Mirage Trading System | Buy Trading Indicator for MetaTrader 5

This functionality is available in the trading system - Version 1.1

Main Manual : Mirage Trading System - Trading Systems - 5 February 2026 - Traders' Blogs

What is Signal Zone Filter?

Signal Zone Filter helps eliminate signals that appear in "floating" positions — meaning they are not near any important price zones. It only keeps signals that are connected to market structure zones (swing high/low, BOS, CHoCH).

Simply put:

-

When a Buy signal appears → the filter checks: "Did this pattern sweep through a nearby support zone? Or was there a recent bullish BOS/CHoCH event?"

-

If yes → signal is kept (displayed on chart)

-

If no → signal is blocked (not displayed)

-

Purpose: Reduce noise signals, trade only at structurally significant price zones.

How it works (2 OR conditions)

The filter uses 2 independent checks; only 1 of the 2 needs to be satisfied for a signal to pass:

Check 1: Swing Sweep

-

Buy: Pattern low must touch below a nearby swing low (sweep support zone HL/LL)

-

Sell: Pattern high must spike above a nearby swing high (sweep resistance zone HH/LH)

-

Sweep distance is limited by Swing Sweep Max Depth to avoid mistaking real breakouts

Why "sweep"? In price action analysis, when price sweeps past a high/low then reverses → this is often a sign of liquidity sweep. Signals appearing right after a sweep typically have higher success probability.

Check 2: Event Recency

-

Look for a BOS or CHoCH event in the same direction occurring within the last N candles

-

Buy: needs recent bullish BOS or bullish CHoCH

-

Sell: needs recent bearish BOS or bearish CHoCH

-

Why recent events? If there was just a BOS/CHoCH → market structure just confirmed the direction → signals in that direction are more reliable.

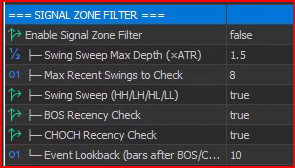

How to enable Signal Zone Filter

Signal Zone Filter is built into these indicators: Mirage (Fakey), PinBar, InvertedHammer (and Template). By default, the filter is off (false).

To enable: right-click the indicator → Properties (or press F7) → find parameter Enable Signal Zone Filter → change to true.

Important note: Signal Zone Filter requires Market Structure to be running (because it needs swing and BOS/CHoCH data from Market Structure). Market Structure is always enabled by default, so you don't need to do anything extra.

Input parameters explained

1. Enable Signal Zone Filter — Turn filter on/off

| Info | Details |

|---|---|

| Name in indicator | Enable Signal Zone Filter |

| Default | false (off) |

| Values | true / false |

Meaning: Main switch. When false, all signals are kept (filter does not interfere). When true, filter starts checking and blocking signals that don't meet criteria.

Tip: Enable filter when you see the indicator displaying too many signals, especially signals in "empty space" (not near any high/low).

2. Swing Sweep Max Depth (×ATR) — Maximum sweep distance

| Info | Details |

|---|---|

| Name in indicator | Swing Sweep Max Depth (×ATR) |

| Default | 1.5 |

| Range | 0.1 to 5.0 |

| Unit | ATR multiplier (×ATR) |

Formula: Max sweep distance = Swing Sweep Max Depth × ATR

Example: ATR = 50 pips, Max Depth = 1.5 → pattern can only sweep maximum 75 pips (1.5 × 50) past the swing level. If it sweeps more than 75 pips → doesn't count as sweep.

When changing:

-

Increase (2.0, 3.0...) → accept farther sweeps → easier to pass filter → more signals

-

Decrease (0.5, 0.8...) → only accept sweeps close to swing level → fewer signals but more accurate

Tip: 1.5 works for most cases. If trading Gold (large range), can increase to 2.0–2.5. If trading forex majors (smaller range), keep 1.0–1.5.

3. Max Recent Swings to Check — Number of recent swings to check

| Info | Details |

|---|---|

| Name in indicator | Max Recent Swings to Check |

| Default | 8 |

| Range | 1 to 20 |

| Unit | Number of swings |

Meaning: Filter will check up to N most recent swings (from newest to oldest) to see if pattern swept past any of them.

When changing:

-

Increase (12, 15, 20) → check more older swings → easier to find a sweep → more signals pass

-

Decrease (3, 5) → only check a few recent swings → signal must be near newer swings to pass

Tip: Value of 8 is well balanced. On small timeframes (M5–M15) can increase to 10–12 because swings form faster. On large timeframes (H4–D1) keep 5–8.

4. Swing Sweep (HH/LH/HL/LL) — Enable/disable swing sweep check

| Info | Details |

|---|---|

| Name in indicator | Swing Sweep (HH/LH/HL/LL) |

| Default | true |

| Values | true / false |

Meaning: Enable/disable the swing sweep check (check 1). If disabled, filter relies only on recent BOS/CHoCH events.

