Trading News Events: USD Retail Sales - Will Lower Energy Prices Fuel Private-Sector Consumption?

What’s Expected:

Why Is This Event Important:

The Fed may stay on course to normalize monetary policy in mid-2015 as

the central bank anticipates lower energy prices to boost private-sector

consumption – one of the leading drivers of growth – and Chair Janet

Yellen may adopt a more hawkish tone at the March 18 meeting as the

board remains confident in achieving the 2% target for inflation.

Nevertheless, subdued wages along with the slowdown in private-sector

credit may drag on retail spending, and another unexpected contraction

may further delay the Fed’s normalization cycle as the ongoing weakness

in household earnings undermines the central bank’s scope to achieve the

inflation target.

How To Trade This Event Risk

Bullish USD Trade: U.S. Retail Sales Rebounds 0.3% or Greater

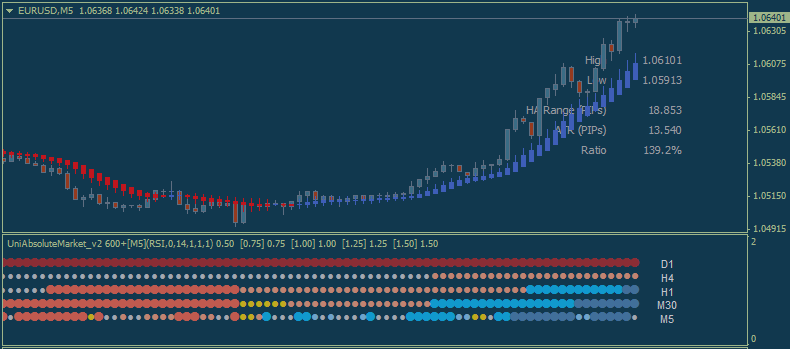

- Need red, five-minute candle following a positive print to consider a short EUR/USD trade.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in reverse.

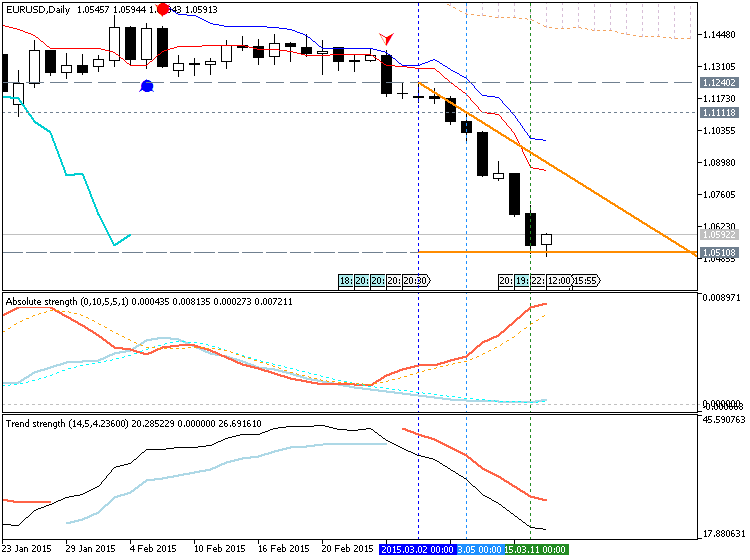

EURUSD Daily Chart

- Despite the long-term bearish outlook for EUR/USD, will keep a close eye on the Relative Strength Index (RSI) as it approaches key support levels.

- Interim Resistance: 1.1185 (23.6% expansion) to 1.1210 (61.8% retracement)

- Interim Support: 1.0375 (78.6% expansion) to 1.0400 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JAN 2014 |

02/12/2014 13:30 GMT | -0.4% | -0.8% | +20 | +97 |

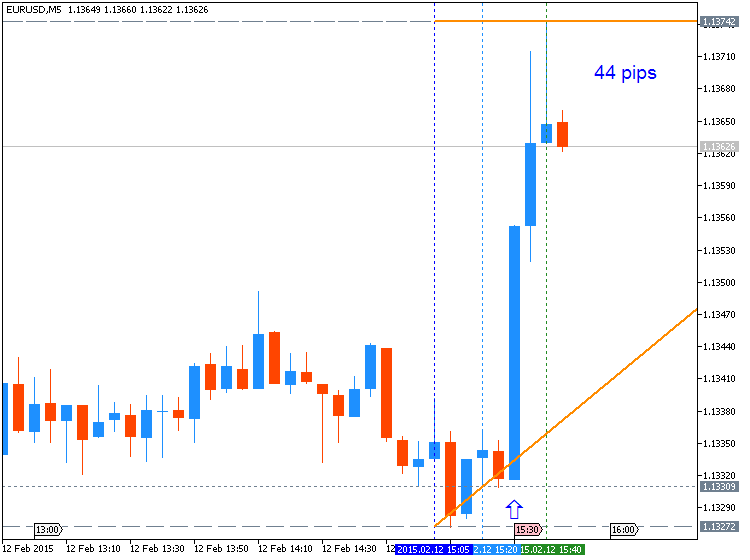

EURUSD M5: 44 pips price movement by USD - Retail Sales news event

U.S. Retail Sales declined another 0.8% in January following a 0.9% contraction the month prior. Despite lower energy costs, discretionary spending at department stores slipped for the second consecutive month, while demand for motor vehicles and parts slid another 0.5% during the same period. Following the worse-than-expected print, the greenback struggled to hold its ground, with EUR/USD climbing above the 1.1400 handle and closed the day at 1.1428.