You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

GBP/USD Intra-Day Fundamentals: Second Estimate U.K. Gross Domestic Product and 19 pips range price movement

2016-08-26 08:30 GMT | [GBP - GDP]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

GBP/USD M5: 19 pips range price movement by Second Estimate U.K. Gross Domestic Product news event

Intra-Day Fundamentals - EUR/USD and GBP/USD: Fed Chair Yellen Speaks

2016-08-26 14:00 GMT | [USD - Fed Chair Yellen Speaks]

[USD - Fed Chair Yellen Speaks] = Speech titled "The Federal Reserve's Monetary Policy Toolkit" at the Federal Reserve Bank of Kansas City Economic Symposium, in Jackson Hole

==========

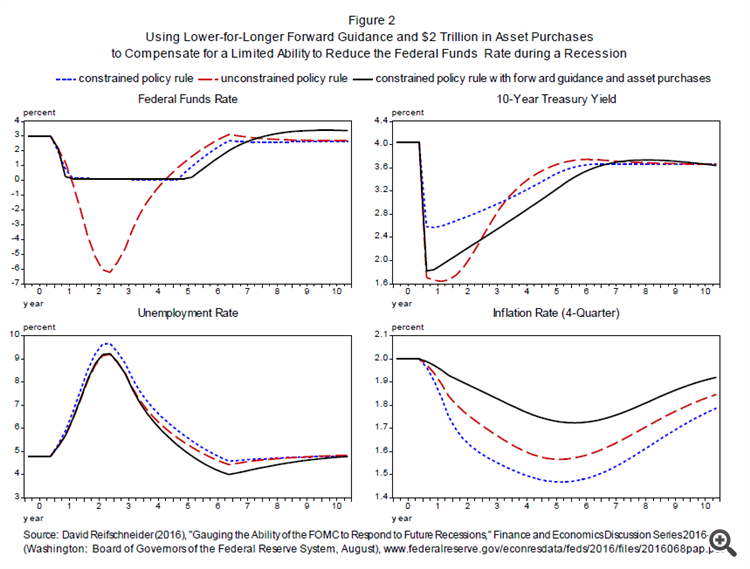

"Although fiscal policies and structural reforms can play an important role in strengthening the U.S. economy, my primary message today is that I expect monetary policy will continue to play a vital part in promoting a stable and healthy economy. New policy tools, which helped the Federal Reserve respond to the financial crisis and Great Recession, are likely to remain useful in dealing with future downturns. Additional tools may be needed and will be the subject of research and debate. But even if average interest rates remain lower than in the past, I believe that monetary policy will, under most conditions, be able to respond effectively."

==========

GBP/USD M5: 136 pips range price movement by Fed Chair Yellen Speech news event==========

EUR/USD M5: 100 pips range price movement by Fed Chair Yellen Speech news eventWeekly Outlook: 2016, August 28 - September 04 (based on the article)

US CB Consumer Confidence, Canadian GDP data, US ISM Manufacturing PMI as well as important employment figures including the all-important monthly NFP report on Friday. These are the main market movers on our weekly outlook.Stocks end mostly lower after Yellen speech (adapted from the article)

"Major U.S. indexes initially climbed after a speech by Fed Chair Janet Yellen that was bullish on the economy but gave no timetable for future rate increases. Then investors began to have second thoughts, wondering if an increase was possible as early as next month, and buyers turned to sellers."

"The S&P 500 slipped 3.43 points, or 0.2 percent, to 2,169.04. The Dow Jones industrial average fell 53.01 points, or 0.3 percent, to 18,395.40. The Nasdaq composite rose 6.71 points, or 0.1 percent, to 5,218.92."

"In Asia, Japan's Nikkei 225 fell 1.2 percent after consumer prices fell the most in three years in July. Hong Kong's Hang Seng index rose 0.4 percent."