Tip: Should keep true. Only disable if you want the filter to rely entirely on BOS/CHoCH events instead of swing zones.

5. BOS Recency Check — Enable/disable recent BOS check

| Info | Details |

|---|---|

| Name in indicator | BOS Recency Check |

| Default | true |

| Values | true / false |

Meaning: Allow signal to pass if there's a same-direction BOS (Break of Structure) event recently.

-

Bullish BOS (BOS ▲) → allows Buy signal to pass

-

Bearish BOS (BOS ▼) → allows Sell signal to pass

Tip: Should keep true. BOS is a trend continuation signal — very reliable.

6. CHOCH Recency Check — Enable/disable recent CHoCH check

| nfo | Details |

|---|---|

| Name in indicator | CHOCH Recency Check |

| Default | true |

| Values | true / false |

Meaning: Allow signal to pass if there's a same-direction CHoCH (Change of Character — reversal sign) event recently.

-

Bullish CHoCH → allows Buy signal to pass

-

Bearish CHoCH → allows Sell signal to pass

When to disable: If you only want to trade with the trend (not trade reversals), disable CHOCH Recency Check so filter only passes signals with BOS or sweep.

7. Event Lookback (bars after BOS/CHOCH) — Event time window

| Info | Details |

|---|---|

| Name in indicator | Event Lookback (bars after BOS/CHOCH) |

| Default | 10 |

| Range | 1 to 50 |

| Unit | Number of candles (bars) |

Meaning: After BOS/CHoCH occurs, signal must appear within the next N candles to be considered "recent". If signal appears after more than N candles → event is considered old → doesn't count.

Example: Event Lookback = 10, on H1 timeframe. If BOS ▲ occurs at 10:00 → Buy signal must appear before 20:00 (10 H1 candles = 10 hours) to pass because of this event.

When changing:

-

Increase (20, 30, 50) → wider "window" → older events still count → easier to pass but less meaningful

-

Decrease (3, 5) → only signals appearing very soon after event pass → stricter, more accurate

Tip: On M15–H1, value of 10 works well. On H4–D1, should decrease to 5–7 (each candle is already long, 10 H4 candles = nearly 2 days). On M1–M5 can increase to 15–20.

Signals visible on chart

Signal Zone Filter is a hidden filter — it doesn't draw any additional objects on the chart. Instead, it blocks or allows pattern signals (Fakey, PinBar, Inverted Hammer) to be displayed.

When filter is ON (enabled = true):

-

Signal passes filter → displays normally (arrow, zone fill, trading line...)

-

Signal is blocked → not displayed on chart (disappears completely)

When filter is OFF (enabled = false):

-

All signals display normally (as if there's no filter)

How to know filter is working:

-

Enable Debug Mode (in indicator parameters) → open Expert tab → find log lines tagged [SZ-FILTER] or [SZ_FILTER]

-

Log will show: which signal PASS (and reason: swept which swing, or which event), which signal BLOCK

