Whether you are trading on a prop firm account or managing your own capital, Sigma PROP offers a robust, optimized, and ready-to-trade system – engineered to perform under real-world market conditions.