How CRT and Higher-Timeframe Fractals Work Together in Live Markets

Most traders fail not because they lack entries,

but because they misread context.

Markets do not move randomly.

They move within ranges, timeframe hierarchy, and liquidity objectives.

Candle Range Theory (CRT) and Higher-Timeframe (HTF) fractals are not entry models.

They are context and validation tools.

When combined correctly, they help traders answer three critical questions:

-

Where is higher-timeframe liquidity located?

-

Has liquidity been taken or is it still forming?

-

Is price reacting with intent or just expanding temporarily?

This article explains how CRT and HTF Fractal logic work together on live charts, using real market structure rather than hindsight markings.

Understanding CRT: Pending vs Completed

CRT is built on a simple but powerful observation:

Price often sweeps a prior candle’s range before committing to direction.

However, not all CRT levels carry the same meaning.

Pending CRT

A CRT level is considered pending when:

-

Price has interacted with a prior range

-

The sweep is forming, but not yet confirmed

-

The higher-timeframe candle has not closed with validation

Pending CRT provides context, not direction.

It tells us:

-

Liquidity is being tested

-

Range boundaries are active

-

Direction is still undecided

This is where many traders make mistakes — treating pending CRT as an entry signal.

Completed CRT

A CRT level becomes completed only when:

-

Liquidity has been swept

-

Price closes back within the range

-

Confirmation is achieved on candle close

Completed CRT represents validation, not anticipation.

This distinction is critical:

-

Pending CRT = awareness

-

Completed CRT = confirmation

Without this separation, CRT becomes subjective and inconsistent.

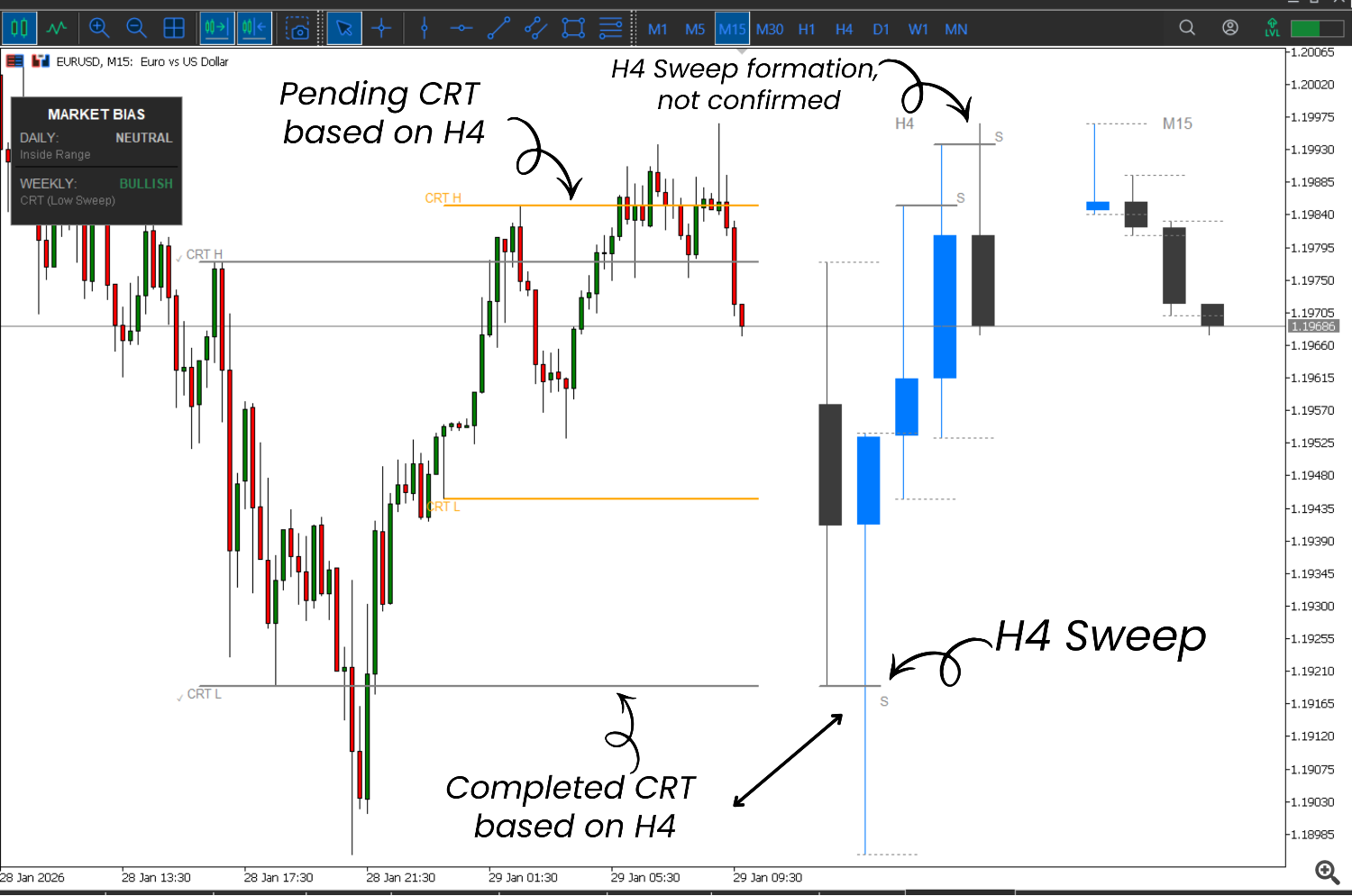

Applying CRT + Higher-Timeframe Fractal Logic on a Live Chart

(Practical Workflow)

This section explains how to interpret the structures shown in the charts above in real time, without prediction or hindsight.

