MindxAlpha

- Experts

- Yug Anil Solanki

- Version: 1.0

- Activations: 5

Why MindXAlpha is Different (The Investor's Edge)

Most commercial Expert Advisors fail because they rely on curve-fitted data or dangerous recovery mechanics. MindXAlpha was engineered from the ground up to prioritize capital preservation and logical transparency.

1. Zero Toxic Risk Management (No Martingale or Grid) MindXAlpha does not average down on losing positions, and it never uses Martingale or Grid systems. Every single trade is an independent event with a hard-coded, point-based Stop Loss. You will never wake up to a blown account due to an algorithmic "death spiral."

2. Institutional Fractional Sizing Instead of using fixed lots that over-leverage small accounts and under-leverage large ones, the EA dynamically calculates position size based on a strict 1.8% equity risk limit. If your account experiences a drawdown, the algorithm automatically reduces the lot size of the next trade, mathematically defending your remaining capital.

3. Advanced Regime Detection (The ADX Shield) A common flaw in trend-following EAs is that they hemorrhage money during ranging, low-volatility markets (whipsawing). MindXAlpha solves this by routing all signals through a strict 31-period ADX filter. If the market lacks genuine momentum, the EA overrides the signal and keeps your capital safely on the sidelines until a true trend emerges.

4. 100% Transparent Logic There is no hidden "black box" code. You know exactly why the EA enters a trade (20/176 EMA crossover + 200 SMA baseline + ADX momentum) and exactly how it exits (Dynamic Trailing Stop or Fixed SL/TP). This allows professional traders to understand the tool they are deploying.

5. High-Conviction Execution (Cleaner Moves) MindXAlpha does not trade for the sake of being in the market. By requiring alignment between the 200 SMA baseline and a surging ADX momentum reading, the algorithm waits patiently for "clean," high-probability market regimes. It ignores the market noise and only deploys capital when the data confirms a genuine structural breakout.

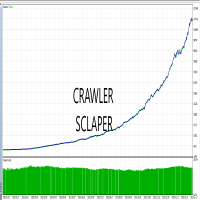

6. Proven Historical Efficiency The system is optimized for aggressive capital growth scaled alongside strict risk limits. Rather than promising unrealistic daily returns, MindXAlpha focuses on a high historical Recovery Factor and compound equity growth, historically demonstrating exceptional yield-to-drawdown ratios over multi-year backtests.