USDJPY Price Action Analysis - ranging between Yearly Pivot at 114.36 and R1 Pivot at 127.96

22 July 2015, 09:11

0

734

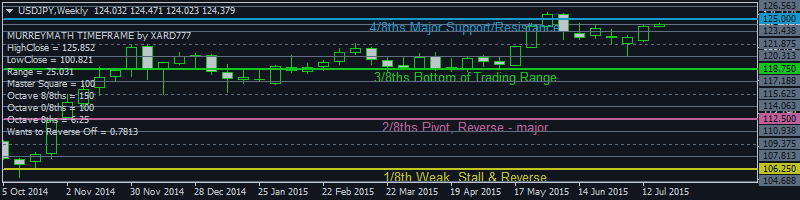

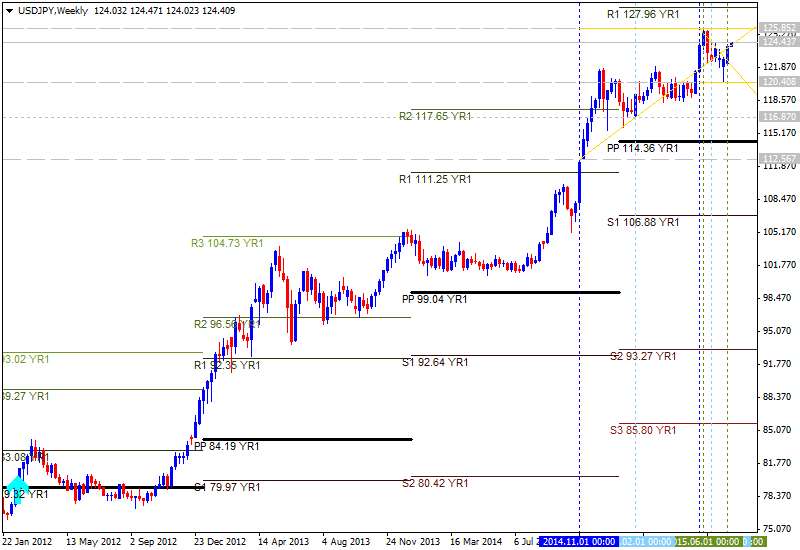

W1 price is located to be above yearly Central Pivot at 114.36 and below R1 Pivot at 127.96:

- The price is on bullish ranging between Central Pivot level at 114.36 and R1 Pivot level at 127.96;

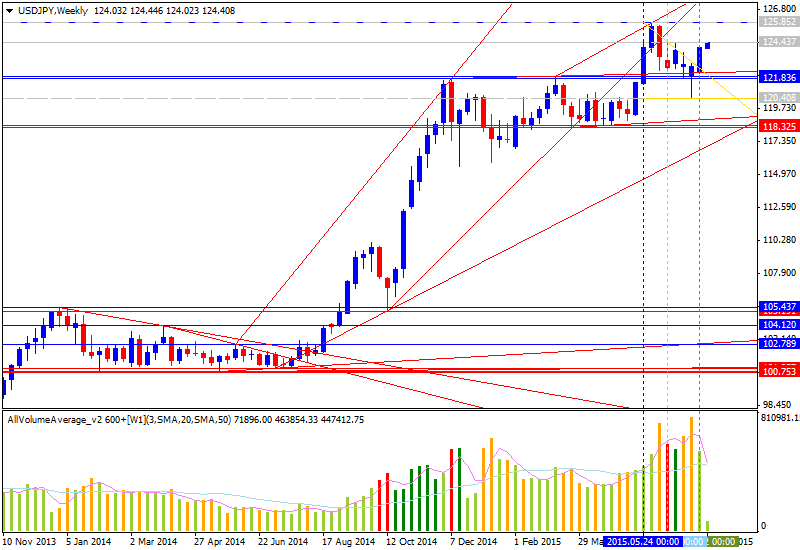

- The price is breaking triangle pattern together with trendline from below to above for the bullish trend to be continuing;

- If weekly price will break R1 Pivot at 127.96 so the primary bullish market condition will be continuing up to R2 Pivot value as the new top in this situation, otherwise the price will be ranging within yearly Central Pivot and yearly R1;

- “The mid-June high around 124.40 and the 78.6% retracement of June – July decline at 124.70 represent the next big hurdle for the exchange rate”;

- “A close under 122.40 would turn us negative again on USD/JPY ”;

| Instrument | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|

| USD/JPY | 106.88 | 114.36 |

127.96 |

Trend:

- W1 - ranging bullish

- MN1 - bullish