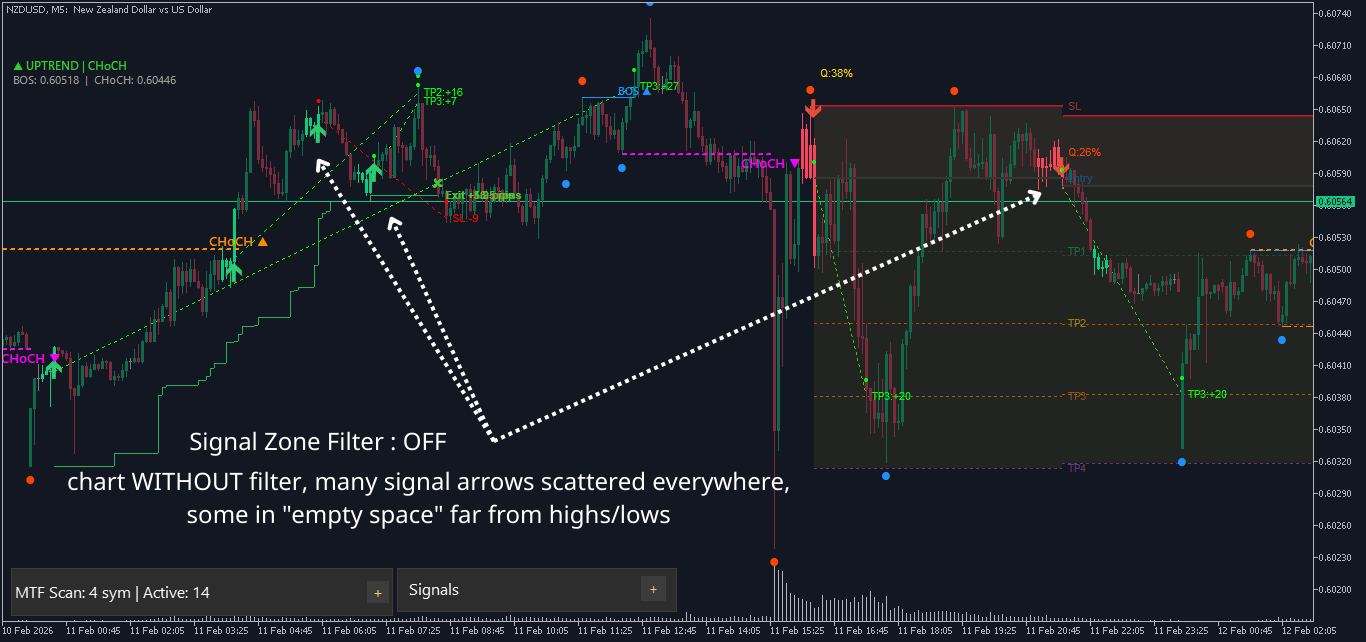

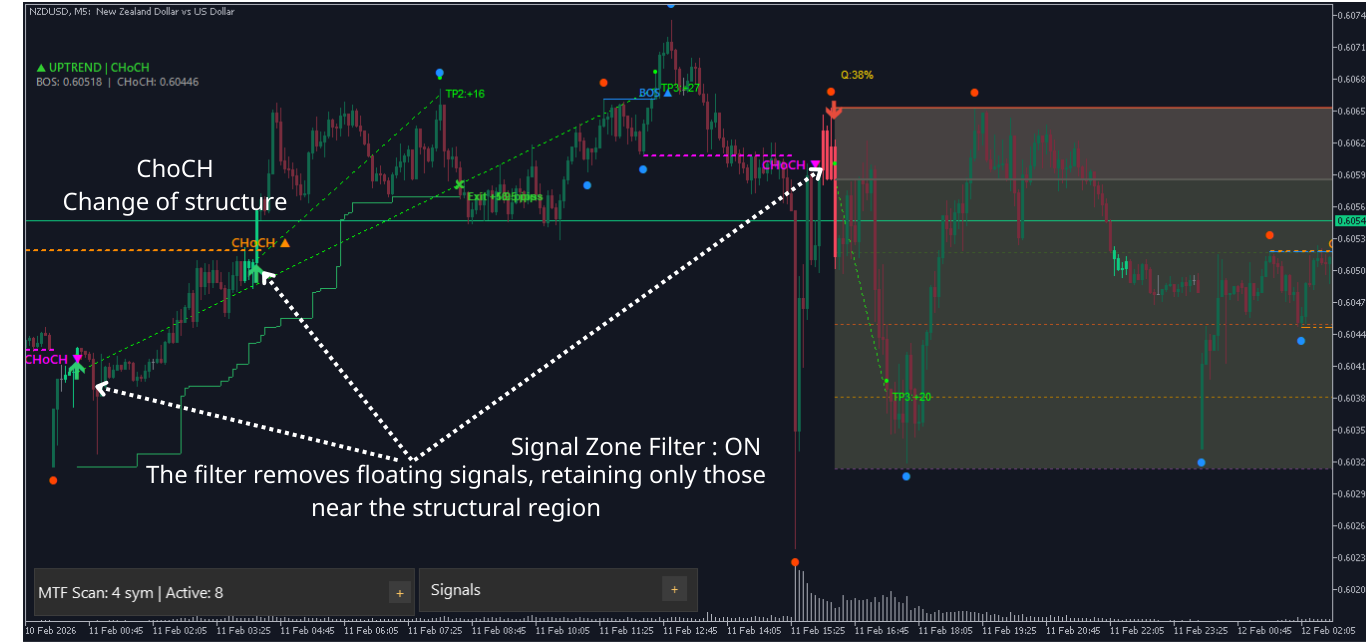

Before/after filter comparison:

| Status | Number of signals | Quality |

|---|---|---|

| Filter OFF | More | Mix of good signals and noise |

| Filter ON | Fewer (typically 30–60% reduction) | Only keeps signals near structure zones |

Trading scenarios (examples)

Scenario 1: Buy signal passes via Swing Sweep

-

Market Structure shows ▲ UPTREND , latest swing low (HL) at 2,030

-

Buy pattern appears (e.g., Fakey Bullish), pattern low touches 2,028 (2 pips below HL)

-

Filter checks: "Pattern low 2,028 < HL 2,030? → Yes. Distance 2 pips < Max Depth 75 pips? → Yes"

-

Result: PASS — Pattern swept support zone → reliable signal → displays on chart

-

Scenario 2: Buy signal passes via recent BOS

-

No nearby swing (pattern doesn't sweep past any high/low)

