Strategy B — How Momentum and Price Action Systems Work in Real Markets

Strategy B is a professional trading system built on Momentum Price Action principles, designed to operate during the most profitable phases of the market — impulsive price movements.

Unlike strategies that attempt to extract profits from market noise, Strategy B focuses on what truly matters:

👉 identifying and riding strong directional moves, where the majority of market profits are generated.

🚀 You can test Strategy B expert advisor here: https://www.mql5.com/en/market/product/156340

An Impulse Is a Result of Liquidity, Not Randomness

Price impulses do not occur randomly.

They are the result of liquidity inflows or outflows and emerge when a large market participant completes a phase of position accumulation or distribution.

During these moments, imbalance zones are formed — sharp directional price moves described in Wyckoff’s theory, which remains one of the foundational frameworks for understanding market structure and participant behavior.

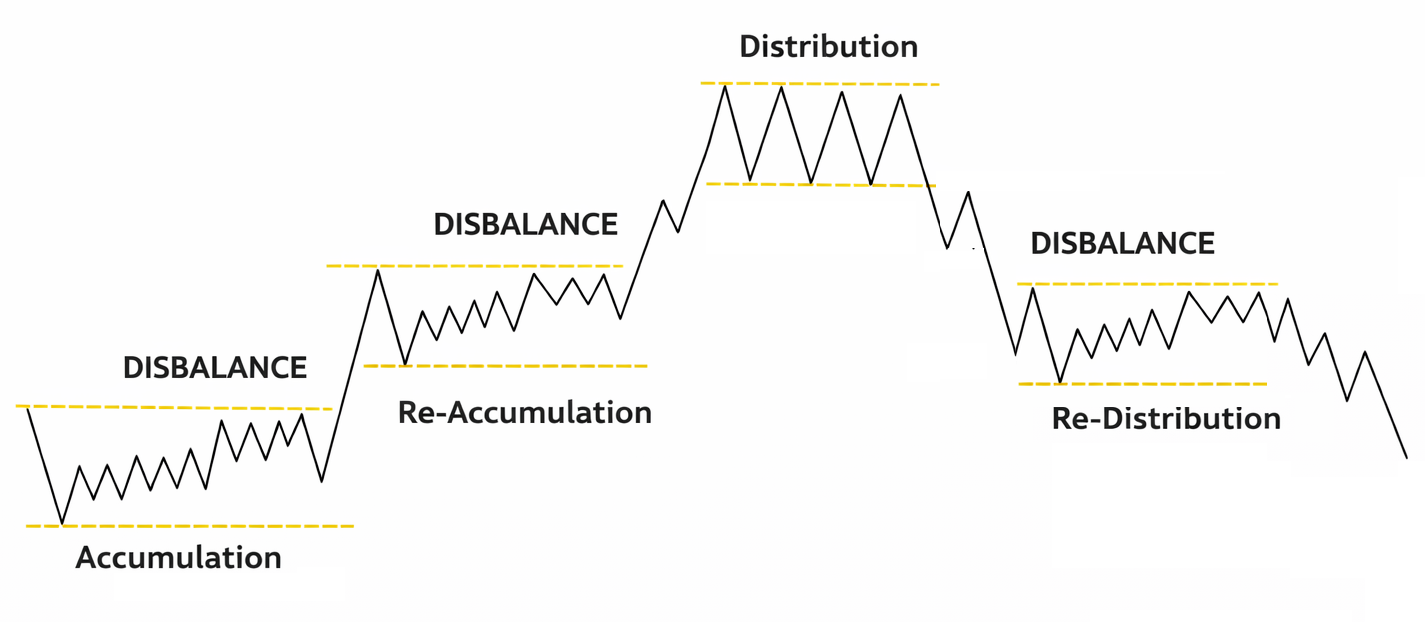

The Wyckoff Market Cycle

According to Wyckoff theory, the market moves through three key phases:

-

Accumulation — price is held within a range while large players build positions

-

Re-accumulation — a pause within an existing trend before continuation

-

Distribution — positions are gradually unwound in a range before a phase shift

Between these phases, disbalance appears — leading to powerful trend movements.

Wyckoff market cycle diagram:

How Strategy B Deals with Market Noise

Momentum and Price Action systems cannot completely avoid market noise.

False impulses and short-lived moves are an inherent part of any market.

Strategy B does not attempt to predict the market.

It operates on probabilities, accepting that some impulses will inevitably turn out to be false.

During range-bound phases, the market is often characterized by:

-

short-term impulses without continuation,

-

news-driven spikes,

-

liquidity grabs according to Smart Money concepts,

-

increased price randomness.

In such conditions, Strategy B may experience sequences of losing trades —

this is normal behavior for momentum-based systems.

The key principle is simple:

👉 one strong trend is enough to compensate for periods of noise, stagnation, and false entries.

How Strategy B Applies Momentum and Price Action

The cryptocurrency market — especially Bitcoin — is well suited for Wyckoff-based analysis:

-

clearly defined market phases,

-

extended accumulation and distribution ranges,

-

strong impulsive breakouts between zones.

Strategy B is designed to capture two types of movements:

1️⃣ Medium-term impulses within ranges

2️⃣ Long-term trends between major market phases

In this system, an impulse acts as a trigger for trend formation, not the final objective.

