When Bulldozers Bust Through Brick Walls:

Reasons for Resistance Breaks in Forex

We've all been there: staring at a chart, price hovering just beneath a seemingly impenetrable resistance level. Orders poised, adrenaline pumping, we wait for the bounce, the confirmation of our analysis. And then... CRACK! That stubborn barrier shatters like a stale baguette, price surging past with the force of a runaway bulldozer. What just happened? Why did resistance, once so resolute, crumble like a sandcastle under a rogue wave?

Fear not, fellow trader, for understanding these breakouts is the key to unlocking hidden opportunities and avoiding painful false dawns. So, grab your coffee and buckle up, because we're diving into the five main reasons why resistance levels in forex get pulverized into trading dust:

Imagine a battle between buyers and sellers. When resistance holds, it's like a stalemate – neither side can overpower the other. But sometimes, external forces tip the scales. A surprise economic release, a geopolitical earthquake, or even a juicy rumor can shift market sentiment like a hurricane's winds. Suddenly, that stubborn resistance line turns into a flimsy beach umbrella in the face of a tidal wave. Buyers surge in, fueled by newfound optimism, and boom! Resistance is history.

Picture this: big banks and hedge funds, the market's heavy cavalry, have been quietly accumulating positions before reaching a key resistance level. They wait patiently, like wolves circling their prey. Then, at the opportune moment, they charge in, unleashing a torrent of buy orders that overwhelms the existing selling pressure. Resistance crumples under the sheer weight of their combined might, paving the way for a sustained uptrend.

3. The Power of Technicals: Confirmation Candles and Breakouts

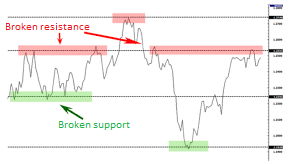

4. The Illusion of Strength: False Breaks and Retests

Not all resistance breaks are created equal. Sometimes, price spikes through a level only to quickly reverse, leaving bewildered traders scratching their heads. These "false breaks" can be caused by fleeting bursts of buying or selling pressure that quickly evaporate. Remember, true breakouts usually have volume confirmation and follow-through on higher timeframes. So, don't jump the gun just because price pokes its head above resistance – wait for the cavalry to arrive before charging in yourself.

5. The Unseen Hand: Fundamental Shifts and Long-Term Trends

Finally, we mustn't forget the underlying fundamentals that drive currency markets. A shift in a country's economic trajectory, a change in monetary policy, or even a trade war can have profound long-term impacts on exchange rates. If these fundamental forces align against a resistance level, it's only a matter of time before it succumbs to the sheer weight of reality.

Bonus Tip:

Remember, context is key. Analyse resistance breaks within the broader market environment, considering timeframes, technical indicators, and fundamental news. Don't chase every breakout blindly – wait for confirmation and trade with proper risk management.

Happy trading!