Differences between transactions in the Strategy Tester and in real trading | causes and consequences

I'm currently closely monitoring my expert advisor's performance on gold. One of the monitoring steps is comparing trades on the signal account with the results obtained in the strategy tester.

I try to write Expert Advisors that only act when a new bar opens. This is due to the lack of high-quality tick data and limited machine resources for testing. So, the results in the strategy tester and on real data should match. But unfortunately, this is not the case.

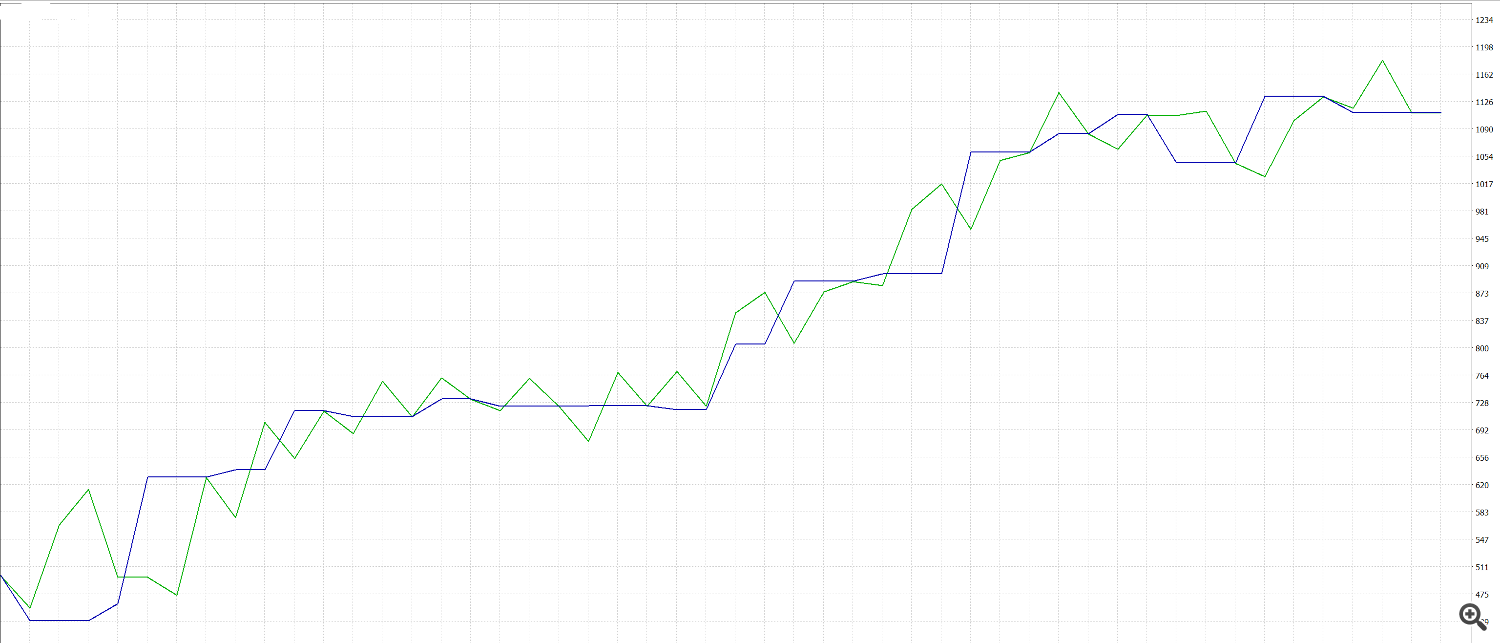

Test results for the first 10 days of February

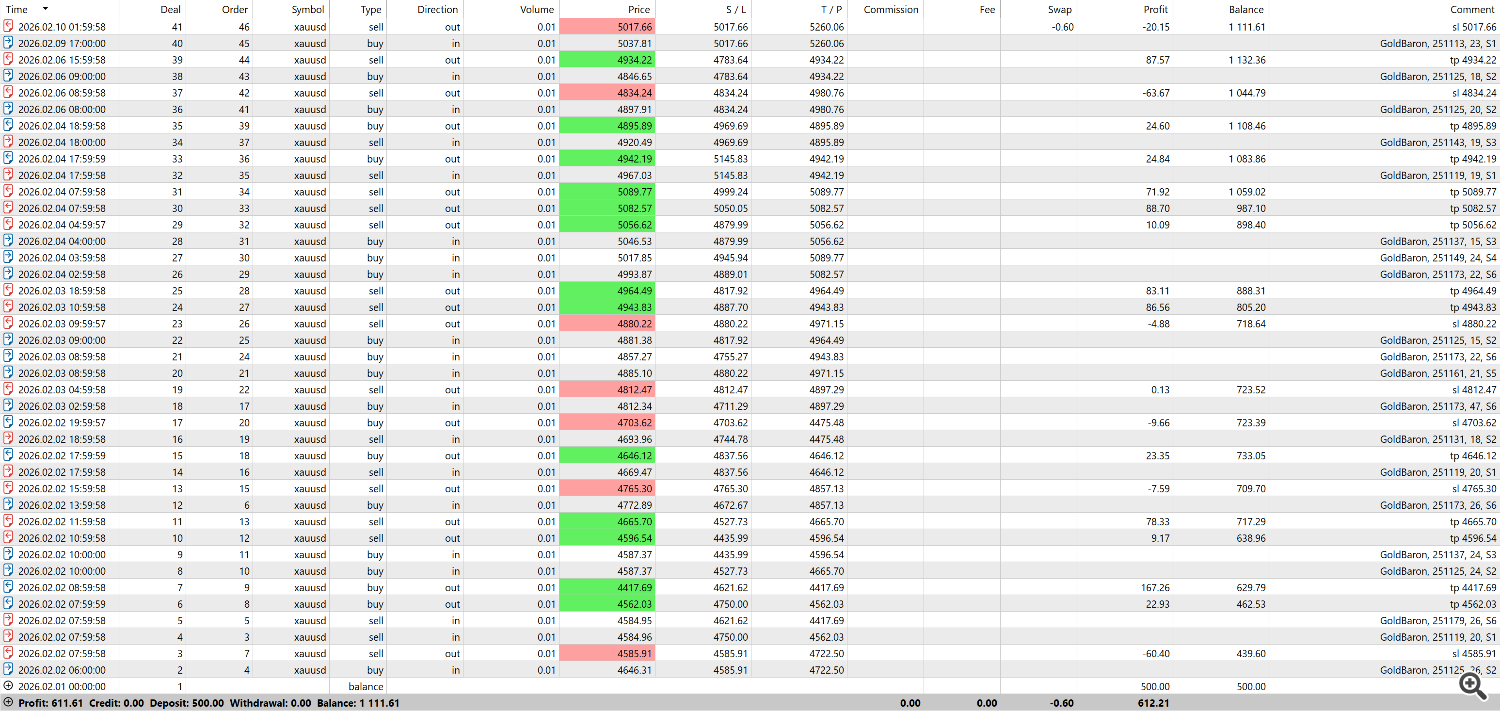

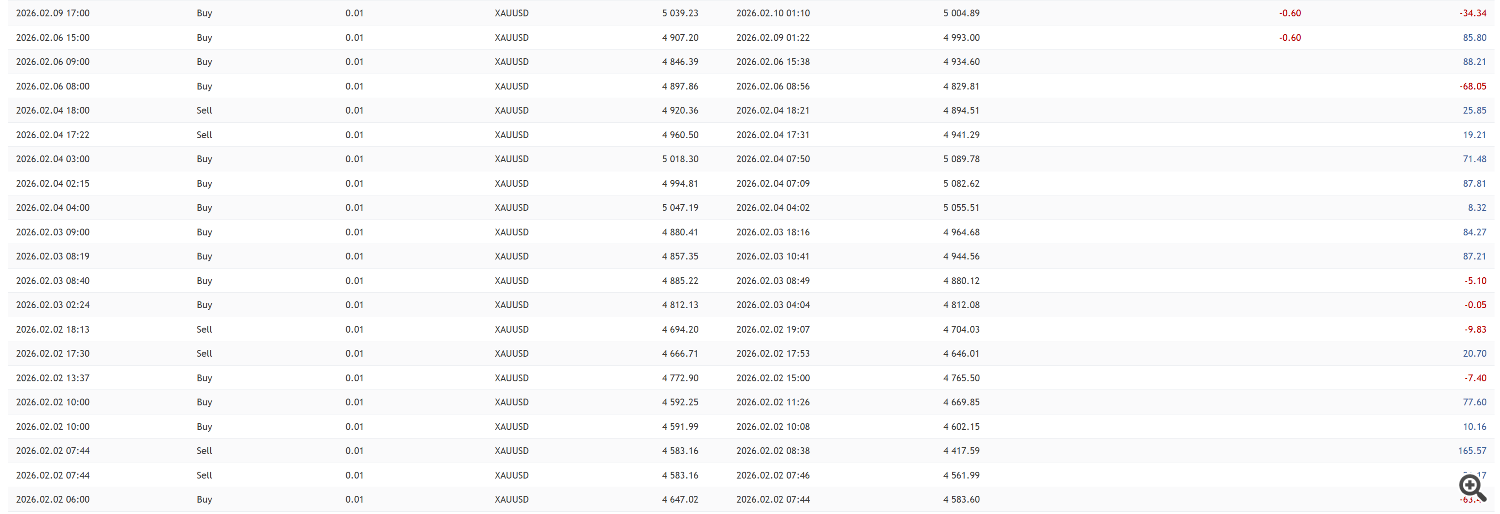

Over the same 10 days, the expert earned 70% on a real account . This is a list of transactions.

Overall, the results are identical. In both cases, the expert advisor demonstrated huge profits with minimal drawdowns.

But there are differences! The real account has more trades and, on average, lower profits. Let's compare trades on the chart from the tester and the real account.

