Developing a Replay System (Part 74): New Chart Trade (I)

In this article, we will modify the last code shown in this series about Chart Trade. These changes are necessary to adapt the code to the current replay/simulation system model. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Arithmetic Optimization Algorithm (AOA): From AOA to SOA (Simple Optimization Algorithm)

In this article, we present the Arithmetic Optimization Algorithm (AOA) based on simple arithmetic operations: addition, subtraction, multiplication and division. These basic mathematical operations serve as the foundation for finding optimal solutions to various problems.

MQL5 Wizard Techniques you should know (Part 73): Using Patterns of Ichimoku and the ADX-Wilder

The Ichimoku-Kinko-Hyo Indicator and the ADX-Wilder oscillator are a pairing that could be used in complimentarily within an MQL5 Expert Advisor. The Ichimoku is multi-faceted, however for this article, we are relying on it primarily for its ability to define support and resistance levels. Meanwhile, we also use the ADX to define our trend. As usual, we use the MQL5 wizard to build and test any potential these two may possess.

Developing a multi-currency Expert Advisor (Part 20): Putting in order the conveyor of automatic project optimization stages (I)

We have already created quite a few components that help arrange auto optimization. During the creation, we followed the traditional cyclical structure: from creating minimal working code to refactoring and obtaining improved code. It is time to start clearing up our database, which is also a key component in the system we are creating.

Atomic Orbital Search (AOS) algorithm: Modification

In the second part of the article, we will continue developing a modified version of the AOS (Atomic Orbital Search) algorithm focusing on specific operators to improve its efficiency and adaptability. After analyzing the fundamentals and mechanics of the algorithm, we will discuss ideas for improving its performance and the ability to analyze complex solution spaces, proposing new approaches to extend its functionality as an optimization tool.

Fast trading strategy tester in Python using Numba

The article implements a fast strategy tester for machine learning models using Numba. It is 50 times faster than the pure Python strategy tester. The author recommends using this library to speed up mathematical calculations, especially the ones involving loops.

Developing a Replay System (Part 73): An Unusual Communication (II)

In this article, we will look at how to transmit information in real time between the indicator and the service, and also understand why problems may arise when changing the timeframe and how to solve them. As a bonus, you will get access to the latest version of the replay /simulation app.

Atomic Orbital Search (AOS) algorithm

The article considers the Atomic Orbital Search (AOS) algorithm, which uses the concepts of the atomic orbital model to simulate the search for solutions. The algorithm is based on probability distributions and the dynamics of interactions in the atom. The article discusses in detail the mathematical aspects of AOS, including updating the positions of candidate solutions and the mechanisms of energy absorption and release. AOS opens new horizons for applying quantum principles to computing problems by offering an innovative approach to optimization.

Developing a Replay System (Part 72): An Unusual Communication (I)

What we create today will be difficult to understand. Therefore, in this article I will only talk about the initial stage. Please read this article carefully, it is an important prerequisite before we proceed to the next step. The purpose of this material is purely didactic as we will only study and master the presented concepts, without practical application.

ALGLIB library optimization methods (Part II)

In this article, we will continue to study the remaining optimization methods from the ALGLIB library, paying special attention to their testing on complex multidimensional functions. This will allow us not only to evaluate the efficiency of each algorithm, but also to identify their strengths and weaknesses in different conditions.

Developing a Replay System (Part 71): Getting the Time Right (IV)

In this article, we will look at how to implement what was shown in the previous article related to our replay/simulation service. As in many other things in life, problems are bound to arise. And this case was no exception. In this article, we continue to improve things. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

ALGLIB library optimization methods (Part I)

In this article, we will get acquainted with the ALGLIB library optimization methods for MQL5. The article includes simple and clear examples of using ALGLIB to solve optimization problems, which will make mastering the methods as accessible as possible. We will take a detailed look at the connection of such algorithms as BLEIC, L-BFGS and NS, and use them to solve a simple test problem.

Developing a multi-currency Expert Advisor (Part 19): Creating stages implemented in Python

So far we have considered the automation of launching sequential procedures for optimizing EAs exclusively in the standard strategy tester. But what if we would like to perform some handling of the obtained data using other means between such launches? We will attempt to add the ability to create new optimization stages performed by programs written in Python.

Developing a Replay System (Part 70): Getting the Time Right (III)

In this article, we will look at how to use the CustomBookAdd function correctly and effectively. Despite its apparent simplicity, it has many nuances. For example, it allows you to tell the mouse indicator whether a custom symbol is on auction, being traded, or the market is closed. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Replay System (Part 69): Getting the Time Right (II)

Today we will look at why we need the iSpread feature. At the same time, we will understand how the system informs us about the remaining time of the bar when there is not a single tick available for it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Replay System (Part 68): Getting the Time Right (I)

Today we will continue working on getting the mouse pointer to tell us how much time is left on a bar during periods of low liquidity. Although at first glance it seems simple, in reality this task is much more difficult. This involves some obstacles that we will have to overcome. Therefore, it is important that you have a good understanding of the material in this first part of this subseries in order to understand the following parts.