-

But 5 candles ago, BOS ▲ (bullish Break of Structure) occurred

-

Filter checks: "Is there bullish BOS within 10 candles? → Yes (5 candles ago)"

-

Result: PASS — Structure just confirmed bullish → Buy signal is reasonable

Scenario 3: Signal blocked

-

Sell signal appears, but pattern high doesn't spike above any swing high

-

And no bearish BOS/CHoCH within the last 10 candles

-

Filter checks: "Sweep? → No. Event? → No"

-

Result: BLOCK — Signal is "floating", not connected to structure zone → eliminated

Practical tips

Tip 1: Start with default values, fine-tune later

Enable filter with all default parameters first. Observe for 1–2 weeks how many signals the filter removes. If too few signals blocked → increase strictness. If too many good signals blocked → decrease strictness.

Tip 2: Combine with Market Structure to understand meaning

When signal passes filter, open Expert tab to see reason:

-

If passed via sweep HL → pattern swept bullish support zone → very strong in Uptrend

-

If passed via sweep LL → pattern swept new low → may be reversal sign (be more careful)

-

If passed via same-direction BOS → momentum is strong → trend-following signal

Tip 3: Disable CHoCH if you only trade with trend

If your trading style is trend-only (no catching reversals):

-

Keep BOS Recency Check = true

-

Set CHOCH Recency Check = false

-

Result: signals only pass when sweeping swing or having BOS (trend continuation) — don't pass because of CHoCH (reversal)

Tip 4: Warning about "false sense of security"

Filter helps eliminate weak signals, but doesn't guarantee 100% remaining signals will win. Risks still exist:

-

Sweep might be a real breakout (price continues far, doesn't return)

-

Recent BOS/CHoCH doesn't guarantee momentum will sustain

-

Always use stop loss and proper money management, regardless of what filter says

Tip 5: Adjust Event Lookback by timeframe

| Timeframe | Suggested Event Lookback | Reason |

|---|---|---|

| M1–M5 | 15–20 bars | Short candles, "recent" event needs more candles |

| M15–H1 | 8–12 bars | Balanced (default 10 works well) |

| H4–D1 | 5–7 bars | Each candle is long, too-old event loses meaning |

Tip 6: Use Debug Mode to understand filter

Enable Debug Mode = true in indicator parameters, then open MT5 → View → Toolbox → Expert tab. You'll see log lines like:

text

Use this information to:

-

Understand why signal was blocked

-

Fine-tune parameters appropriately

Tip 7: Be careful using filter on small timeframes + ranging markets

In ranging markets (Market Structure shows ◆ RANGING ), swing highs/lows alternate close together. Patterns easily "sweep" past swings → most signals pass → filter is less effective.

Recommendation: Combine Signal Zone Filter with Direction Filter. Direction Filter will block signals in ranging markets, while Signal Zone Filter filters position in trending markets.

Optimize by trading style

| Style | Swing ATR Mult | Max Zones | Event Lookback | CHoCH | Notes |

|---|---|---|---|---|---|

| Scalp (M1–M5) | 1.0–1.5 | 10–12 | 15–20 | true | Need many swings, wide event window |

| Intraday (M15–H1) | 1.5 (default) | 8 | 10 | true | Balanced — recommended for most |

| Swing (H4–D1) | 2.0–2.5 | 5–8 | 5–7 | false | Strict filtering, only large sweeps + BOS, no CHoCH |

Quick summary

| If you want to... | Do this |

|---|---|

| Enable filter | Set Enable Signal Zone Filter = true |

| Keep more signals | Increase Swing ATR Mult, Max Zones, Event Lookback |

| Filter more strictly | Decrease above values, disable CHoCH |

| Only trade with trend | Disable CHOCH Recency Check |

| Understand why signal was blocked | Enable Debug Mode, read Expert tab |

| Signals disappeared after enabling | Normal — filter is removing weak signals |

Frequently Asked Questions (FAQ)

Q: After enabling filter, all signals disappeared?

A: Possibly market is ranging + no recent BOS/CHoCH. Try increasing Event Lookback or Swing ATR Mult. If still none → market truly has no suitable structure zones.

Q: Does filter draw anything on chart?

A: No. Filter works "behind the scenes" — only blocks/allows signals. To see swing zones (HH/HL/LH/LL) and BOS/CHoCH, enable Show Swing Markers and Show BOS/CHOCH Lines in Market Structure section.

Q: Must Market Structure be enabled for filter to work?

A: Yes. Market Structure provides swing and event data for the filter. Market Structure is always enabled by default, so no need to worry.

Q: Should I enable filter from the start or only when needed?

A: Recommended to use indicator without filter first to get familiar with signals. Then enable filter to reduce noise once you understand how the indicator works.