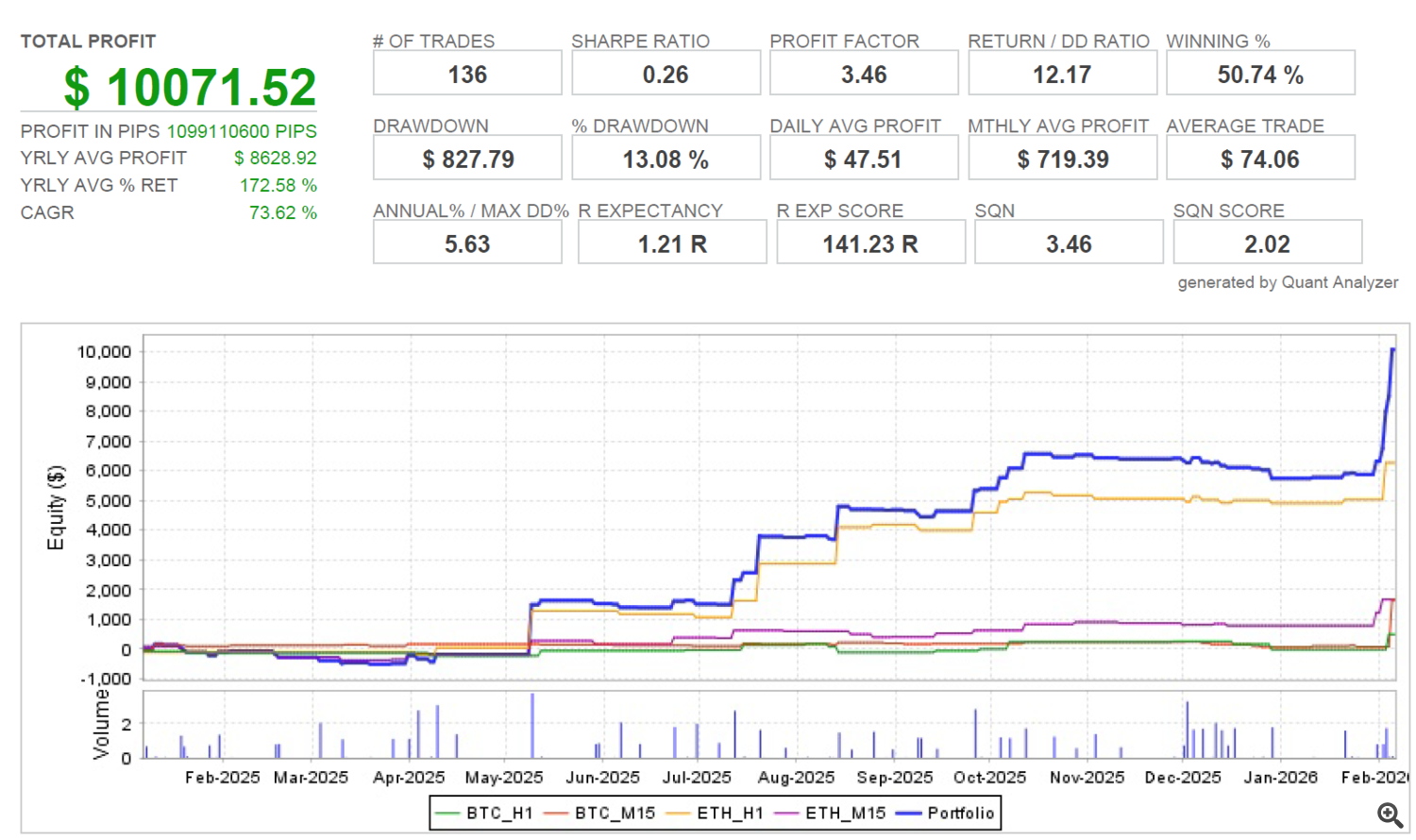

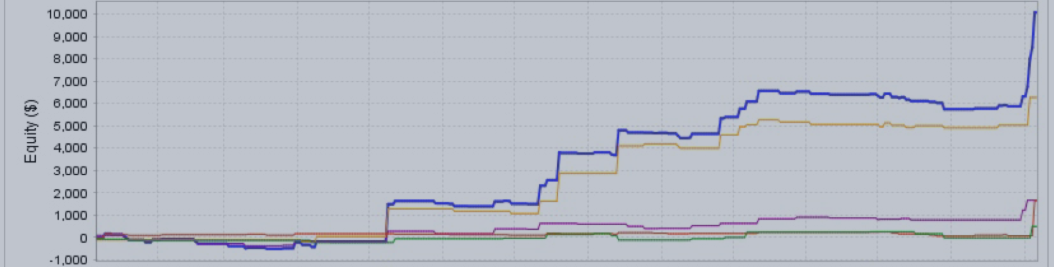

Real Strategy B Performance Over Time

The equity curve and statistics of Strategy B for 2025 and early 2026 clearly demonstrate how a momentum-based approach performs in real market conditions.

📊 2025 — A Range-Bound Market

-

Bitcoin spent most of the year moving sideways

-

BTC returns were limited

-

The majority of portfolio profits were generated by Ethereum

➡️ As a result, the portfolio achieved approximately 100% return in 2025.

🚀 January 2026 — When the Impulse Matters

In January 2026, the crypto market entered a phase of strong imbalance:

-

a sharp Bitcoin move from the 80–90k area down to 60k,

-

preceded by a clear impulsive move.

Strategy B was able to enter and follow this trend.

➡️ In less than one week, the system generated around 90% profit, which is comparable to the entire performance of 2025.

Drawdowns Are Part of the Strategy, Not a Flaw

The November–December 2025 period was marked by:

-

sideways price action,

-

multiple false impulses,

-

a temporary drawdown.

For momentum-based systems, this behavior is expected and unavoidable.

Such strategies should never be evaluated over short time windows.

A single strong trend:

-

offsets periods of stagnation,

-

compensates losing streaks,

-

defines the long-term performance of the strategy.

Who Strategy B Is Designed For

Strategy B is not a system for daily profits.

It is a tool for traders and investors who:

✔ understand market cycles

✔ accept waiting periods

✔ prioritize Risk / Reward over high win rates

✔ focus on long-term consistency rather than short-term noise