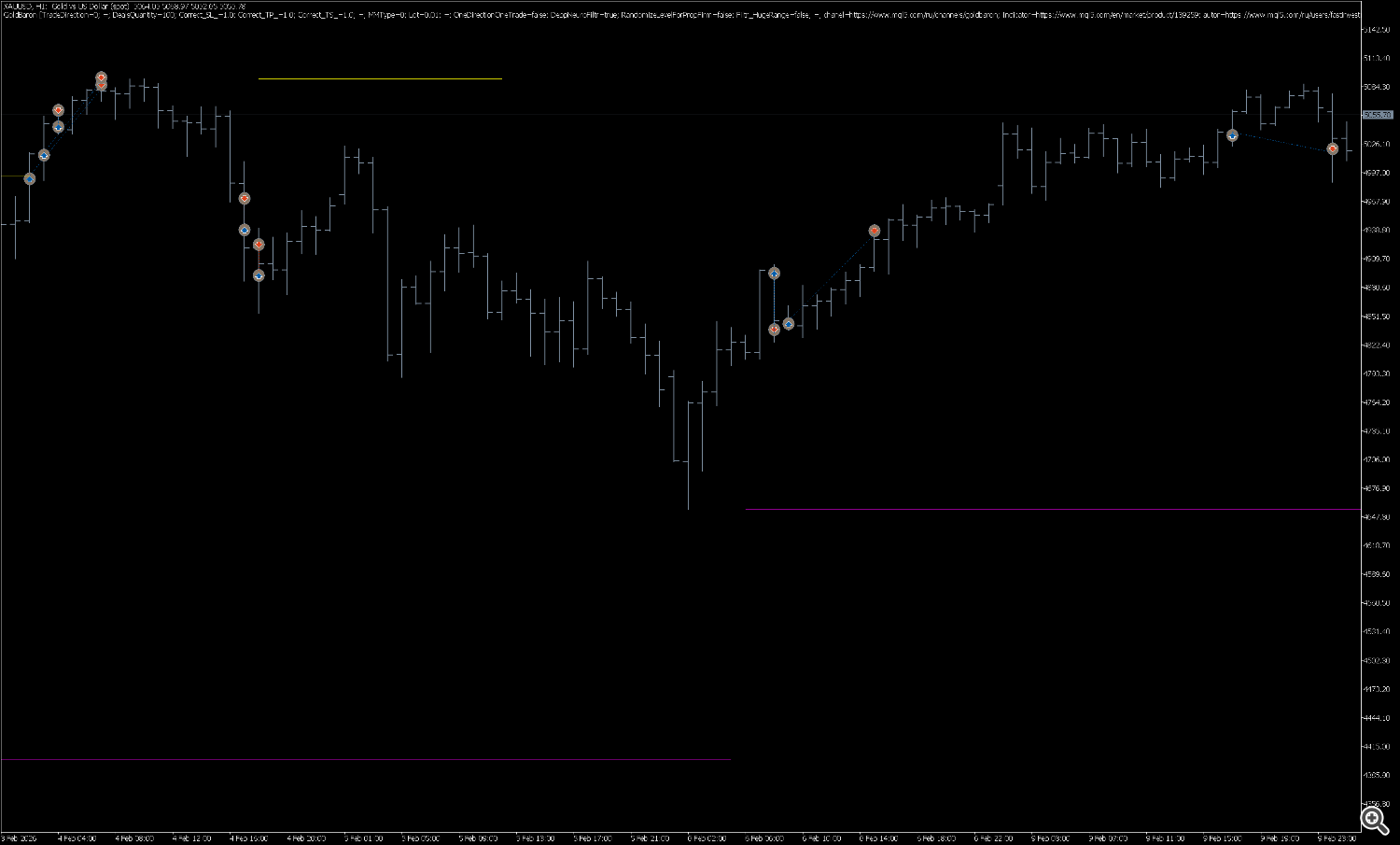

Tester

Real score

Reasons for this behavior

1) The difference in the number of trades occurs because, in the "at opening prices" testing mode, the expert advisor is late learning about a trade closed by stop-loss or take-profit. Consequently, it doesn't open a new trade using the same system. On a real account, the trade is closed within the bar, and when a new bar opens, the expert advisor can open a new position.

2) Profit on a real account is lower due to slippage, opening delays and other requotes.

Results and conclusions

Having conducted a comparative analysis of the advisor's work in the "testing at opening prices" mode (Open Prices) and on a real account, we can draw the following key conclusions.

1. The order closing phase is the testing bottleneck

The main reason for the discrepancy in the number of transactions is the different logic of event processing. closing a position .

-

In the tester: The signal about the activation of Stop Loss or Take Profit is sent to the advisor Strictly at the opening of the next bar . Because of this, the opportunity to open a new trade at the same levels is missed—one time interval is "dropped" from trading.

-

In real life: The deal is closed within the bar. The system immediately releases the margin and locks in the result. By the time new bar The advisor is no longer burdened by the previous position and has the right to open a new transaction immediately after receiving a tick/bar.

Conclusion: The "Open Prices" testing mode underestimates the number of completed trades by artificially creating "dead zones" after protective orders are triggered.

2. The nature of lower returns on real money

The difference in final profit is due solely to the market microstructure, which cannot be simulated in a tester without tick data:

-

Slippage: Execution at a price worse than the asking price, especially during periods of high volatility.

-

Execution delays: The price at which the system sees a signal to open and the price at which the order is actually filled are different values.

-

Re-quotas: Loss of time and potential profit when asking for a price again.

Conclusion: The tester idealizes the entry, assuming the order will always be opened at the current market request price. A real account pays a liquidity tax.

3. Fundamental limitation of the methodology

Despite the mathematical discrepancy (number of transactions + percentage of profit), the system behavior pattern is preserved :

-

Huge profits with minimal drawdowns.

-

Absence of multidirectional signals.

This means that the advisor's code is correct and the decision-making logic works correctly. Deviations are quantitative , not qualitative character.