Step 1: Start From the Higher Timeframe Context

Begin by identifying the higher-timeframe structure that controls price delivery.

-

Observe the HTF ghost candles (for example, H4 on an M15 chart)

-

Note the current HTF range (high and low)

-

Check whether price is operating inside range or interacting with range boundaries

At this stage, there is no trade bias — only context.

Step 2: Identify a Pending CRT Zone

A Pending CRT forms when price sweeps a prior higher-timeframe high or low but has not yet closed with confirmation.

Characteristics of a Pending CRT:

-

Price temporarily trades beyond a prior range level

-

The candle has not yet closed back inside the range

-

Liquidity may still be forming

This phase represents context, not validation.

Reacting here is anticipation, not confirmation.

Step 3: Wait for Completed CRT Confirmation

A Completed CRT occurs only after candle close confirms that:

-

Liquidity has been swept

-

Price has closed back inside the higher-timeframe range

-

The CRT level transitions from pending to confirmed

This is a structural event, not a signal.

Completed CRT defines:

-

Where liquidity was taken

-

Where imbalance may now exist

-

Where reactions become possible, not guaranteed

Step 4: Evaluate Higher-Timeframe Sweep Status

Not all sweeps are equal.

Use HTF fractal logic to differentiate between:

-

Sweep forming (noise)

-

Sweep confirmed (intent)

Key distinction:

-

A dotted or forming sweep indicates potential

-

A confirmed sweep (validated on close) indicates institutional participation

Only confirmed HTF sweeps should influence directional expectations.

Step 5: Align Lower-Timeframe Execution With HTF Intent

Once the following conditions align:

-

Completed CRT is present

-

HTF sweep is confirmed

-

Price reacts within the HTF range

You now have validated context.

Lower-timeframe execution (entries, risk placement, management) should occur only after this alignment, using the trader’s own execution model.

CRT and HTF fractals do not tell you when to enter —

they tell you when the market has revealed intent.

Step 6: When Not to Trade

Equally important is knowing when not to act.

Avoid engagement when:

-

CRT is still pending

-

HTF sweep is forming but unconfirmed

-

Price is expanding without structure

In these conditions, price movement is informational, not actionable.

Key Principle to Remember

Pending CRT is context.

Completed CRT is validation.

HTF sweep forming is noise.

HTF sweep confirmed is intent.

Once you stop chasing candles and start reading structure,

the market becomes quieter — and decisions become clearer.

Why This Workflow Matters

This approach:

-

Reduces overtrading

-

Removes emotional decision-making

-

Forces patience until confirmation

-

Aligns execution with higher-timeframe intent

CRT and HTF fractals are not entry systems.

They are filters that tell you when the market is worth engaging.

Higher-Timeframe Fractals: Noise vs Intent

Higher-timeframe fractals help identify liquidity events, but only when interpreted correctly.

HTF Sweep Forming

A sweep is forming when:

-

Price extends beyond a prior HTF high or low

-

The candle has not yet closed

-

Liquidity interaction is still in progress

Forming sweeps are noise.

They are common and often misleading.

HTF Sweep Confirmed

A sweep is confirmed only when:

-

The higher-timeframe candle closes

-

The sweep is validated using close-based logic

-

Liquidity has clearly been taken

Confirmed HTF sweeps represent intent.

They signal that:

-

Stops have been cleared

-

Higher-timeframe objectives are in play

-

Price is more likely to expand or react meaningfully

Why CRT and HTF Fractals Must Be Read Together

Individually, CRT and HTF fractals provide partial information.

Together, they form a complete validation framework:

-

CRT defines range logic

-

HTF fractals define liquidity behavior

-

Confirmation comes only when both align

For example:

-

A completed CRT aligned with a confirmed HTF sweep carries far more significance than either alone

-

A pending CRT during a forming HTF sweep should be treated with caution

This alignment removes guesswork and emotional decision-making.

Lower-Timeframe Execution with Higher-Timeframe Context

Most execution happens on lower timeframes (M5–M15).

Most mistakes happen when higher-timeframe context is ignored.

By projecting HTF structure onto lower timeframes:

-

Traders avoid overtrading

-

Entries become selective

-

Stops and targets align with real liquidity zones

This approach does not predict price.

It filters low-quality decisions.

Common Misconceptions

“CRT is an entry model.”

No. CRT is a range validation framework.

“Every sweep means reversal.”

No. Only confirmed sweeps matter.

“Lower timeframes are noisy.”

They are noisy only when higher-timeframe context is missing.

Practical Takeaways

-

Pending CRT = context, not action

-

Completed CRT = validation

-

HTF sweep forming = noise

-

HTF sweep confirmed = intent

-

Confirmation always comes from candle close

-

Structure matters more than speed

When traders stop chasing candles and start reading structure,

the market becomes quieter, clearer, and more disciplined.

Final Thoughts

CRT and Higher-Timeframe Fractal logic are not shortcuts.

They are discipline frameworks.

They help traders:

-

Respect market hierarchy

-

Understand liquidity behavior

-

Trade less, but with higher clarity

The goal is not more trades.

The goal is better decisions.

Disclaimer

This article is for educational and analytical purposes only.

It does not constitute financial advice or trading signals.

All trading involves risk, and discretion is required.