Artificial Ecosystem-based Optimization (AEO) algorithm

The article considers a metaheuristic Artificial Ecosystem-based Optimization (AEO) algorithm, which simulates interactions between ecosystem components by creating an initial population of solutions and applying adaptive update strategies, and describes in detail the stages of AEO operation, including the consumption and decomposition phases, as well as different agent behavior strategies. The article introduces the features and advantages of this algorithm.

African Buffalo Optimization (ABO)

The article presents the African Buffalo Optimization (ABO) algorithm, a metaheuristic approach developed in 2015 based on the unique behavior of these animals. The article describes in detail the stages of the algorithm implementation and its efficiency in finding solutions to complex problems, which makes it a valuable tool in the field of optimization.

Raw Code Optimization and Tweaking for Improving Back-Test Results

Enhance your MQL5 code by optimizing logic, refining calculations, and reducing execution time to improve back-test accuracy. Fine-tune parameters, optimize loops, and eliminate inefficiencies for better performance.

Developing a Replay System (Part 67): Refining the Control Indicator

In this article, we'll look at what can be achieved with a little code refinement. This refinement is aimed at simplifying our code, making more use of MQL5 library calls and, above all, making it much more stable, secure and easy to use in other projects that we may develop in the future.

Artificial Showering Algorithm (ASHA)

The article presents the Artificial Showering Algorithm (ASHA), a new metaheuristic method developed for solving general optimization problems. Based on simulation of water flow and accumulation processes, this algorithm constructs the concept of an ideal field, in which each unit of resource (water) is called upon to find an optimal solution. We will find out how ASHA adapts flow and accumulation principles to efficiently allocate resources in a search space, and see its implementation and test results.

Developing a Replay System (Part 66): Playing the service (VII)

In this article, we will implement the first solution that will allow us to determine when a new bar may appear on the chart. This solution is applicable in a wide variety of situations. Understanding its development will help you grasp several important aspects. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Atmosphere Clouds Model Optimization (ACMO): Practice

In this article, we will continue diving into the implementation of the ACMO (Atmospheric Cloud Model Optimization) algorithm. In particular, we will discuss two key aspects: the movement of clouds into low-pressure regions and the rain simulation, including the initialization of droplets and their distribution among clouds. We will also look at other methods that play an important role in managing the state of clouds and ensuring their interaction with the environment.

Developing a Replay System (Part 65): Playing the service (VI)

In this article, we will look at how to implement and solve the mouse pointer issue when using it in conjunction with a replay/simulation application. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Trading with the MQL5 Economic Calendar (Part 7): Preparing for Strategy Testing with Resource-Based News Event Analysis

In this article, we prepare our MQL5 trading system for strategy testing by embedding economic calendar data as a resource for non-live analysis. We implement event loading and filtering for time, currency, and impact, then validate it in the Strategy Tester. This enables effective backtesting of news-driven strategies.

From Novice to Expert: Programming Candlesticks

In this article, we take the first step in MQL5 programming, even for complete beginners. We'll show you how to transform familiar candlestick patterns into a fully functional custom indicator. Candlestick patterns are valuable as they reflect real price action and signal market shifts. Instead of manually scanning charts—an approach prone to errors and inefficiencies—we'll discuss how to automate the process with an indicator that identifies and labels patterns for you. Along the way, we’ll explore key concepts like indexing, time series, Average True Range (for accuracy in varying market volatility), and the development of a custom reusable Candlestick Pattern library for use in future projects.

Formulating Dynamic Multi-Pair EA (Part 2): Portfolio Diversification and Optimization

Portfolio Diversification and Optimization strategically spreads investments across multiple assets to minimize risk while selecting the ideal asset mix to maximize returns based on risk-adjusted performance metrics.

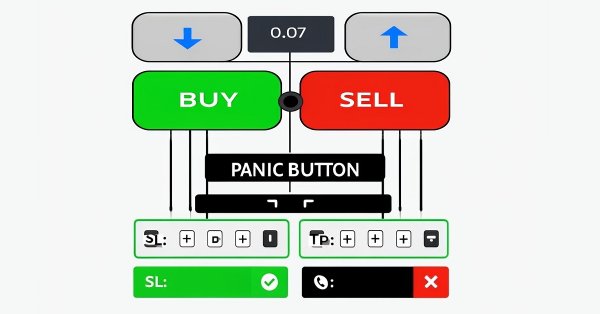

Manual Backtesting Made Easy: Building a Custom Toolkit for Strategy Tester in MQL5

In this article, we design a custom MQL5 toolkit for easy manual backtesting in the Strategy Tester. We explain its design and implementation, focusing on interactive trade controls. We then show how to use it to test strategies effectively

Developing a Replay System (Part 64): Playing the service (V)

In this article, we will look at how to fix two errors in the code. However, I will try to explain them in a way that will help you, beginner programmers, understand that things don't always go as you expect. Anyway, this is an opportunity to learn. The content presented here is intended solely for educational purposes. In no way should this application be considered as a final document with any purpose other than to explore the concepts presented.