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, NZD/USD, USD/CNH and GOLD (based on the article)

Dollar Index - "It will difficult to keep the market on pace for US hawkishness and thereby Dollar bullishness. First of all, it will be difficult to weave a fundamental path where the heat keeps rising for rate hike expectations. More systemically, the pull of complacency will be exceptionally strong on skepticism. While the week ahead is active for scheduled event risk, the backdrop for activity is stubbornly quiet. Add to that the anticipation of the Labor Day holiday the first Monday of September, and the perception of a seasonal inhibitor will readily open a crack in any conviction that attempts run more significant resistance for the Dollar."

GBP/USD - "With U.S. Non-Farm Payrolls (NFP) anticipated increasing another 185K in August, a positive development may boost the appeal of the greenback especially as ‘Chair Janet Yellen warns ‘the case for an increase in the federal funds rate has strengthened in recent months, and comments from Boston Fed President Eric Rosengren, Minneapolis Fed President Neel Kashkari, Cleveland Fed Loretta Mester and Richmond Fed President Jeffrey Lacker may largely reinforce a more hawkish tilt for the policy outlook as the U.S. economy approaches ‘full-employment.’"

USD/JPY - "At a certain point these traders will lose patience given the cost of borrowing USD in order to buy the lower-yielding JPY, and the threat of short-covering adds topside risk to the USD/JPY. The coming week’s US Nonfarm Payrolls report could go a long way in improving the odds of a Fed rate hike. It will be critical to watch whether traders may finally force the USD/JPY out of its long-standing trading range."

AUD/USD - "On the domestic front, a steady stream of activity data will feed speculation about the RBA’s policy trajectory. Building Permits, Retail Sales and capex numbers are all due to cross the wires. Australian economic news-flow has weakened relative to economists’ expectations over recent weeks and the year-end monetary policy outlook implied in futures prices has steadily eroded despite central bank officials’ downplaying of near-term stimulus expansion prospects. Another soft round of data outcomes may encourage the markets’ dovish disposition, compounding downward-pulling external forces and deepening the selloff."

NZD/USD - "From a technical perspective, it’s worth keeping an eye on the 0.7350 level, which the price of NZD/USD has failed to overcome. Much focus is on the US Dollar into the Kansas City Fed’s Annual Jackson Hole Symposium. A more dovish than expected Janet Yellen, and a break above 0.7350 could signal the beginning of the next big move higher in NZD/USD. However, a breakdown below 0.7200 could show that a shift has happened in the market that would lean toward a weaker NZD and/ or strong USD that could eventually bring us below 0.7000."

USD/CNH - "The current moderate policy could help the Yuan avoid sudden plunges driven by internal forces. Also, the G20 meetings, a top event for China, will start next week on next Wednesday. As we discussed last week, Yuan rates saw low volatility ahead of past G20 meetings; it could be the case this time as well. Next week, the offshore Yuan may continue to consolidate with a range between 6.6500 and 6.7000 with this main theme."

GOLD (XAU/USD) - "Heading into next week, greater emphasis may surround the August U.S. Non-Farm Payrolls report as market participants continue to gauge the outlook for the next Fed rate hike. Indeed on Friday Federal Reserve Vice Chairman Stanley Fischer stated that, “We’ve had very strong hiring reports in the last three months,” and incoming labor data, “will probably weigh on our decision, along with other data that may come in.” In light of the recent rhetoric emanating from the economic symposium, a strong employment report may boost expectations for a 2016 rate hike as Chair Yellen argues the, “case for an increase in the federal funds rate has strengthened in recent months.” From a technical standpoint, the risk remains for further losses near-term before mounting a more significant rally."

AUD/USD Intra-Day Fundamentals: Australia Building Approvals and 15 pips price movement

2016-08-30 01:30 GMT | [AUD - Building Approvals]

if actual > forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Building Approvals] = Change in the number of new building approvals issued.

