Bank of Tokyo-Mitsubishi (BTMU) made their fundamental forecasts for EURUSD based on some fundamental factors:

- "The euro weakened in July with the focus in the foreign exchange market shifting away from the uncertainty related to ‘Grexit’ and back to the monetary policy divergence between the euro-zone and the US. That should mean that the euro reverts to being the funding currency of choice."

-

"We suspect there’s a lot more potential selling to come."

- "However, falling oil prices, if extended, will complicate the ECB’s achievement of its inflation target that could mean the ECB needs to extend QE while China weakness that keeps capital flowing out of China means reduced FX reserves that removes reverse recycling support for the euro as well."

-

"Despite the resolution to the crisis in Greece, at least for

now, we maintain that the fundamentals point to renewed EUR weakness and

a decline in EUR/USD toward parity."

Bank of Tokyo-Mitsubishi (BTMU) forecasts for EURUSD to be at parity by year-end and at 0.96 by Q1'16-end.

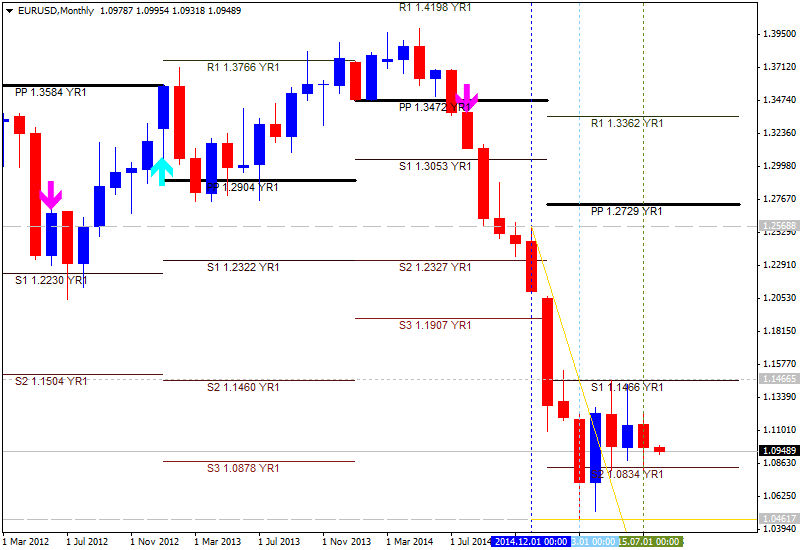

By the way, the price is located to be below yearly Central Pivot at 1.2729 for the primary ranguing between S1 Pivot at 1.1466 and S2 Pivot at 1.0834, and the next target in the case the bearish trend will be continuing is S3 Pivot at 0.9571. So, the Bank of Tokyo-Mitsubishi (BTMU) is right with their forecast.