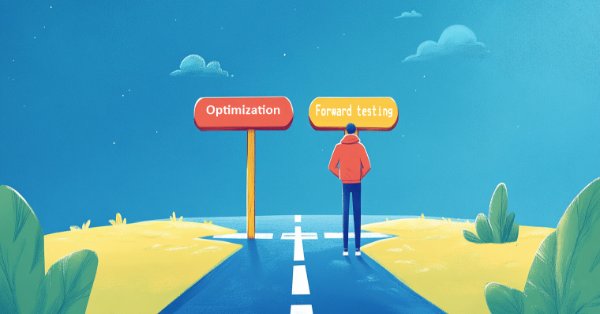

Developing a multi-currency Expert Advisor (Part 18): Automating group selection considering forward period

Let's continue to automate the steps we previously performed manually. This time we will return to the automation of the second stage, that is, the selection of the optimal group of single instances of trading strategies, supplementing it with the ability to take into account the results of instances in the forward period.

Developing a Replay System (Part 63): Playing the service (IV)

In this article, we will finally solve the problems with the simulation of ticks on a one-minute bar so that they can coexist with real ticks. This will help us avoid problems in the future. The material presented here is for educational purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing a Trading System Based on the Order Book (Part I): Indicator

Depth of Market is undoubtedly a very important element for executing fast trades, especially in High Frequency Trading (HFT) algorithms. In this series of articles, we will look at this type of trading events that can be obtained through a broker on many tradable symbols. We will start with an indicator, where you can customize the color palette, position and size of the histogram displayed directly on the chart. We will also look at how to generate BookEvent events to test the indicator under certain conditions. Other possible topics for future articles include how to store price distribution data and how to use it in a strategy tester.

Atmosphere Clouds Model Optimization (ACMO): Theory

The article is devoted to the metaheuristic Atmosphere Clouds Model Optimization (ACMO) algorithm, which simulates the behavior of clouds to solve optimization problems. The algorithm uses the principles of cloud generation, movement and propagation, adapting to the "weather conditions" in the solution space. The article reveals how the algorithm's meteorological simulation finds optimal solutions in a complex possibility space and describes in detail the stages of ACMO operation, including "sky" preparation, cloud birth, cloud movement, and rain concentration.

Quantitative approach to risk management: Applying VaR model to optimize multi-currency portfolio using Python and MetaTrader 5

This article explores the potential of the Value at Risk (VaR) model for multi-currency portfolio optimization. Using the power of Python and the functionality of MetaTrader 5, we demonstrate how to implement VaR analysis for efficient capital allocation and position management. From theoretical foundations to practical implementation, the article covers all aspects of applying one of the most robust risk calculation systems – VaR – in algorithmic trading.

Advanced Memory Management and Optimization Techniques in MQL5

Discover practical techniques to optimize memory usage in MQL5 trading systems. Learn to build efficient, stable, and fast-performing Expert Advisors and indicators. We’ll explore how memory really works in MQL5, the common traps that slow your systems down or cause them to fail, and — most importantly — how to fix them.

Archery Algorithm (AA)

The article takes a detailed look at the archery-inspired optimization algorithm, with an emphasis on using the roulette method as a mechanism for selecting promising areas for "arrows". The method allows evaluating the quality of solutions and selecting the most promising positions for further study.

Developing a Replay System (Part 62): Playing the service (III)

In this article, we will begin to address the issue of tick excess that can impact application performance when using real data. This excess often interferes with the correct timing required to construct a one-minute bar in the appropriate window.

Bacterial Chemotaxis Optimization (BCO)

The article presents the original version of the Bacterial Chemotaxis Optimization (BCO) algorithm and its modified version. We will take a closer look at all the differences, with a special focus on the new version of BCOm, which simplifies the bacterial movement mechanism, reduces the dependence on positional history, and uses simpler math than the computationally heavy original version. We will also conduct the tests and summarize the results.

Developing a Replay System (Part 61): Playing the service (II)

In this article, we will look at changes that will allow the replay/simulation system to operate more efficiently and securely. I will also not leave without attention those who want to get the most out of using classes. In addition, we will consider a specific problem in MQL5 that reduces code performance when working with classes, and explain how to solve it.

A New Approach to Custom Criteria in Optimizations (Part 1): Examples of Activation Functions

The first of a series of articles looking at the mathematics of Custom Criteria with a specific focus on non-linear functions used in Neural Networks, MQL5 code for implementation and the use of targeted and correctional offsets.