==========

==========

AUD/USD M5: 15 pips range price movement by Australia Building Approvals news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

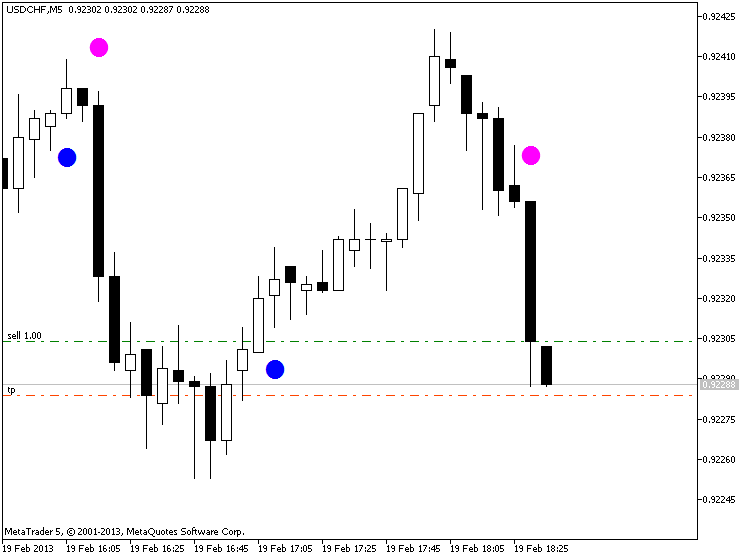

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

GBP/USD Intra-Day Fundamentals: BoE Mortgage Approvals and 15 pips range price movement

2016-08-30 08:30 GMT | [GBP - Mortgage Approvals]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Mortgage Approvals] = Number of new mortgages approved for home purchases during the previous month.

==========

From BBC article: Mortgage approvals at 19-month low, says Bank of England

During July - the first full month after the Brexit vote - 60,912 new mortgages were approved, down from 64,152 approvals in June.

"Mortgage approvals for house purchases have progressively slowed after being buoyed in the first quarter by buy-to-let and second home sectors rushing to beat April's Stamp Duty increase for these sectors," said Howard Archer, chief UK and European economist at IHS Global Insight.

"It is also highly possible that mortgage activity was hit in July by heightened uncertainty following June's vote for Brexit."

==========

GBP/USD M5: 15 pips range price movement by BoE Mortgage Approvals news event

Intra-Day Fundamentals - EUR/USD, GBP/USD and AUD/USD: The Conference Board Consumer Confidence

2016-08-30 14:00 GMT | [USD - Consumer Confidence]

[USD - Consumer Confidence] = Level of a composite index based on surveyed households. Survey of about 5,000 households which asks respondents to rate the relative level of current and future economic conditions including labor availability, business conditions, and overall economic situation.

==========

The Conference Board Consumer Confidence Index®, which had decreased slightly in July, increased in August. The Index now stands at 101.1 (1985=100), compared to 96.7 in July. The Present Situation Index rose from 118.8 to 123.0, while the Expectations Index improved from 82.0 last month to 86.4.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was August 18.

“Consumer confidence improved in August to its highest level in nearly a year, after a marginal decline in July,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of both current business and labor market conditions was considerably more favorable than last month. Short-term expectations regarding business and employment conditions, as well as personal income prospects, also improved, suggesting the possibility of a moderate pick-up in growth in the coming months.”

==========

EUR/USD M5: 11 pips price movement by The Conference Board Consumer Confidence news event

==========

GBP/USD M5: 18 pips price movement by The Conference Board Consumer Confidence news event

==========

AUD/USD M5: 16 pips price movement by The Conference Board Consumer Confidence news event

AUD/USD Intra-Day Fundamentals: RBA Assist Gov Debelle Speech and 11 pips range price movement

2016-08-31 01:00 GMT | [AUD - RBA Assist Gov Debelle Speaks]

[AUD - RBA Assist Gov Debelle Speaks] = The Speech at the FX Week Asia conference in Singapore.

==========

A well-functioning foreign exchange market is very much in the interest of all market participants. This clearly includes central banks, both in their own role as market participants but also as the exchange rate is an important channel of monetary policy transmission. In a globalised world, the foreign exchange market is one of the most vital parts of the financial plumbing.

==========

AUD/USD M5: 11 pips range price movement by RBA Assist Gov Debelle Speech news event