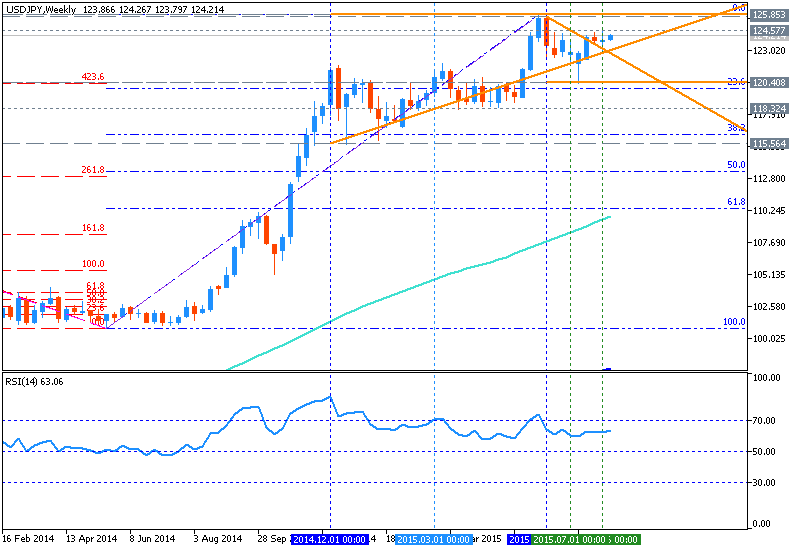

USDJPY Weekly Outlook - symmetric triangle pattern to be broken for breakout

5 August 2015, 12:11

0

982

W1 price is located above 200 period SMA (200-SMA) and 100 period SMA (100-SMA) with the primary bullish for secondary ranging between Fibo resistance level at 125.85 and 23.6% Fibo support level at 119.93:

- symmetric triangle pattern was broken by the price from below to above for the bullish trend to be continuing;

- "USD/JPY continues to consolidate below the 124.70 78.6% retracement of the June/July range";

- “A daily close above 124.70 is needed to re-instill upside mometum into the exchange rate”;

- “A close back below 123.00 would turn us negative again USD/JPY”;

- RSI indicator is estimating the uptrend to be continuing.

If the price will break 23.6% Fibo support level at 119.93 so we may see the secondary correction within the primary bullish.

If the price will break Fibo resistance level at 125.85 from below to above so the primary bullish market condition will be continuing.

If not so the price will be ranging between between the levels.

Trend: