In the times when the gold standard was being used, the US dollar was associated with gold. During that time, the value of a unit of currency was linked with a specific amount of gold.

The gold standard was used from 1900 till 1971 when separation happened. The U.S. dollar and gold were freed and could be valued based on supply and demand. The U.S. dollar became a fiat currency - a currency that gets its value from government regulation, but isn’t backed by a physical commodity. It traded on foreign markets. The U.S. dollar was used as a reserve currency.

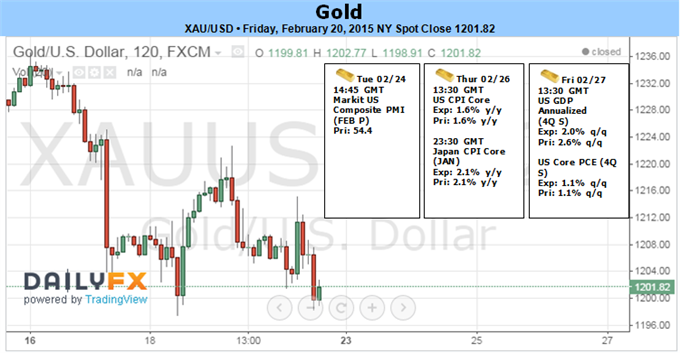

After 1971 gold moved to floating exchange rates, which made its price vulnerable to the U.S. dollar’s external value. In 2008, the International Monetary Fund concluded that 40–50% of the moves in the gold prices since 2002 were dollar-related. A 1% change in the effective external value of the U.S. dollar led to more than a 1% change in gold prices.

There exists an inverse relationship between the

trade-weighted U.S. dollar and the price of gold. Even though the gold

standard is gone, there’s still a psychological tilt towards gold

whenever the value of the U.S. dollar decreases.

Two factors keep the inverse relationship:

- A falling dollar increases the value of other countries’ currencies. This increases the demand for commodities including gold. It also increases the prices.

- When the U.S. dollar starts to lose its value, investors look for alternative investment sources to store value. Gold is an alternative.

However, it’s possible for the

U.S. dollar and gold price to rise at the same time. This can happen because of a crisis in some country or a region, making investors flock to safer assets - the U.S. dollar and gold.

The greenback is also driven by many factors - like monetary policy and inflation in the U.S. vs. other countries. It’s also spurred by economic prospects in the U.S. vs. other countries. When making a decision, investors consider all of these factors.

Getting a sense of the direction that gold prices will take is vitally important for investors.

Gold stocks like Goldcorp Inc., Barrick Gold Corp., Newmont Mining Corporation, Agnico-Eagle Mines, Yamana Gold, and exchange-traded funds (or ETFs) like the SPDR Gold Trust and the Gold Miners Index are connected to gold prices.